The Bitcoin halving is the single most significant and predictable event in cryptocurrency. Every approximately four years, the reward that miners receive for processing transactions is cut in half, reducing the rate of new Bitcoin supply entering the market. This supply shock has historically preceded massive bull runs.

In this guide, we analyze every halving cycle in detail and outline specific strategies for positioning around these events.

What Is the Bitcoin Halving?

Bitcoin's protocol is designed with a fixed monetary policy:

- Total supply cap: 21 million BTC (no more will ever be created)

- Block reward halving: Every 210,000 blocks (~4 years), the mining reward is cut in half

- Current reward: 3.125 BTC per block (after the April 2024 halving)

- Next halving: Expected around March-April 2028

Halving History

| Halving | Date | Block Reward | BTC Price at Halving | Peak Price After | Peak Timeline |

|---------|------|-------------|---------------------|-----------------|---------------|

| 1st | Nov 2012 | 50 → 25 BTC | ~$12 | ~$1,100 | ~12 months |

| 2nd | Jul 2016 | 25 → 12.5 BTC | ~$650 | ~$19,700 | ~17 months |

| 3rd | May 2020 | 12.5 → 6.25 BTC | ~$8,700 | ~$69,000 | ~18 months |

| 4th | Apr 2024 | 6.25 → 3.125 BTC | ~$63,000 | TBD | TBD |

The pattern is clear: every halving has preceded a significant bull run, with the peak occurring 12-18 months after the halving event.

Why Halvings Drive Price Increases

The economic logic is straightforward:

Supply Reduction

Each halving cuts the daily issuance of new Bitcoin by 50%. Before the 2024 halving, miners received 900 BTC per day. After, they receive 450 BTC per day. At $80,000 per BTC, that is $36 million less daily selling pressure from miners.

Demand Dynamics

While supply decreases, demand factors typically increase around halvings:

- Media attention: Halving events generate massive media coverage, attracting new investors

- Narrative momentum: "Last chance to buy cheap Bitcoin" drives FOMO

- Institutional interest: Each cycle has brought more institutional adoption

- ETF inflows: The 2024 cycle benefits from spot Bitcoin ETFs (a first)

The Stock-to-Flow Thesis

The Stock-to-Flow (S2F) model, popularized by PlanB, measures scarcity by comparing the existing stock of an asset to its annual production flow. Each halving doubles Bitcoin's S2F ratio, pushing it toward the scarcity of gold and beyond.

While the S2F model has been debated, the underlying principle — decreasing supply growth with constant or increasing demand leads to higher prices — is basic economics.

Trading Strategies for Halving Cycles

Strategy 1: The Accumulation Strategy

This is the simplest and historically most effective approach:

When to Buy: 6-12 months before the halving What to Buy: Bitcoin primarily; select high-quality altcoins secondarily When to Sell: 12-18 months after the halving, using Fibonacci extension levels as targets Risk Management: Dollar-cost average (DCA) into positions; never invest more than you can hold through a 50% drawdownStrategy 2: The Phase Trading Strategy

Divide the halving cycle into four phases:

Phase 1 — Pre-Halving Accumulation (6-12 months before):- Begin accumulating BTC and ETH

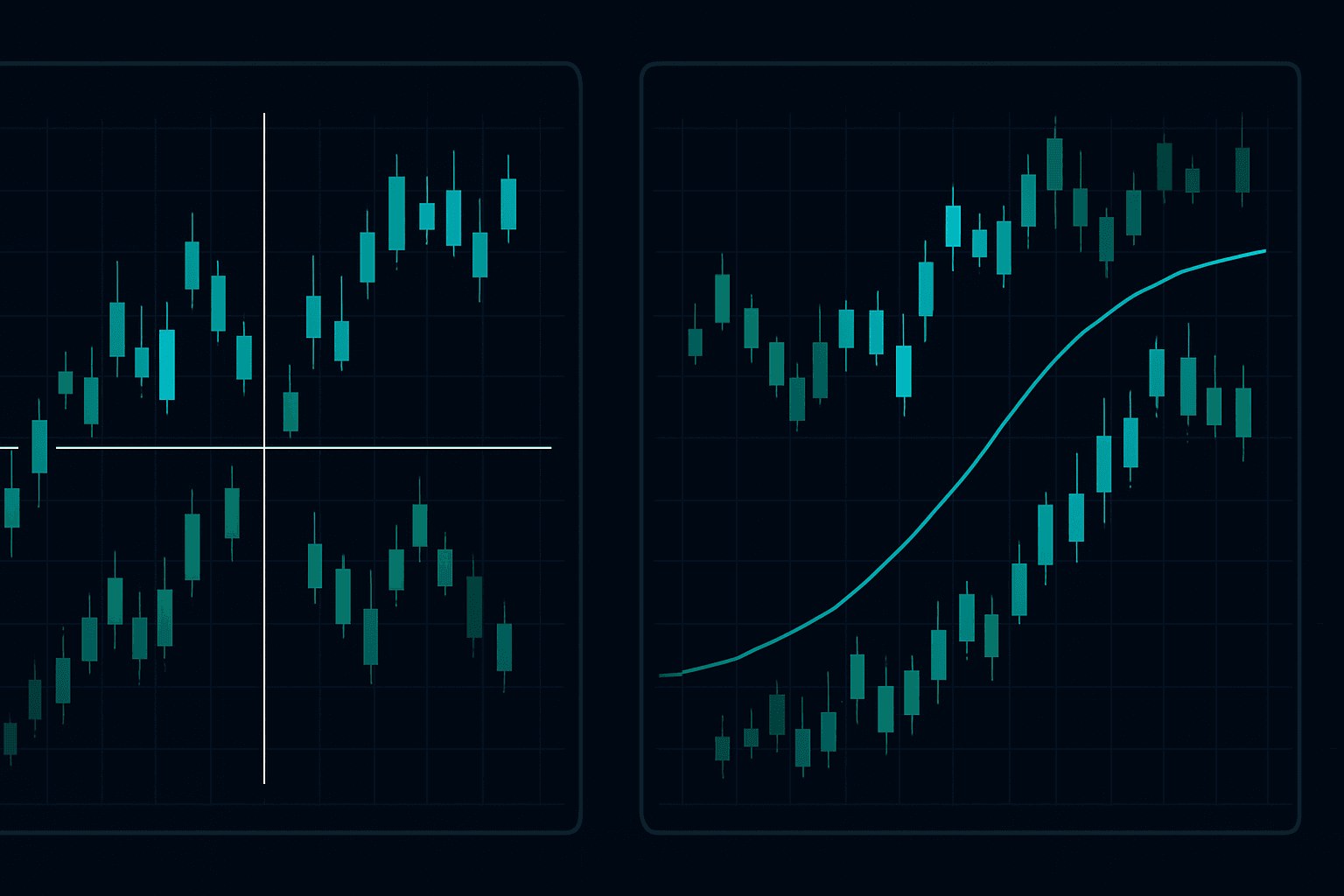

- Use technical analysis to time entries at support levels

- Position size: 40% of planned allocation

- Prices often consolidate around the halving event itself

- Continue accumulating on dips

- Add position size: 30% of planned allocation

- The supply shock begins to impact price

- Start looking at high-potential altcoins for the "altseason"

- Add remaining 30% of planned allocation to altcoins

- Begin taking profits systematically

- Use trailing stops and Fibonacci extensions for exit timing

- Reduce exposure gradually as sentiment reaches extreme greed

- Monitor sentiment indicators for cycle top signals

Strategy 3: The Altcoin Rotation Strategy

Historically, altcoins significantly outperform Bitcoin in the later stages of bull runs:

- Accumulate Bitcoin first (it leads the market)

- Watch Bitcoin dominance — when it peaks and starts declining, rotate a portion into quality altcoins

- Focus on altcoins with real utility: Layer 1s, DeFi protocols, infrastructure projects

- Avoid low-quality tokens: Meme coins and vaporware projects often collapse the hardest

- Take profits earlier with altcoins — they peak faster and crash harder than Bitcoin

Strategy 4: The DCA Approach

For those who prefer a stress-free approach:

- Set up automatic weekly or monthly Bitcoin purchases

- Continue DCA regardless of price (this is the key — do not stop during dips)

- Only pause or reduce DCA if price enters the extreme greed phase post-halving

- Resume DCA after the inevitable post-cycle correction

This approach has historically outperformed most active trading strategies with zero chart-reading required.

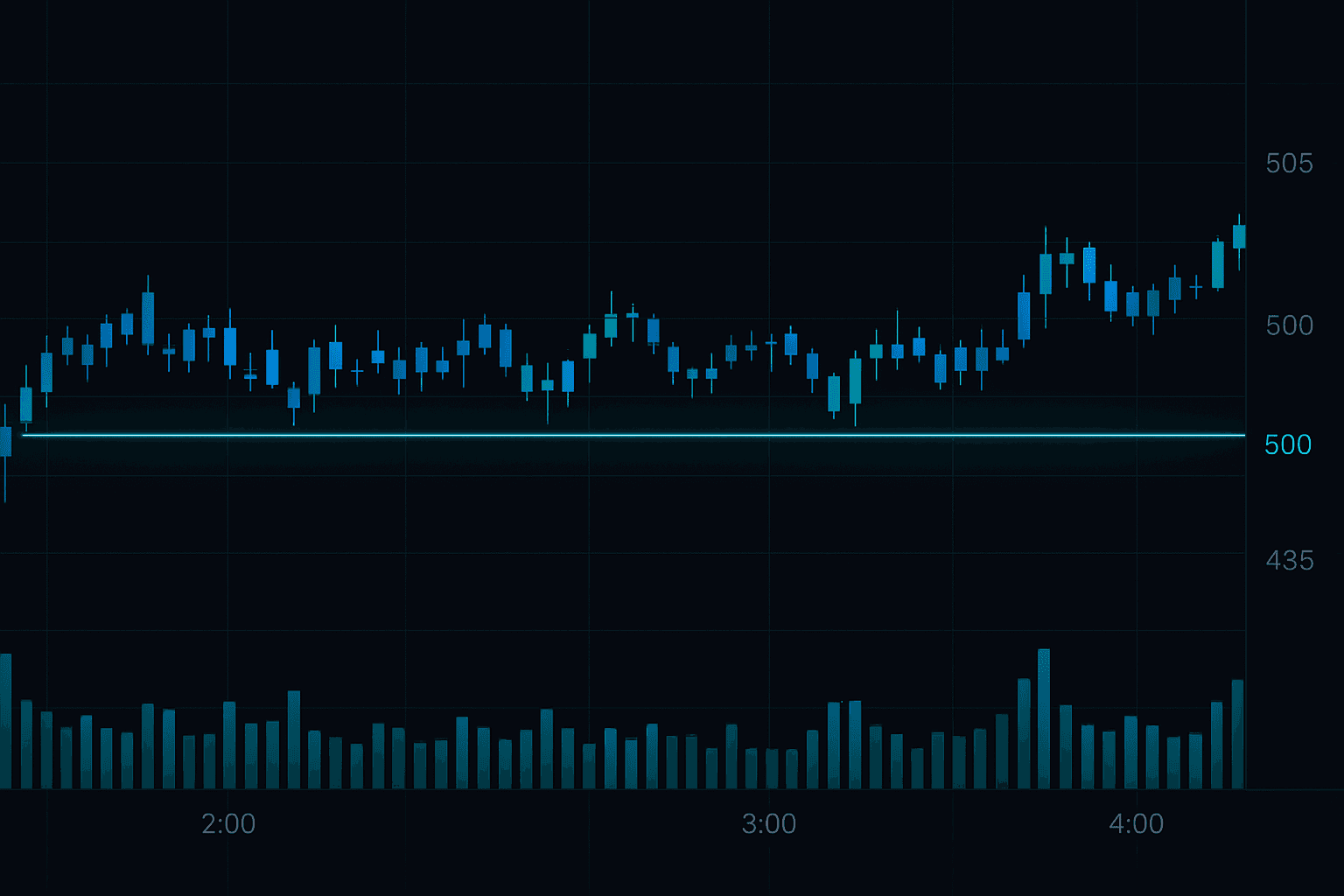

Technical Analysis for Halving Cycles

Key Levels to Watch

Using Fibonacci analysis on the macro Bitcoin chart reveals important levels for each cycle:

- Previous all-time high: Acts as psychological resistance, then support once broken

- 0.382 retracement of the previous cycle: Common re-accumulation zone

- 1.618 extension of the previous cycle: Common price target for the new cycle

- 2.618 extension: Stretch target in euphoric conditions

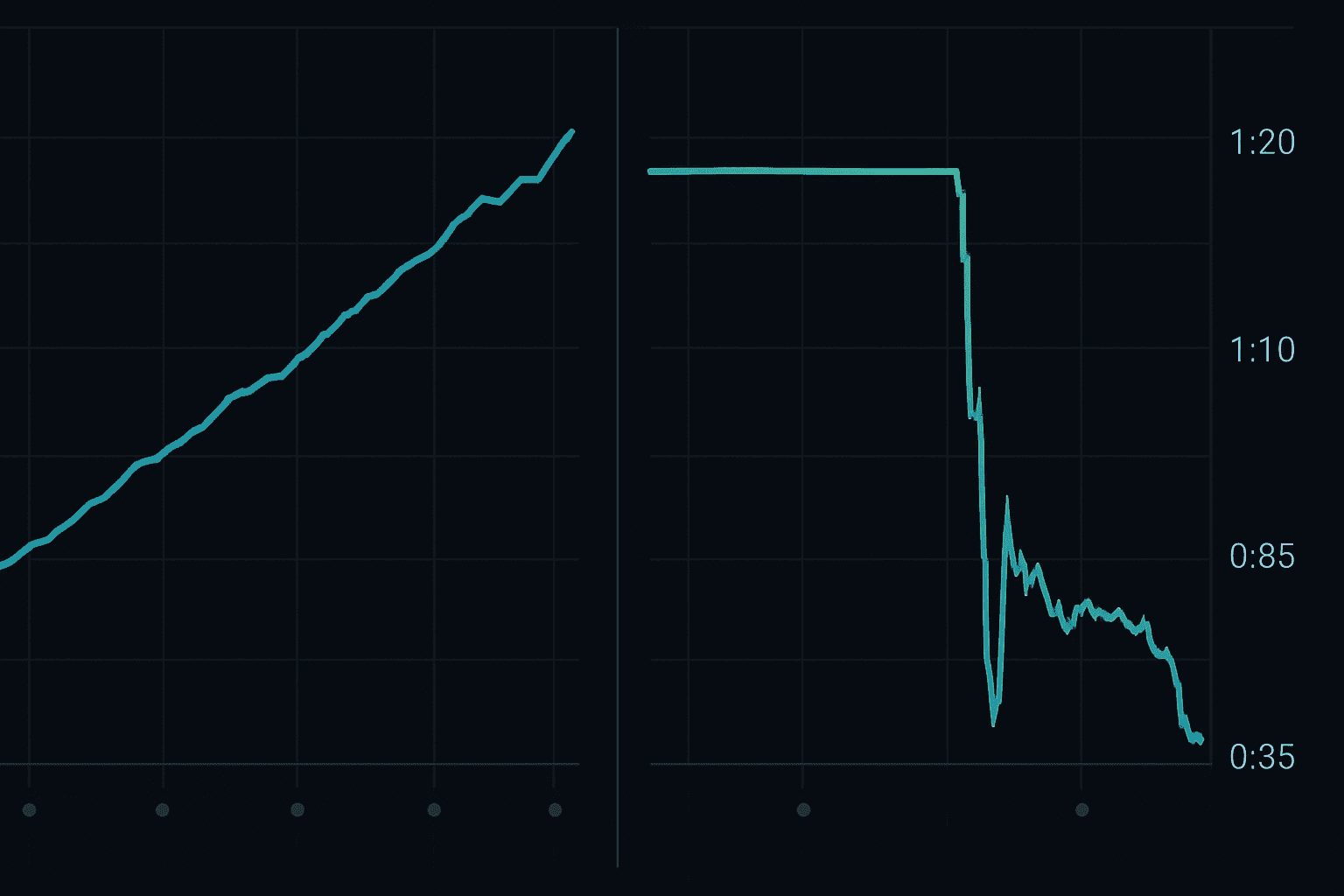

Cycle Patterns

Each halving cycle has followed a similar pattern:

- Bottom: Typically 12-15 months before the halving

- Recovery rally: Price recovers from the bear market low to the halving

- Post-halving consolidation: 2-4 months of sideways after the event

- Parabolic phase: Rapid price appreciation over 6-12 months

- Blow-off top: Sharp spike followed by crash (60-80% decline)

- Bear market: 12-18 months of declining prices to the next cycle bottom

Understanding where we are in this cycle helps you make better decisions about position sizing and risk management.

Risks and Considerations

Diminishing Returns

Each cycle has produced smaller percentage gains:

- Halving 1 → ~9,000% gains

- Halving 2 → ~3,000% gains

- Halving 3 → ~700% gains

- Halving 4 → ???

This trend suggests that while halvings will likely continue to be bullish, the magnitude of returns may decrease as Bitcoin matures and its market cap grows larger.

The "This Time Is Different" Risk

While history provides a framework, every cycle has unique characteristics:

- 2024 cycle: First with spot ETFs, more institutional participation, regulatory clarity

- Macro environment: Interest rates, inflation, and global politics differ each cycle

- Market maturity: More sophisticated participants may front-run the cycle

Black Swan Events

Halvings do not protect against unexpected events:

- Exchange collapses (FTX in 2022)

- Regulatory crackdowns

- Global financial crises

- Technical vulnerabilities or network attacks

Always maintain proper risk management regardless of cycle positioning.

Beyond Bitcoin: How Halvings Affect the Broader Market

Ethereum and Smart Contract Platforms

While Ethereum does not have a halving, it benefits enormously from Bitcoin halving cycles:

- Bitcoin rallies bring media attention and new users to crypto

- New users discover DeFi, NFTs, and other Ethereum applications

- ETH/BTC ratio often increases significantly post-Bitcoin-peak

- Layer 2 solutions and competing Layer 1s see increased adoption

DeFi Protocols

DeFi protocols typically see:- Increased TVL (Total Value Locked) during bull markets

- Higher trading volumes = higher fee revenue for liquidity providers

- Token prices appreciate with increased usage and speculation

- New protocols launch to capture the influx of capital

Altcoin Season

"Altseason" — the period when altcoins dramatically outperform Bitcoin — historically occurs in the late stages of post-halving bull runs:

- Bitcoin dominance peaks and starts declining

- Capital rotates from Bitcoin into smaller-cap tokens

- Returns can be extraordinary but so can losses

- The window is typically 2-4 months before the cycle peak

Tools for Halving Cycle Trading

For optimal cycle timing, combine:

- Macro analysis: Halving dates, supply metrics, on-chain data

- Technical analysis: FibAlgo's AI indicators for entry/exit timing

- Sentiment analysis: Fear and Greed Index, funding rates, social sentiment

- Risk management: Position sizing and stop loss strategies

Conclusion

The Bitcoin halving is the most reliable bullish catalyst in crypto. While past performance does not guarantee future results, the fundamental logic — reduced supply with increasing demand — is as valid for the 2024 cycle as it was for the first halving in 2012.

The key to maximizing returns is planning ahead, accumulating during the boring accumulation phases, and having the discipline to take profits during the euphoric distribution phases.

For traders looking to optimize their entry timing within the halving cycle, FibAlgo's technical analysis tools provide precise support and resistance levels, Fibonacci targets, and AI-powered signals that help you buy the dips and sell the rips with data-driven confidence.

Explore more trading strategies in our guides on Smart Money Concepts, best TradingView indicators, and common trading mistakes to avoid.