Technical analysis is the study of past price action to forecast future price movements. In the cryptocurrency market, where fundamentals can be nebulous and speculation runs high, technical analysis (TA) is the primary decision-making framework for the vast majority of successful traders.

This guide covers everything from candlestick basics to advanced multi-timeframe analysis, giving you a complete technical analysis toolkit for crypto trading.

Why Technical Analysis Works in Crypto

Crypto markets are ideal for technical analysis for several reasons:

- High retail participation: More retail traders mean more predictable crowd behavior

- 24/7 trading: Continuous price discovery means patterns have time to form cleanly

- High volatility: More price movement creates more trading opportunities

- Limited fundamental data: Many crypto projects lack traditional fundamental metrics

- Self-fulfilling prophecy: When millions of traders watch the same levels, those levels become significant

Candlestick Patterns: Reading the Language of Price

Japanese candlestick patterns remain the foundation of visual price analysis. Each candle tells a story about the battle between buyers and sellers:

Single Candle Patterns

- Doji: Open and close are virtually the same — indecision, potential reversal

- Hammer/Hanging Man: Long lower wick, small body — rejection of lower prices

- Shooting Star/Inverted Hammer: Long upper wick, small body — rejection of higher prices

- Marubozu: Large body with no wicks — strong conviction in one direction

Multi-Candle Patterns

- Engulfing: A candle that completely engulfs the previous candle — strong reversal signal

- Morning Star/Evening Star: Three-candle reversal pattern at key support/resistance

- Three White Soldiers/Three Black Crows: Three consecutive strong candles — trend confirmation

- Harami: Small candle contained within the previous candle — potential reversal, needs confirmation

Context Matters More Than Patterns

A hammer at a key Fibonacci retracement level is far more significant than a hammer in the middle of nowhere. Always consider where a pattern forms, not just what the pattern is.

Support and Resistance: The Battlefield Lines

Support and resistance (S/R) levels are prices where buying or selling pressure has historically been strong enough to reverse or stall price movement.

Types of Support and Resistance

- Historical S/R: Price levels that have been tested multiple times

- Psychological S/R: Round numbers ($50,000, $100,000 for Bitcoin)

- Dynamic S/R: Moving averages, trend lines, and Fibonacci levels

- Structural S/R: Previous swing highs and lows, order blocks

The Role Reversal Principle

When a support level is broken, it often becomes resistance, and vice versa. This role reversal creates opportunities:

- Support breaks → wait for a retest as resistance → short entry

- Resistance breaks → wait for a retest as support → long entry

This principle works because traders who were wrong at the original level (stopped out) create the orders that establish the new role of that price level.

Chart Patterns: The Geometry of Markets

Chart patterns represent repeating formations that indicate potential future price movement. Here are the most reliable patterns for crypto:

Continuation Patterns

- Bull/Bear Flags: A strong move followed by a tight, counter-trend consolidation

- Ascending/Descending Triangles: Contracting range with a flat edge and a sloping edge

- Symmetrical Triangles: Converging trendlines with decreasing volume

- Pennants: Similar to flags but symmetrical, forming after strong moves

Reversal Patterns

- Head and Shoulders: Three peaks with the middle one highest — bearish reversal

- Inverse Head and Shoulders: Three troughs with the middle one lowest — bullish reversal

- Double Top/Bottom: Two tests of the same level followed by reversal

- Rounding Bottom/Top: Gradual shift in momentum (longer-term pattern)

Measuring Pattern Targets

Most chart patterns have measured move targets:

- Flags: Target = the length of the pole added to the breakout point

- Head and Shoulders: Target = the distance from the head to the neckline

- Triangles: Target = the widest part of the triangle projected from the breakout point

For more precise targets, use Fibonacci extensions from the pattern's structure.

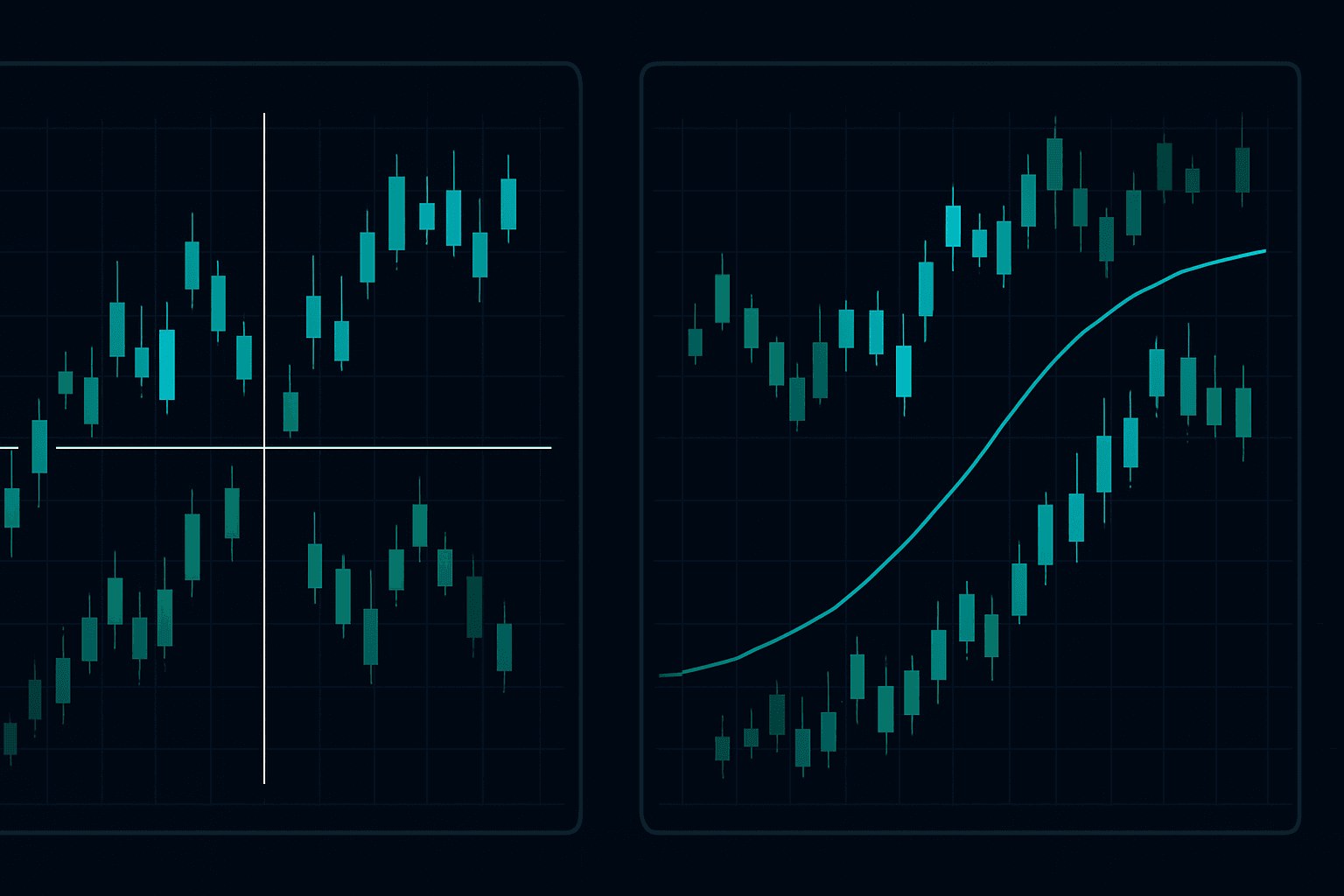

Technical Indicators: Your Dashboard Gauges

Technical indicators are mathematical calculations applied to price and volume data. They fall into several categories:

Trend Indicators

- Moving Averages (SMA, EMA): Smooth out price data to identify trends. The 50 and 200 EMAs are most widely watched.

- MACD: Shows the relationship between two EMAs. Crossovers signal trend changes.

- ADX: Measures trend strength regardless of direction. Above 25 = trending, below 20 = ranging.

Momentum Indicators

- RSI (Relative Strength Index): Measures overbought/oversold conditions. Above 70 = overbought, below 30 = oversold.

- Stochastic Oscillator: Shows where the current price is relative to its range over a period.

- CCI (Commodity Channel Index): Identifies cyclical trends and overbought/oversold conditions.

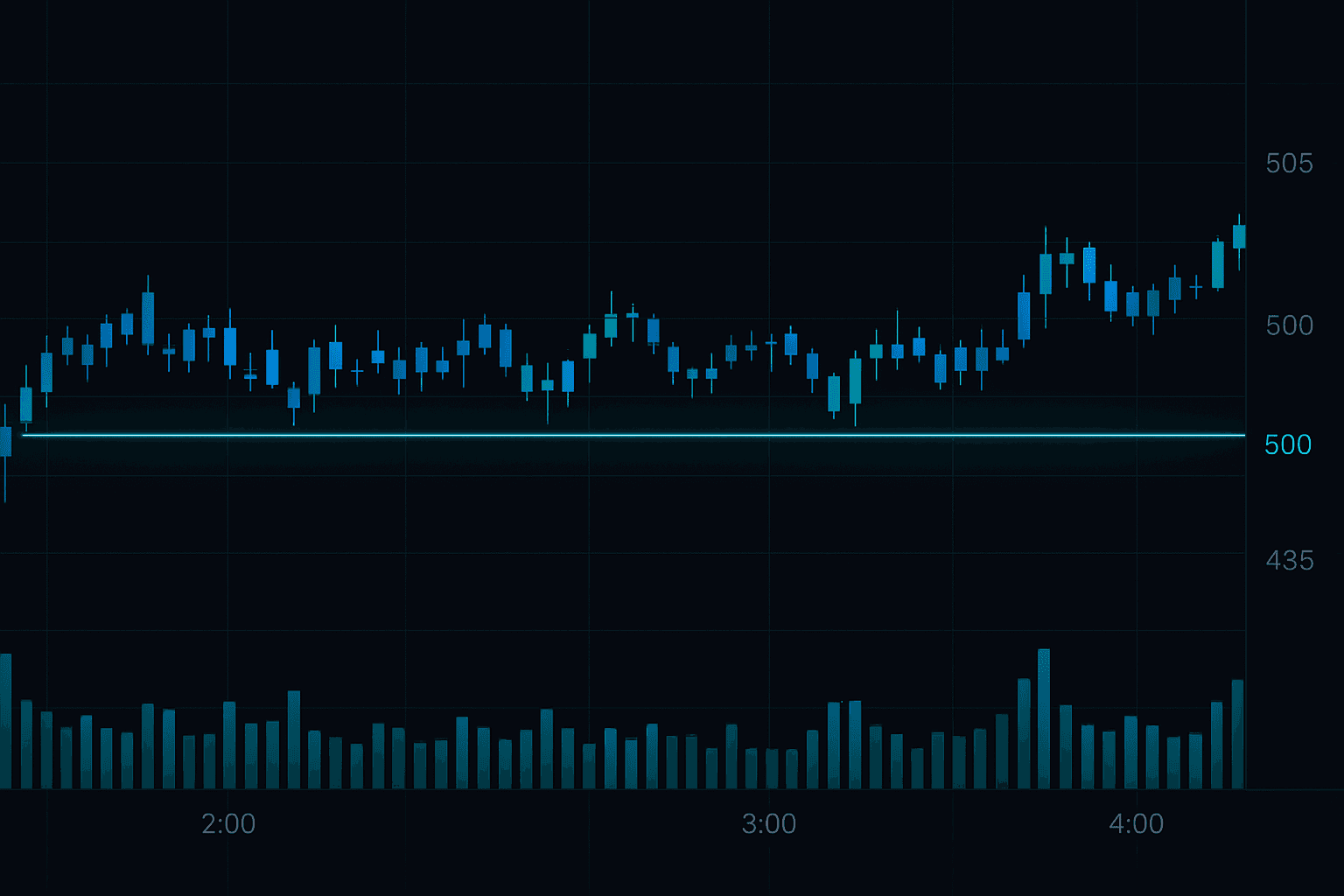

Volume Indicators

- Volume: The simplest but most important indicator. Volume confirms price movements.

- OBV (On-Balance Volume): Running total of volume showing accumulation/distribution.

- Volume Profile: Shows trading activity at each price level (horizontal volume analysis).

Volatility Indicators

- Bollinger Bands: Dynamic bands that expand and contract with volatility. Squeezes precede big moves.

- ATR (Average True Range): Measures average volatility over a period. Essential for stop loss placement.

- Keltner Channels: Similar to Bollinger Bands but uses ATR instead of standard deviation.

The Indicator Trap

The biggest mistake new traders make is using too many indicators. This leads to "analysis paralysis" and conflicting signals. Choose 2-3 indicators that complement each other:

- One trend indicator (e.g., EMA)

- One momentum indicator (e.g., RSI)

- Volume for confirmation

Volume Analysis: The Truth Behind the Move

Volume is the most underrated tool in technical analysis. Price shows you what happened; volume shows you how much conviction was behind it.

Key Volume Principles

- Volume confirms trends: Rising price with rising volume = healthy trend

- Volume precedes price: Volume often increases before significant price moves

- Volume at key levels: High volume at support/resistance confirms the level's importance

- Divergence: Price making new highs with declining volume = potential reversal

- Climax volume: Extremely high volume after a prolonged trend often signals exhaustion

Volume Profile Analysis

Volume Profile is one of the most powerful technical tools available:

- Point of Control (POC): The price level with the most trading activity — acts as a magnet for price

- Value Area: The range containing 70% of trading activity — price tends to stay within this area

- High Volume Nodes: Strong support/resistance levels

- Low Volume Nodes: Areas price moves through quickly (gaps in trading activity)

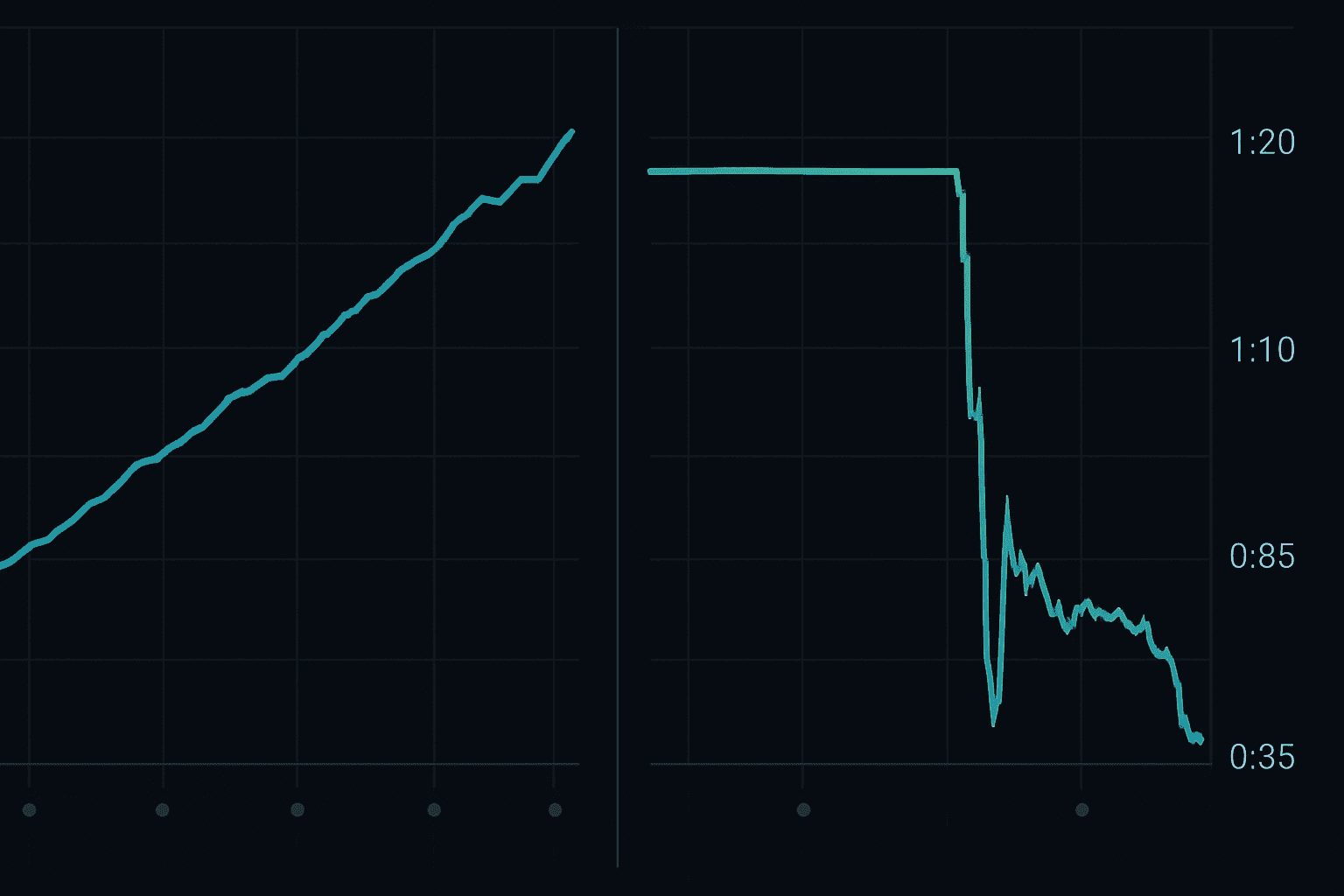

Multi-Timeframe Analysis (MTFA)

Professional traders never make decisions based on a single timeframe. MTFA involves analyzing multiple timeframes to get a complete picture:

The Triple Screen Approach

- Higher timeframe (Weekly/Daily): Determine the primary trend direction

- Trading timeframe (4H/1H): Identify specific entry and exit levels

- Lower timeframe (15M/5M): Fine-tune entries for better risk-to-reward

Rules of MTFA

- The higher timeframe always takes precedence

- Only take trades in the direction of the higher timeframe trend

- Use the trading timeframe for setup identification

- Use the lower timeframe only for entry timing, not trade decisions

Advanced TA Concepts

Market Regime Detection

Markets exist in different states:

- Trending up: Use trend-following strategies (buy dips)

- Trending down: Use trend-following strategies (sell rallies)

- Ranging: Use mean-reversion strategies (buy support, sell resistance)

- Volatile: Reduce position sizes, widen stops

Identifying the current regime is crucial because strategies that work in trending markets fail in ranges, and vice versa. AI-powered tools like FibAlgo's indicators can automatically detect market regimes and adjust signals accordingly.

Wyckoff Method

The Wyckoff Method analyzes market cycles through four phases:

- Accumulation: Smart Money buys at low prices (range with increasing volume on up moves)

- Markup: The uptrend phase as price moves higher

- Distribution: Smart Money sells at high prices (range with increasing volume on down moves)

- Markdown: The downtrend phase as price moves lower

Understanding these phases helps you identify where in the cycle the market currently sits. For more on institutional behavior, read our guide on Smart Money Concepts.

Intermarket Analysis

Crypto does not exist in a vacuum. Key intermarket relationships to monitor:

- Bitcoin dominance: Rising = altcoins underperforming, falling = altcoin season

- DXY (US Dollar Index): Inverse correlation with crypto; strong dollar usually means weak crypto

- S&P 500: Growing correlation between Bitcoin and equities

- Bond yields: Rising yields = risk-off sentiment, can pressure crypto

- Gold: Bitcoin is increasingly compared to gold as a store of value

Building Your Technical Analysis Routine

Here is a daily TA routine used by professional crypto traders:

- Check the macro picture (5 min): DXY, S&P 500 futures, Bitcoin dominance

- Review higher timeframes (10 min): Weekly and daily charts of your watchlist

- Mark key levels (10 min): Support, resistance, Fibonacci levels, order blocks

- Identify setups (15 min): Which charts are approaching your entry zones?

- Set alerts (5 min): Place price alerts at key levels so you do not have to stare at charts

- Review and journal (10 min): Record your analysis and any trades taken

Risk Management Integration

Technical analysis tells you where to trade. Risk management tells you how much to trade. Always:

- Place stops at technical levels where your trade is invalidated

- Calculate position size based on the distance to your stop

- Only take trades with at least 2:1 risk-to-reward based on technical targets

- Avoid trading during low-volume periods or around major news events

Conclusion

Technical analysis is both an art and a science. The mathematical tools are objective, but their application requires experience, judgment, and discipline. Start with the basics — candlestick patterns, support/resistance, and a few indicators — then gradually add more advanced concepts as your skills develop.

The best traders are not the ones who use the most indicators; they are the ones who have mastered a few tools and apply them consistently with proper risk management. For traders looking to accelerate their analysis, FibAlgo's AI-powered indicator suite automates the most time-consuming aspects of technical analysis.

Continue your education with our guides on common trading mistakes and the best TradingView indicators for 2025.