Fibonacci trading has been a cornerstone of technical analysis for decades, used by everyone from retail traders to hedge fund managers. In this comprehensive guide, we will explore every aspect of Fibonacci-based trading strategies, from the mathematical foundations to advanced multi-timeframe confluences that professional traders rely on daily.

Whether you are trading crypto, forex, or stocks, understanding Fibonacci levels can dramatically improve your ability to identify high-probability trade setups. By the end of this guide, you will have a complete framework for integrating Fibonacci analysis into your trading plan.

The Mathematical Foundation of Fibonacci in Markets

The Fibonacci sequence — 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144 — appears everywhere in nature, from the spiral of a nautilus shell to the branching of trees. In financial markets, these ratios manifest as psychological price levels where large groups of traders make buying and selling decisions.

The key Fibonacci ratios used in trading are derived from the relationships between numbers in the sequence:

- 23.6% — Derived from dividing a number by the number three places to the right

- 38.2% — Derived from dividing a number by the number two places to the right

- 50.0% — Not technically a Fibonacci ratio but widely used in trading

- 61.8% — The Golden Ratio, derived from dividing any number by its successor

- 78.6% — The square root of 61.8%

These percentages become support and resistance levels when applied to price swings, and understanding why they work is the first step to using them profitably.

Fibonacci Retracement: The Foundation of Every Setup

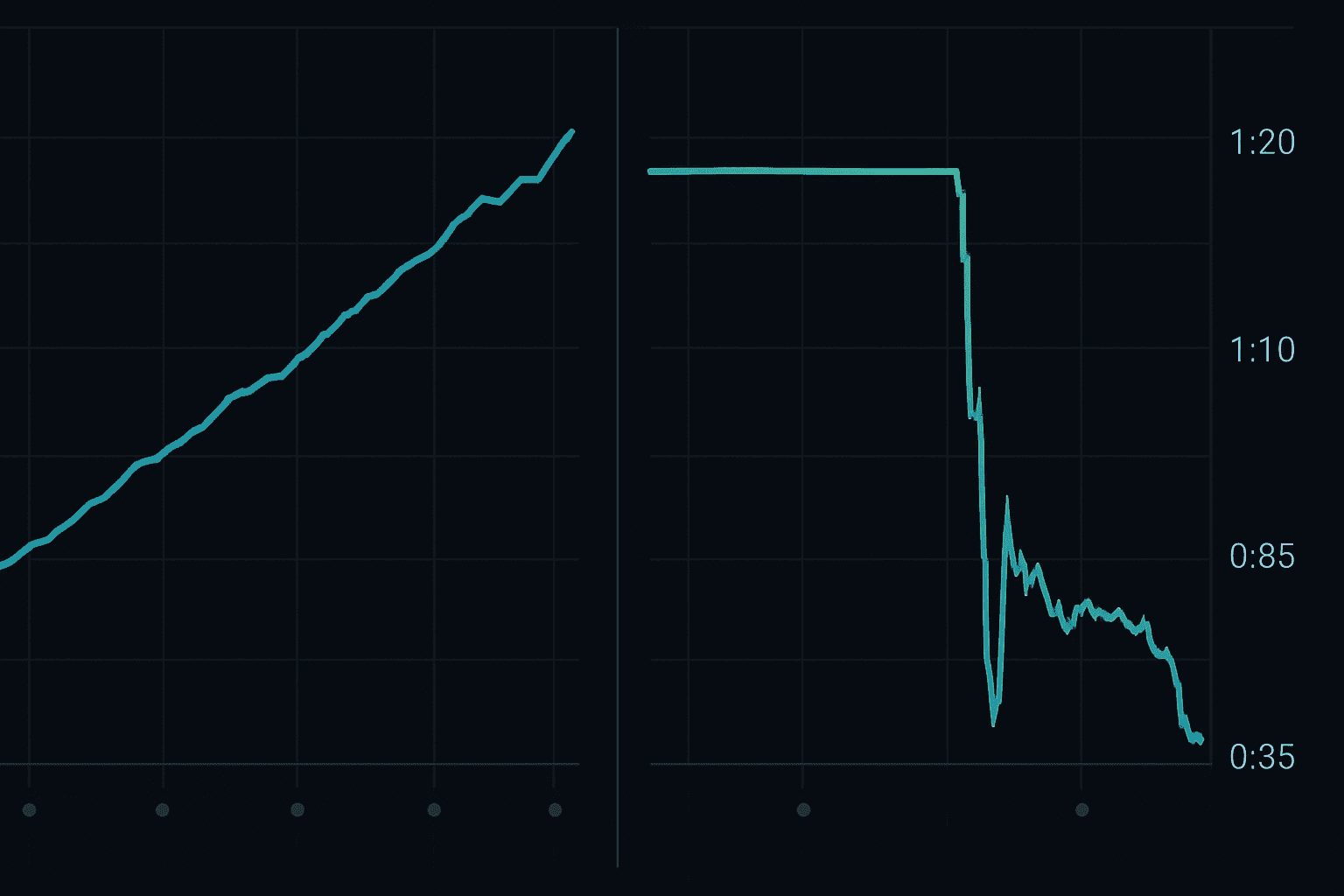

Fibonacci retracement is the most commonly used Fibonacci tool. It measures how far a price has pulled back from a recent swing, helping traders identify potential reversal zones.

How to Draw Fibonacci Retracements Correctly

The most common mistake traders make is drawing Fibonacci retracements incorrectly. Here is the proper method:

- Identify a clear swing high and swing low — The trend should be obvious and well-defined

- In an uptrend, draw from the swing low to the swing high

- In a downtrend, draw from the swing high to the swing low

- Use wicks, not candle bodies — Wicks represent the true extremes of price action

The most important levels to watch are the 38.2%, 50%, and 61.8% retracements. The 61.8% level, known as the Golden Ratio, is statistically the most significant reversal zone.

The Golden Pocket: 61.8% to 65% Zone

Professional traders pay special attention to what is known as the "Golden Pocket" — the area between the 61.8% and 65% retracement levels. This zone has the highest probability of producing a reversal because:

- Institutional algorithms are programmed to execute at these levels

- It represents the deepest retracement before a trend is considered broken

- Multiple timeframe confluences often align in this zone

When price enters the Golden Pocket with declining volume and momentum divergence, you have one of the highest-probability setups in all of trading. For automated detection of these setups, FibAlgo's AI-powered indicators can scan hundreds of pairs simultaneously.

Fibonacci Extensions: Setting Profit Targets Like a Pro

While retracements help you find entry points, Fibonacci extensions help you set rational profit targets based on the same mathematical principles.

The key extension levels are:

- 1.272 — Conservative first target

- 1.618 — The Golden Extension, most commonly hit target

- 2.0 — Full measured move target

- 2.618 — Extended target for strong trends

- 3.618 — Rare but powerful target in parabolic moves

How to Use Extensions in Practice

After entering a trade at a Fibonacci retracement level, use extensions to plan your exit:

- Take 50% of your position off at the 1.272 extension

- Move your stop to breakeven

- Take another 25% at the 1.618 extension

- Let the remaining 25% run to the 2.0 or 2.618 extension with a trailing stop

This scaling strategy ensures you lock in profits while still capturing large moves. Many traders who struggle with profitability make the mistake of closing entire positions too early or too late — Fibonacci extensions solve this problem by giving you mathematical targets.

Fibonacci Time Zones: The Overlooked Dimension

Most traders focus exclusively on price levels, but Fibonacci time zones add a powerful temporal dimension to your analysis. Time zones help you predict when reversals are most likely to occur, not just where.

To use Fibonacci time zones:

- Place vertical lines at Fibonacci intervals from a significant market turning point

- Look for clusters where time zones from different starting points overlap

- When a price reaches a key Fibonacci retracement level at the same time as a Fibonacci time zone, the probability of reversal increases dramatically

This concept of time-price confluence is used extensively by professional Smart Money traders who understand that markets operate in cycles.

Multi-Timeframe Fibonacci Confluence

The most powerful Fibonacci setups occur when levels from different timeframes align at the same price. Here is how to implement multi-timeframe analysis:

Step-by-Step Multi-Timeframe Process

- Weekly chart: Draw the primary Fibonacci retracement from the major swing

- Daily chart: Draw secondary Fibonacci levels from the intermediate swing

- 4-hour chart: Draw tertiary levels from the most recent swing

- Confluence zones: Mark areas where levels from 2 or more timeframes cluster within a tight price range

When you find a zone where the weekly 61.8%, daily 38.2%, and 4-hour 78.6% all converge within 0.5% of each other, you have found an institutional-grade entry point.

These multi-timeframe confluences are exactly what FibAlgo's advanced indicators are designed to detect automatically, saving you hours of manual charting.

Combining Fibonacci with Other Technical Tools

Fibonacci levels become exponentially more powerful when combined with other forms of analysis:

Fibonacci + Support/Resistance

When a Fibonacci level aligns with a historical support or resistance level, the significance of that price zone increases dramatically. Look for price levels that have been tested multiple times in the past AND coincide with a key Fibonacci ratio.

Fibonacci + Moving Averages

The 200-period moving average is the most watched moving average in the world. When it intersects with a Fibonacci retracement level, both institutional and retail traders focus on that zone.

Fibonacci + RSI Divergence

When price pulls back to a Fibonacci level and RSI shows divergence (price making new lows while RSI makes higher lows), the probability of a bounce increases significantly. This combination is one of the most reliable reversal signals available to traders.

Fibonacci + Volume Profile

Volume profile shows where the most trading activity has occurred at each price level. When a Fibonacci retracement aligns with a high-volume node, it becomes a stronger support/resistance zone. Conversely, low-volume areas near Fibonacci levels suggest price may move through quickly.

For more on how to combine technical analysis tools effectively, read our guide on Technical Analysis for Crypto Trading.

Common Fibonacci Trading Mistakes to Avoid

Even experienced traders make these costly errors with Fibonacci analysis:

- Drawing retracements on random swings — Only use clear, significant price swings

- Ignoring the bigger picture — Always check higher timeframe trends first

- Using Fibonacci in isolation — Combine with volume, momentum, and structure

- Forcing levels to fit — If the Fibonacci does not align clearly, skip the trade

- Trading every Fibonacci touch — Wait for confirmation (candlestick patterns, volume)

- Not accounting for spread/slippage — Place orders slightly beyond the exact Fibonacci level

Risk Management with Fibonacci Trading

No strategy works without proper risk management. Here are Fibonacci-specific risk rules:

- Stop loss placement: Place stops 1-2% beyond the next Fibonacci level (e.g., if entering at 61.8%, stop below 78.6%)

- Position sizing: Risk no more than 1-2% of your account per trade

- Risk-to-reward ratio: Only take trades with at least 1:2 risk-to-reward based on Fibonacci extension targets

- Correlation management: Avoid having more than 3 correlated Fibonacci trades open simultaneously

For a deeper dive into risk management strategies, check out our article on Risk Management in Crypto Trading.

Building a Complete Fibonacci Trading Plan

Here is a complete framework for trading with Fibonacci levels:

- Identify the trend on the weekly and daily charts

- Wait for a pullback to begin against the trend

- Draw Fibonacci retracement from the swing low to swing high (or vice versa)

- Mark confluence zones where Fibonacci levels overlap with other technical factors

- Wait for price to reach your zone — never chase

- Look for confirmation — rejection candles, volume surge, momentum shift

- Enter with a plan — know your stop loss and profit targets before entering

- Scale out at Fibonacci extensions — lock in profits systematically

Conclusion

Fibonacci trading is not magic — it is a mathematical framework for understanding where crowds of traders are likely to act. When applied correctly with proper risk management and confluence analysis, Fibonacci strategies can provide a significant edge in any market.

The key to success is consistency: apply the same process to every trade, journal your results, and refine your approach over time. For traders who want to automate Fibonacci detection and receive real-time alerts when high-probability setups form, FibAlgo's indicator suite handles the heavy lifting so you can focus on execution.

Ready to take your trading to the next level? Explore our complete indicator library or read more about how AI is transforming trading analysis.