In the world of crypto trading, understanding what the crowd is thinking can be just as important as reading charts. Market sentiment — the overall attitude of investors toward a particular asset or the market as a whole — drives price movements, especially in crypto where speculation dominates.

This guide will teach you how to measure and interpret market sentiment, and more importantly, how to use it to gain an edge in your trading.

What Is Market Sentiment and Why Does It Matter?

Market sentiment is the collective emotional state of market participants. It swings between two extremes:

- Extreme greed: Everyone is buying, prices are "only going up," social media is euphoric

- Extreme fear: Everyone is selling, prices are "going to zero," social media is panicking

The legendary investor Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful." This contrarian approach is the foundation of sentiment-based trading.

In crypto, sentiment matters more than in traditional markets because:

- Less institutional dominance: Retail traders drive a larger share of volume

- Higher emotional volatility: The 24/7 market and volatile prices amplify emotions

- Social media influence: A single tweet can move prices 10%

- Narrative-driven market: Crypto prices are heavily influenced by stories and hype

The Fear and Greed Index

The Crypto Fear and Greed Index is the most widely followed sentiment indicator. It combines multiple data sources into a single score from 0 (extreme fear) to 100 (extreme greed):

Components of the Fear and Greed Index

- Volatility (25%): Higher volatility indicates fear; lower volatility indicates complacency

- Market Momentum/Volume (25%): High buying volume = greed; high selling volume = fear

- Social Media (15%): Sentiment and engagement across Twitter, Reddit, Telegram

- Surveys (15%): Weekly crypto polls and surveys

- Bitcoin Dominance (10%): Rising dominance = fear (flight to safety); falling = greed (risk-on)

- Google Trends (10%): Search volume for crypto-related terms

How to Use the Fear and Greed Index

- 0-24 (Extreme Fear): Historically, the best time to buy. Markets tend to overreact to the downside

- 25-49 (Fear): Getting close to buying opportunities, but may have further downside

- 50-74 (Greed): Time to be cautious. Consider taking partial profits

- 75-100 (Extreme Greed): Historically, the worst time to buy. Markets tend to overreact to the upside

Important: Do not use the Fear and Greed Index in isolation. Combine it with technical analysis for timing and Fibonacci levels for price targets.

On-Chain Sentiment Metrics

On-chain data provides objective, tamper-proof insights into what market participants are actually doing — not just what they are saying on social media.

Exchange Flows

- Exchange inflows increasing: Traders moving coins to exchanges to sell — bearish

- Exchange outflows increasing: Traders moving coins to cold storage — bullish (long-term holding)

- Net exchange flow: The difference between inflows and outflows gives the clearest picture

Whale Activity

Whale wallets (holding 1,000+ BTC) can move markets. Monitoring their behavior provides insight into institutional sentiment:

- Whale accumulation: Large wallets increasing holdings — bullish

- Whale distribution: Large wallets sending to exchanges — bearish

- New whale addresses: More large-holding wallets appearing — confidence is growing

MVRV Ratio

The Market Value to Realized Value (MVRV) ratio compares the current market cap to the "realized" market cap (where each coin is valued at its last transaction price):

- MVRV > 3.5: Market is significantly overvalued; participants are sitting on large unrealized profits

- MVRV < 1: Market is undervalued; most participants are at a loss — historically the best time to buy

- MVRV near 1: Fair value zone

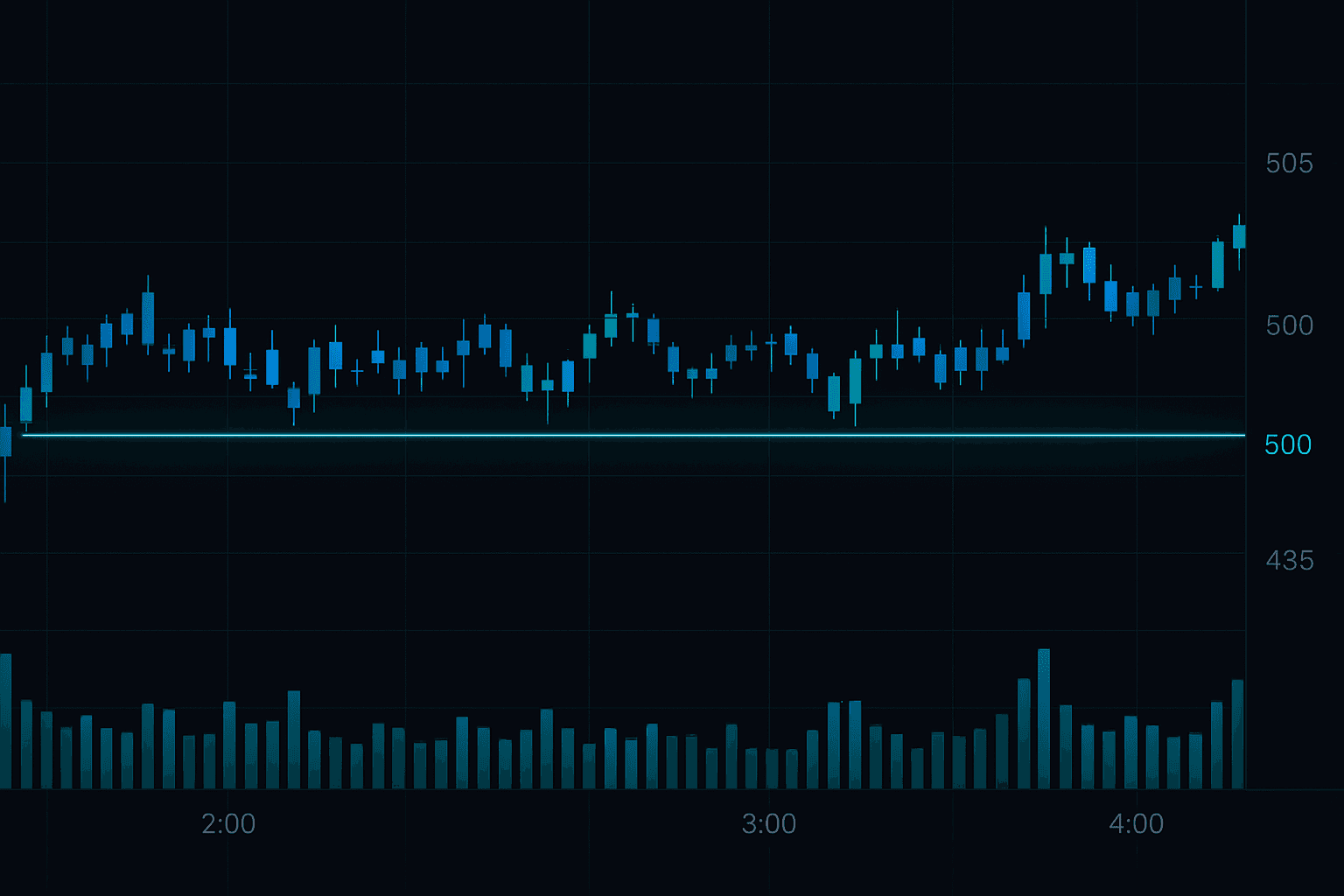

Funding Rates

In perpetual futures markets, funding rates show the balance between long and short positions:

- Positive funding (> 0.01%): Longs paying shorts — market is over-leveraged long (bearish contrarian signal)

- Negative funding (< -0.01%): Shorts paying longs — market is over-leveraged short (bullish contrarian signal)

- Near zero funding: Balanced market — no strong sentiment signal

Open Interest

Open interest (OI) measures the total number of outstanding derivative contracts:

- Rising OI + rising price: New money entering long positions — bullish

- Rising OI + falling price: New money entering short positions — bearish

- Falling OI + rising price: Short squeeze — shorts closing positions

- Falling OI + falling price: Long liquidations — longs closing positions

Social Sentiment Analysis

Social media is a powerful leading indicator for crypto markets:

Metrics to Track

- Social volume: How many mentions is a coin getting? Spikes often precede price moves

- Sentiment ratio: The balance of positive vs. negative mentions

- Influencer activity: What are key opinion leaders (KOLs) saying?

- Developer activity: GitHub commits, protocol updates, team engagement

How to Read Social Sentiment

- Increasing social volume + positive sentiment: Potential breakout approaching

- Extreme positive sentiment: Time to be cautious — "buy the rumor, sell the news"

- Very low social volume: Opportunity — the crowd is not paying attention yet

- Rising negative sentiment: Potential capitulation — could be a buying opportunity

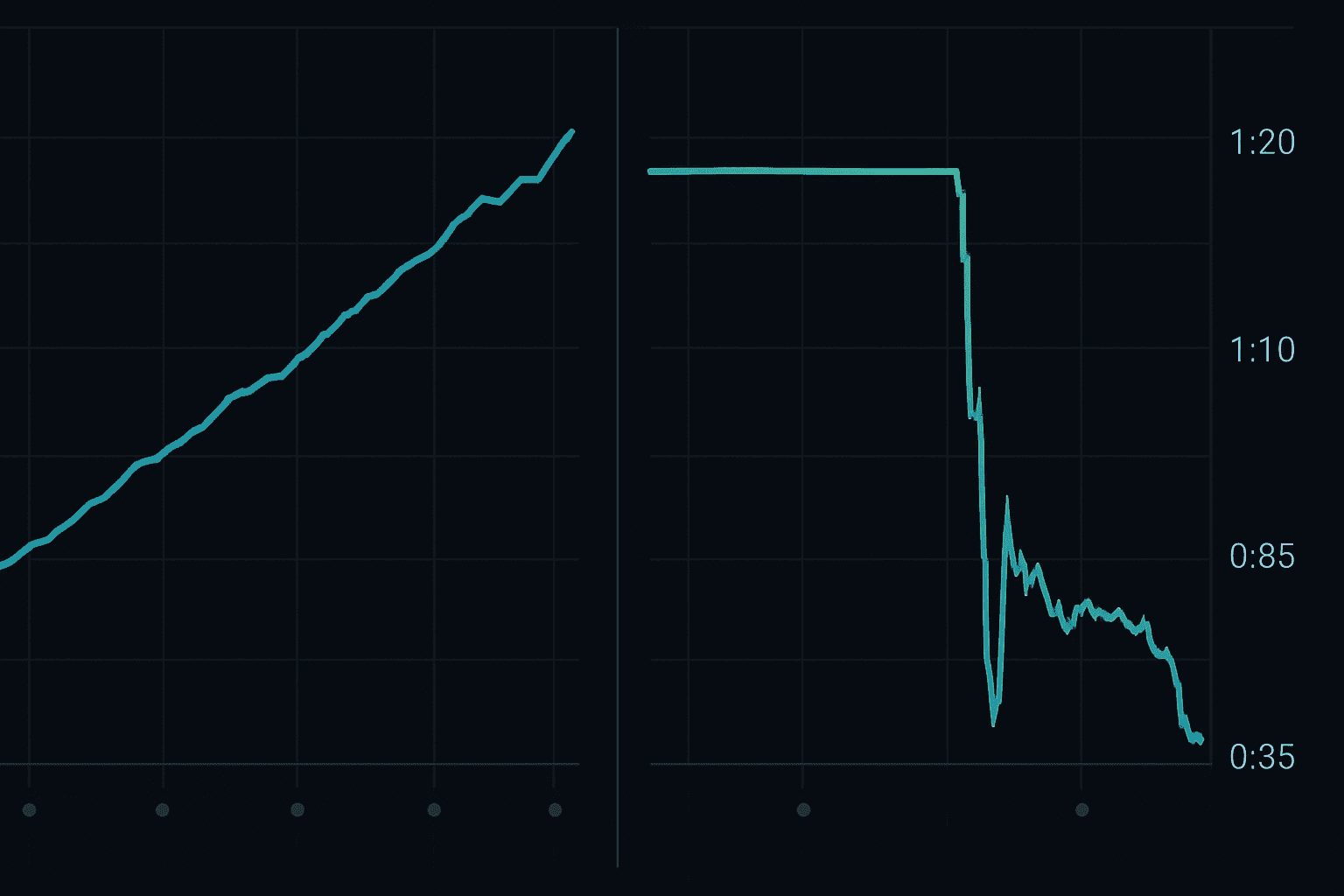

The Hype Cycle

New crypto narratives follow a predictable hype cycle:

- Innovation trigger: New technology or concept emerges

- Peak of inflated expectations: Massive social buzz, prices surge

- Trough of disillusionment: Reality sets in, prices crash, sentiment turns negative

- Slope of enlightenment: Genuine value builders continue working

- Plateau of productivity: Sustainable growth begins

Understanding where a narrative sits in this cycle helps you time your entries and exits. AI tools like FibAlgo's indicators can help identify when sentiment extremes align with technical levels.

Contrarian Trading Strategies

Contrarian trading means going against the crowd when sentiment reaches extremes. Here are practical contrarian strategies:

Strategy 1: Fear and Greed Extremes

- When the Fear and Greed Index drops below 15, start building long positions

- When it rises above 80, start taking profits and preparing for shorts

- Combine with Fibonacci support levels for precise entry timing

Strategy 2: Funding Rate Reversals

- When funding rates are extremely positive (> 0.05%), look for short setups

- When funding rates are extremely negative (< -0.05%), look for long setups

- These extremes often precede liquidation cascades

Strategy 3: Social Media Contrarianism

- When "everyone" is bullish and your Twitter feed is pure euphoria, consider reducing exposure

- When respected traders are posting bear theses and panic selling, consider accumulating

- Track the ratio of bull vs. bear posts — extremes in either direction are contrarian signals

Strategy 4: Exchange Balance Divergence

- When price is falling but exchange balances are also falling (coins moving to cold storage), this is a bullish divergence — smart money is accumulating while retail panics

- When price is rising but exchange balances are increasing, this is a bearish divergence — holders are preparing to sell into strength

Sentiment Analysis Tools and Resources

Free Tools

- Alternative.me Fear and Greed Index: Daily sentiment score

- CoinGlass: Funding rates, open interest, liquidations

- Glassnode free tier: Basic on-chain metrics

- LunarCrush: Social sentiment analytics

Premium Tools

- Glassnode Professional: Comprehensive on-chain analytics

- Santiment: Social + on-chain combined analysis

- The TIE: Institutional-grade sentiment data

- FibAlgo: AI-powered technical + sentiment analysis combined with automated signals

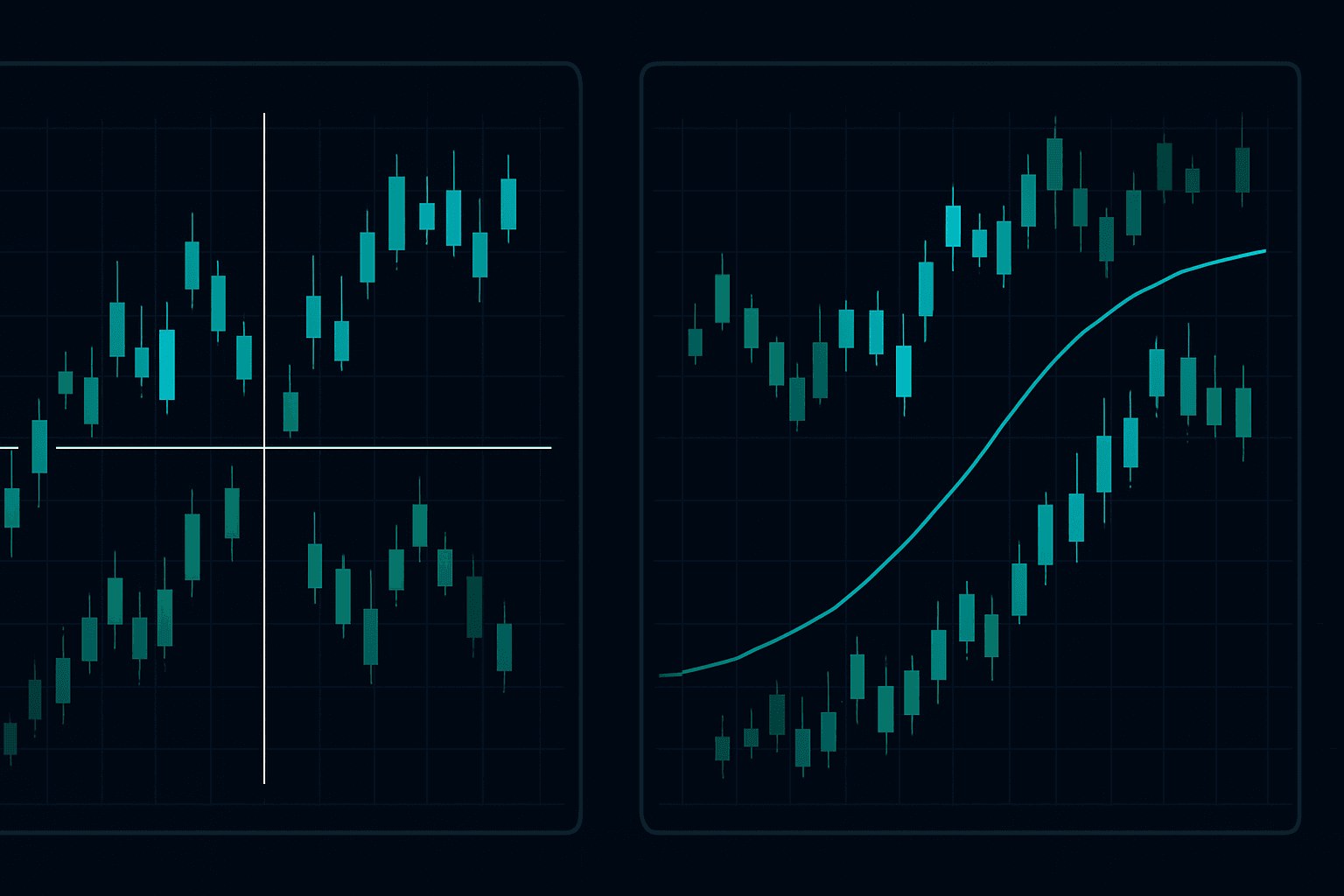

Building a Sentiment-Aware Trading Framework

Here is how to integrate sentiment analysis into your trading:

- Check the Fear and Greed Index daily — Is sentiment at an extreme?

- Monitor funding rates — Are traders over-leveraged in one direction?

- Check exchange flows — Is money flowing in or out of exchanges?

- Scan social sentiment — What is the crowd saying and feeling?

- Combine with technical analysis — Use TA tools to find specific entries

- Apply risk management — Follow the rules in our risk management guide

Common Sentiment Analysis Mistakes

- Confusing sentiment with trend — Bearish sentiment does not mean you should short; it means a reversal may be approaching

- Acting too early — Extremes can get more extreme. Wait for technical confirmation

- Following influencers blindly — Many crypto influencers are paid to promote projects

- Ignoring time frames — Short-term sentiment can be bearish while long-term is bullish

- Not combining with other analysis — Sentiment alone is insufficient for trading decisions

Conclusion

Sentiment analysis is the third pillar of crypto trading, alongside technical and fundamental analysis. By understanding what the crowd is thinking and feeling, you can position yourself ahead of major moves and avoid the emotional traps that catch the majority of traders.

The most profitable trades often come from doing the opposite of what feels comfortable — buying during extreme fear and selling during extreme greed. When you combine sentiment analysis with AI-powered technical tools like FibAlgo's indicator suite, you have a comprehensive framework for navigating the volatile crypto market.

For more trading strategies, explore our guides on the best TradingView indicators and the most common trading mistakes.