Decentralized Finance (DeFi) has created a new paradigm for earning returns on crypto assets. Yield farming — the practice of deploying crypto assets across DeFi protocols to earn returns — has matured significantly since its explosive growth in 2020. In 2025, yield farming offers sustainable opportunities for those who understand the risks and strategies involved.

This guide covers everything from basic concepts to advanced strategies for building a resilient yield farming portfolio.

What Is Yield Farming?

At its simplest, yield farming is the process of putting your cryptocurrency to work in DeFi protocols to earn a return. Instead of leaving your assets idle in a wallet, you deploy them in:

- Lending protocols: Earn interest by lending your crypto to borrowers

- Liquidity pools: Provide trading liquidity and earn a share of trading fees

- Staking protocols: Lock tokens to secure a network and earn rewards

- Vaults and aggregators: Automated strategies that optimize yield across protocols

The returns come from various sources:

- Trading fees: When you provide liquidity to a DEX, you earn a percentage of every trade in that pool

- Lending interest: Borrowers pay interest on the assets they borrow from you

- Protocol incentives: Many protocols distribute their native tokens to attract liquidity

- Governance rewards: Some protocols reward participation in governance

How Yield Farming Works: Step by Step

Step 1: Choose a Network

Yield farming exists on many blockchains:

- Ethereum: Largest DeFi ecosystem, but high gas fees

- Solana: Fast and cheap, growing DeFi ecosystem

- Arbitrum/Optimism: Ethereum L2s with lower fees but Ethereum security

- Avalanche: Fast finality, growing DeFi presence

- Base: Coinbase's L2, rapidly growing TVL

Step 2: Select a Protocol

Research protocols based on:

- Total Value Locked (TVL): Higher TVL generally indicates more trust and stability

- Audit status: Has the protocol been audited by reputable firms?

- Team reputation: Are the developers known and trustworthy?

- Track record: How long has the protocol been operating without incidents?

- APY sustainability: Is the yield coming from real revenue or just token emissions?

Step 3: Provide Liquidity or Deposit Assets

Depending on the protocol:

- Lending: Deposit your tokens and start earning interest immediately

- LP (Liquidity Providing): Pair two tokens (e.g., ETH/USDC) and deposit them into a pool

- Staking: Lock your tokens in a staking contract

- Vaults: Deposit tokens and let the vault strategy manage everything

Step 4: Harvest and Compound

- Many protocols require you to manually "harvest" earned rewards

- Auto-compounding vaults handle this automatically

- Compounding frequency significantly impacts your effective APY

Understanding Impermanent Loss

Impermanent Loss (IL) is the biggest risk in liquidity providing. It occurs when the price ratio of your paired tokens changes from when you deposited them.

How Impermanent Loss Works

If you provide ETH/USDC liquidity when ETH is $3,000:

- ETH doubles to $6,000: You experience about 5.7% IL compared to just holding both assets

- ETH triples to $9,000: IL increases to about 13.4%

- ETH drops 50% to $1,500: IL is about 5.7% (it is symmetric)

Mitigating Impermanent Loss

- Choose correlated pairs: ETH/stETH or USDC/USDT have minimal IL because the prices move together

- Concentrated liquidity: Protocols like Uniswap V3 let you provide liquidity in a specific price range for higher fees

- Single-sided staking: Some protocols allow you to deposit only one token

- IL protection: Some protocols offer insurance against IL

- High-fee pools: Trading fees can offset IL if the pool has enough volume

When IL Does Not Matter

IL is only "realized" when you withdraw. If trading fees earned exceed the IL, you are still profitable. Pools with high trading volume relative to TVL often generate enough fees to make IL irrelevant.

Types of Yield Farming Strategies

Conservative Strategies (5-15% APY)

Stablecoin LendingLending stablecoins (USDC, USDT, DAI) on protocols like Aave, Compound, or Morpho Blue:

- Very low risk (no price exposure)

- Yields are lower but sustainable

- Ideal for risk-averse investors or parking idle cash

- Returns come from real borrowing demand

Staking ETH through Lido (stETH) or Rocket Pool (rETH):

- Earn ~3-5% APY on your ETH

- Exposure only to ETH (an asset you would hold anyway)

- Liquid staking derivatives can be used in other DeFi protocols simultaneously

- No impermanent loss risk

Moderate Strategies (15-50% APY)

Stable-Volatile LP PairsProviding liquidity to pairs like ETH/USDC on major DEXes:

- Higher fees from volatile trading activity

- Moderate impermanent loss risk

- Protocol incentives often boost returns

- Requires monitoring and position management

Depositing an asset, borrowing against it, depositing the borrowed asset, and repeating:

- Amplifies lending yield through leverage

- Higher risk due to liquidation potential

- Requires careful health factor management

- Works best in stable interest rate environments

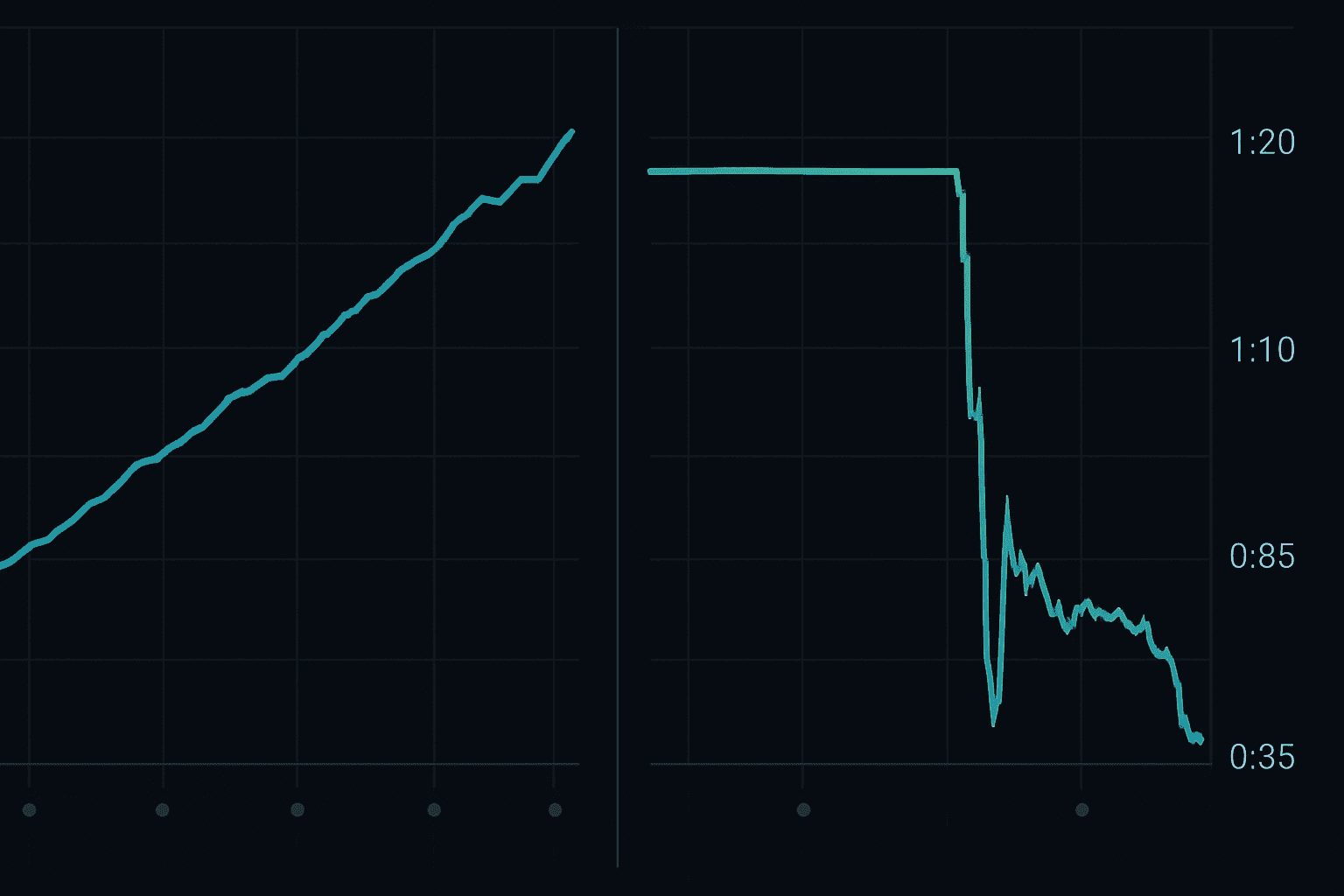

Aggressive Strategies (50%+ APY)

Farming new protocols that distribute generous token rewards:

- Very high initial yields that decline rapidly

- High risk of token price depreciation

- Smart contract risk is highest in new protocols

- Only appropriate for small portions of your portfolio

Using platforms that automatically leverage your yield farming position:

- Amplified returns but also amplified losses

- Liquidation risk if prices move against you

- Requires constant monitoring

- Not suitable for beginners

DeFi Risk Framework

Smart Contract Risk

Every DeFi protocol is only as secure as its code. Mitigate this risk by:

- Only using protocols with multiple audits from reputable firms

- Checking for bug bounty programs

- Starting with small amounts before committing significant capital

- Diversifying across protocols (do not put everything in one protocol)

Economic/Design Risk

Some protocols have flawed economic designs that work in bull markets but collapse in downturns:

- Unsustainable APYs funded purely by token emissions

- Insufficient liquidation mechanisms

- Circular dependencies between protocols

- Governance attacks or malicious proposals

Regulatory Risk

DeFi regulation is evolving rapidly. Potential risks include:

- Protocols being forced to implement KYC

- Tax implications of yield farming activities

- Jurisdiction-specific restrictions on DeFi access

- Token classifications as securities

Impermanent Loss Risk

As discussed above, IL can significantly eat into your returns. Use the mitigation strategies outlined earlier.

Building a Sustainable Yield Portfolio

Portfolio Allocation

A balanced yield farming portfolio might look like:

- 50% Conservative: Stablecoin lending + ETH staking (5-15% APY)

- 30% Moderate: Blue-chip LP pairs with protocol incentives (15-30% APY)

- 15% Growth: Newer protocols with strong fundamentals (30-60% APY)

- 5% Speculative: High-risk, high-reward opportunities (60%+ APY)

Monitoring and Rebalancing

- Check positions daily (or use monitoring tools)

- Rebalance monthly or when allocations drift more than 10%

- Move capital from declining-yield protocols to better opportunities

- Track all activities for tax purposes

Tax Considerations

Yield farming creates taxable events in most jurisdictions:

- Harvesting rewards is typically taxable income

- Providing/removing liquidity may trigger capital gains

- Token swaps are taxable events

- Keep detailed records of all transactions

Tools for Yield Farming

Portfolio Trackers

- DeBank: Track all your DeFi positions across chains

- Zapper: Portfolio visualization and management

- DefiLlama: Compare yields across protocols

Analytics

- Dune Analytics: Custom dashboards for protocol analysis

- Token Terminal: Revenue and earnings data for protocols

- DeFi Pulse: TVL tracking and protocol rankings

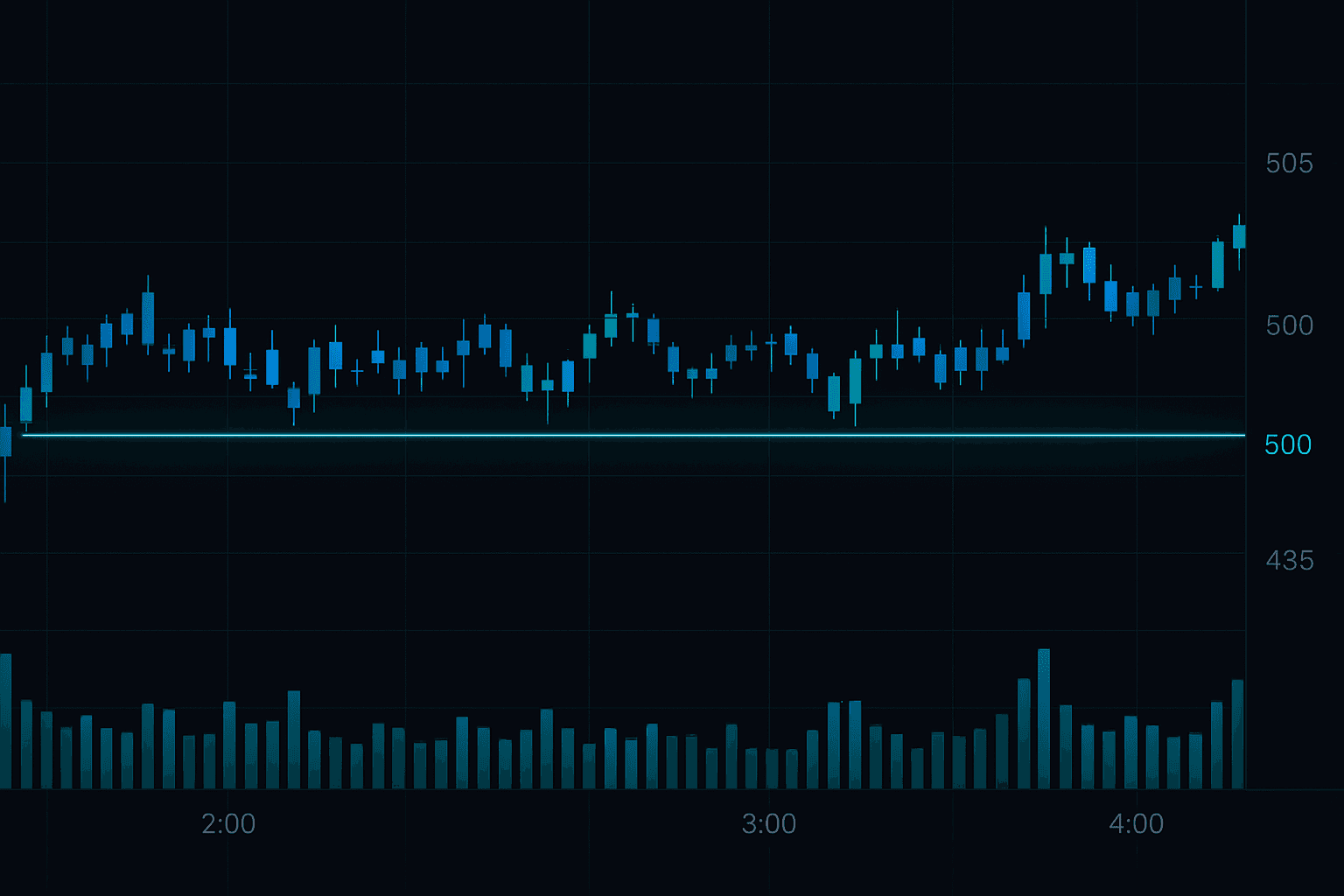

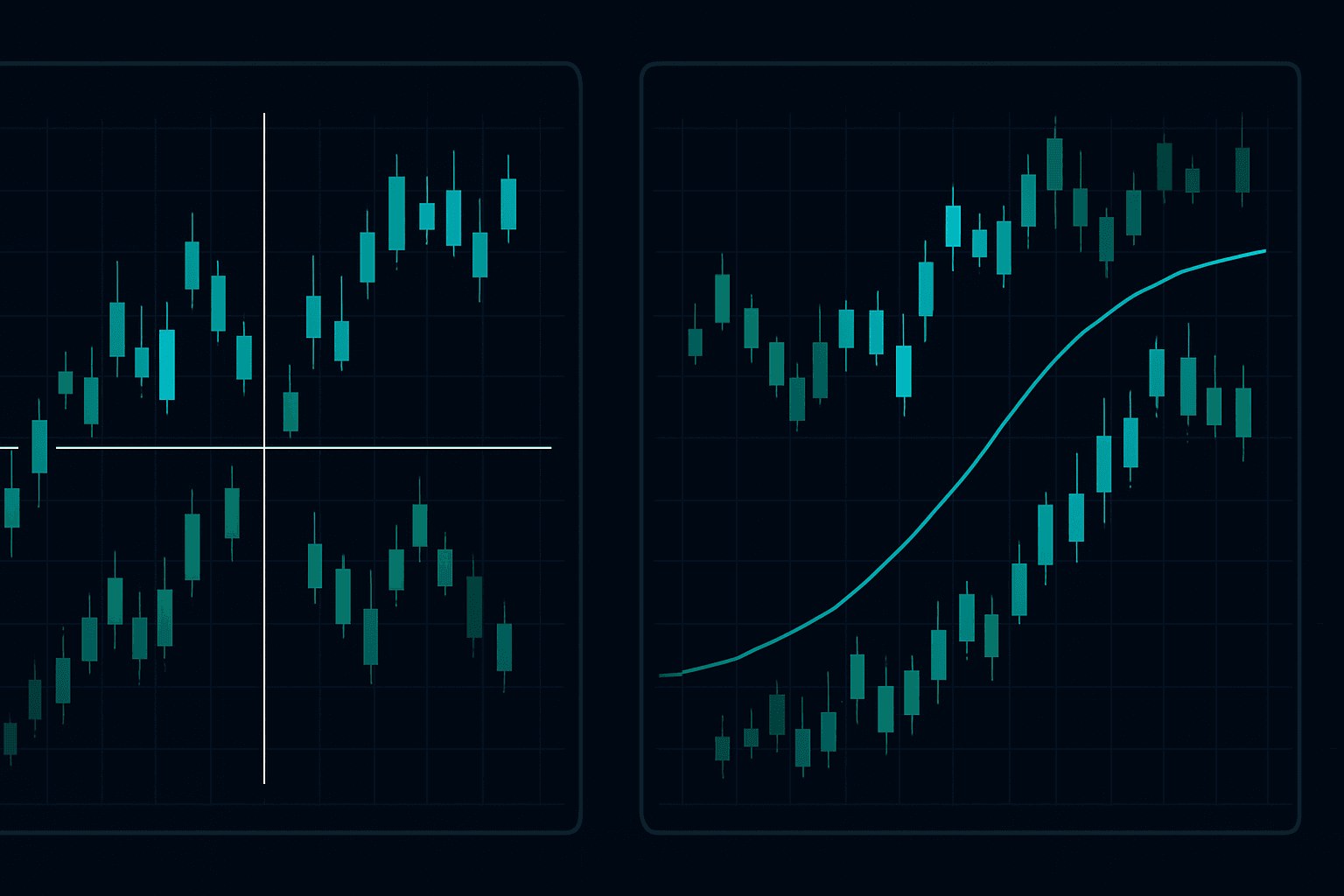

Trading and Analysis

For traders who also participate in DeFi, combining yield farming with active trading can be powerful. Use FibAlgo's technical indicators to time entries and exits from yield farming positions — buying the underlying tokens at optimal Fibonacci levels before depositing them into yield farms.

Common Yield Farming Mistakes

- Chasing the highest APY: Unsustainably high yields almost always decline rapidly or end in a loss

- Ignoring gas costs: On Ethereum mainnet, gas can eat your profits if your position is too small

- Not accounting for impermanent loss: Always calculate whether fees will exceed IL

- Putting everything in one protocol: One exploit can wipe out your entire position

- Not tracking for taxes: This creates nightmares at tax time and potential legal issues

- Ignoring token emissions: High APY funded by token printing is not real yield

- Forgetting about risk management: Apply the same risk management principles from trading to DeFi

Conclusion

DeFi yield farming in 2025 offers genuine opportunities for earning passive income on crypto assets. The key is approaching it with the same discipline and risk awareness you would apply to trading.

Focus on protocols with real revenue, diversify across strategies and risk levels, and never deploy more capital than you can afford to lose. The best yield farmers are not the ones chasing the highest APY — they are the ones who consistently earn sustainable returns while preserving capital.

For traders looking to optimize their DeFi entries, combining yield farming with FibAlgo's technical analysis tools can help you enter positions at the best possible prices. Explore our guides on market sentiment and technical analysis to enhance your DeFi strategy.