TradingView has become the world's most popular charting platform, with over 60 million users worldwide. Its vast library of indicators — both built-in and community-created — provides traders with powerful tools for analyzing any market. But with thousands of indicators available, choosing the right ones can be overwhelming.

In this guide, we rank the top 15 TradingView indicators for 2025, explain how to use each one, and show you which combinations produce the best results.

How We Ranked These Indicators

Our rankings are based on:

- Accuracy: How reliably does the indicator generate profitable signals?

- Versatility: Does it work across different markets and timeframes?

- Complementarity: How well does it work with other indicators?

- User-friendliness: Is it easy to understand and apply?

- Community validation: How well-rated is it by the TradingView community?

The Top 15 TradingView Indicators

1. FibAlgo Smart AI Indicator

The top pick for 2025 is FibAlgo's Smart AI indicator. Unlike traditional indicators that use fixed mathematical formulas, FibAlgo's indicator uses machine learning to adapt to changing market conditions.

Key Features:- Real-time trend detection across multiple timeframes

- Smart Money Concept integration (order blocks, FVGs, liquidity zones)

- Fibonacci confluence detection with AI-powered analysis

- Non-repainting signals with probability scores

- Works on crypto, forex, stocks, and commodities

- Use default settings for most markets

- Increase sensitivity for scalping on lower timeframes

- Decrease sensitivity for swing trading on higher timeframes

2. Volume Profile (VPVR)

Volume Profile shows trading activity at each price level rather than each time period. This "horizontal volume" reveals where the most significant buying and selling occurred.

How to Use:- Identify the Point of Control (POC) — the price with the highest volume

- Use Value Area High and Low as dynamic support/resistance

- Look for low-volume areas (gaps) where price moves quickly

- Combine with Fibonacci levels for powerful confluence

- Row Size: 200

- Value Area: 70%

- Display: Histogram + POC + VA

3. SuperTrend

SuperTrend is a trend-following indicator that plots a dynamic support/resistance level on the chart. It is one of the most clean and easy-to-read trend indicators available.

How to Use:- When price is above the SuperTrend line (green), the trend is bullish

- When price is below the SuperTrend line (red), the trend is bearish

- Use color changes as entry/exit signals

- Combine with volume for confirmation

- Period: 10

- Multiplier: 3.0

- For scalping: Period 7, Multiplier 2.0

4. RSI (Relative Strength Index)

RSI remains one of the most valuable indicators for identifying overbought/oversold conditions and momentum divergence.

Advanced RSI Techniques:- RSI Divergence: Price making new highs while RSI makes lower highs = bearish divergence

- RSI Range Shifts: In strong uptrends, RSI oscillates between 40-80; in downtrends, between 20-60

- RSI Support/Resistance: Draw trendlines on RSI itself for early breakout signals

- Standard: 14 period

- For crypto scalping: 7 period

- For swing trading: 21 period

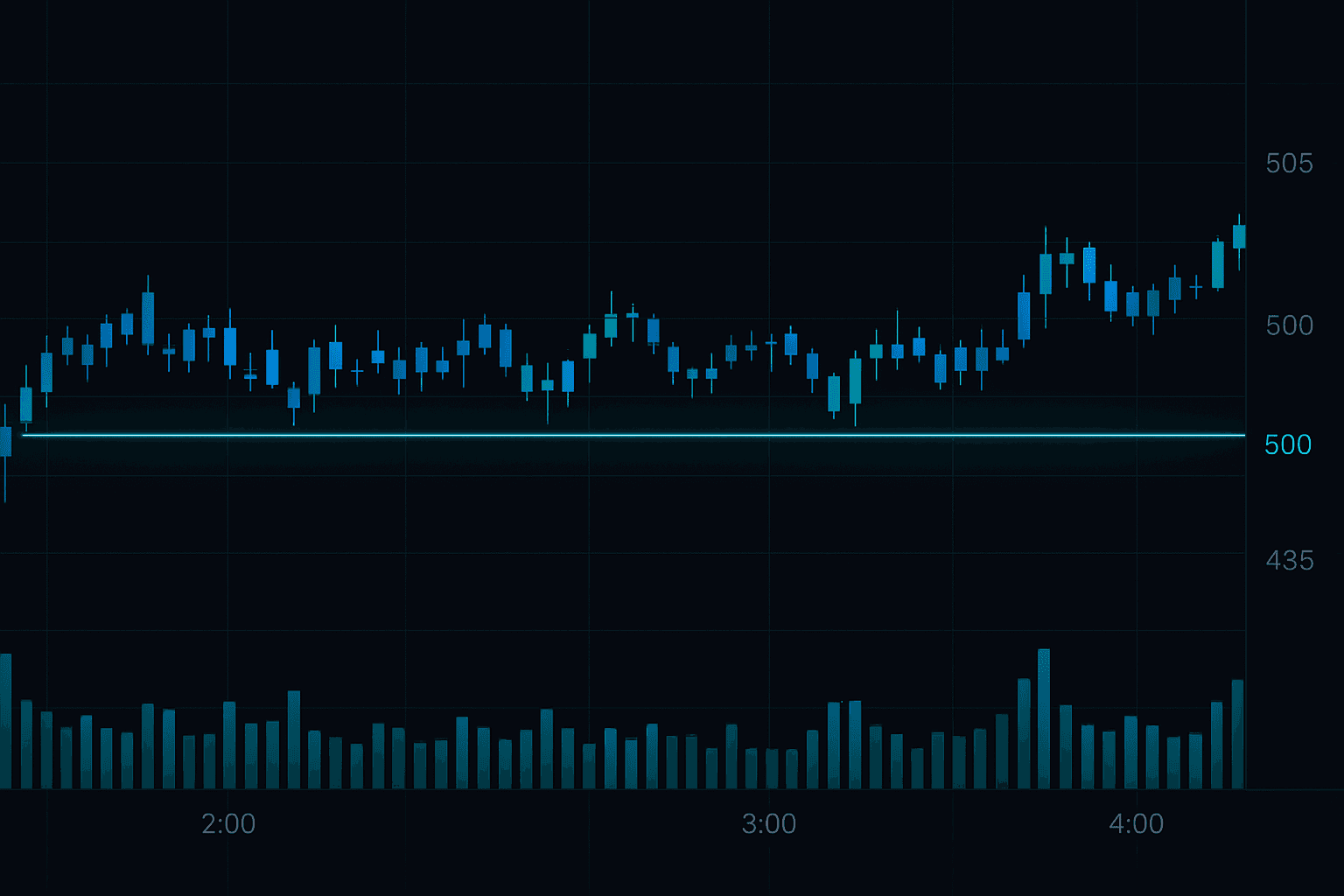

5. VWAP (Volume Weighted Average Price)

VWAP shows the average price weighted by volume. Institutional traders use it extensively as a benchmark for trade execution.

How to Use:- Price above VWAP = bullish bias; below = bearish bias

- VWAP acts as dynamic support in uptrends, resistance in downtrends

- Anchored VWAP from significant events (halvings, major lows/highs) provides powerful levels

6. Bollinger Bands

Bollinger Bands measure volatility and help identify overbought/oversold conditions and potential breakouts.

Advanced Bollinger Band Strategies:- Squeeze: When bands contract, a big move is coming — trade the breakout direction

- Walk the Band: In strong trends, price can "walk" along the upper or lower band

- Double Bottom with Bollinger: A double bottom where the second low is above the lower band is a strong buy signal

- Standard: 20 period, 2 standard deviations

- For crypto: 20 period, 2.5 standard deviations (wider due to higher volatility)

7. MACD (Moving Average Convergence Divergence)

MACD shows the relationship between two EMAs and is excellent for identifying trend changes and momentum shifts.

Key Signals:- Signal line crossover: MACD crossing above signal line = bullish

- Zero line crossover: MACD crossing above zero = trend confirmation

- Histogram expansion: Growing histogram bars = increasing momentum

- Divergence: Most powerful MACD signal — price diverging from MACD

- Standard: 12, 26, 9

- For faster signals: 8, 21, 5

8. Ichimoku Cloud

Ichimoku provides a comprehensive view of support, resistance, trend direction, momentum, and future levels all in one indicator.

Components:- Tenkan-sen (Conversion Line): Short-term trend

- Kijun-sen (Base Line): Medium-term trend; excellent for stop loss placement

- Senkou Span A & B (Cloud): Future support/resistance

- Chikou Span (Lagging Span): Confirmation of trend direction

- Standard: 9, 26, 52

- Crypto-optimized: 10, 30, 60 (adjusts for 24/7 markets)

9. Fibonacci Retracement Tool

TradingView's built-in Fibonacci tool is essential for any trader who uses retracement and extension levels.

- Draw from swing low to swing high in uptrends (and vice versa)

- Focus on the 38.2%, 50%, 61.8%, and 78.6% levels

- Use the 0.618 extension as your primary profit target

- Combine with Smart Money Concepts for institutional-grade analysis

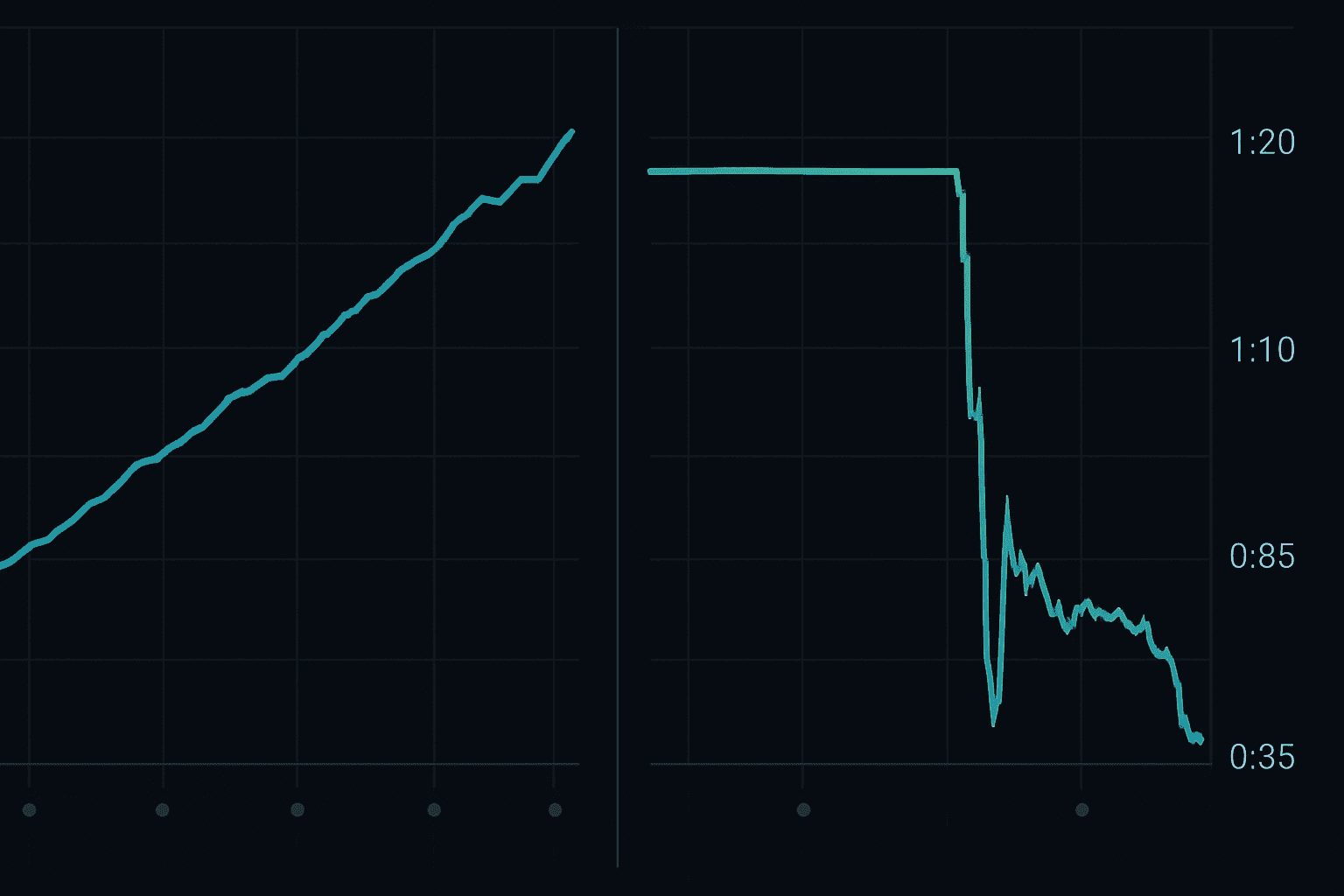

10. ATR (Average True Range)

ATR measures volatility and is essential for position sizing and stop loss placement.

How to Use:- Stop loss = Entry ± (2 × ATR) for swing trades

- Position size calculation: Risk Amount / (ATR × Multiplier)

- High ATR = reduce position size; Low ATR = increase position size

- ATR squeeze (unusually low) often precedes big moves

- Standard: 14 period

- For day trading: 7 period

11. Stochastic RSI

StochRSI applies the Stochastic formula to RSI values, creating a more sensitive momentum indicator.

How to Use:- Overbought above 80, oversold below 20

- Crossovers in extreme zones are the strongest signals

- Combine with trend direction — only take long signals in uptrends

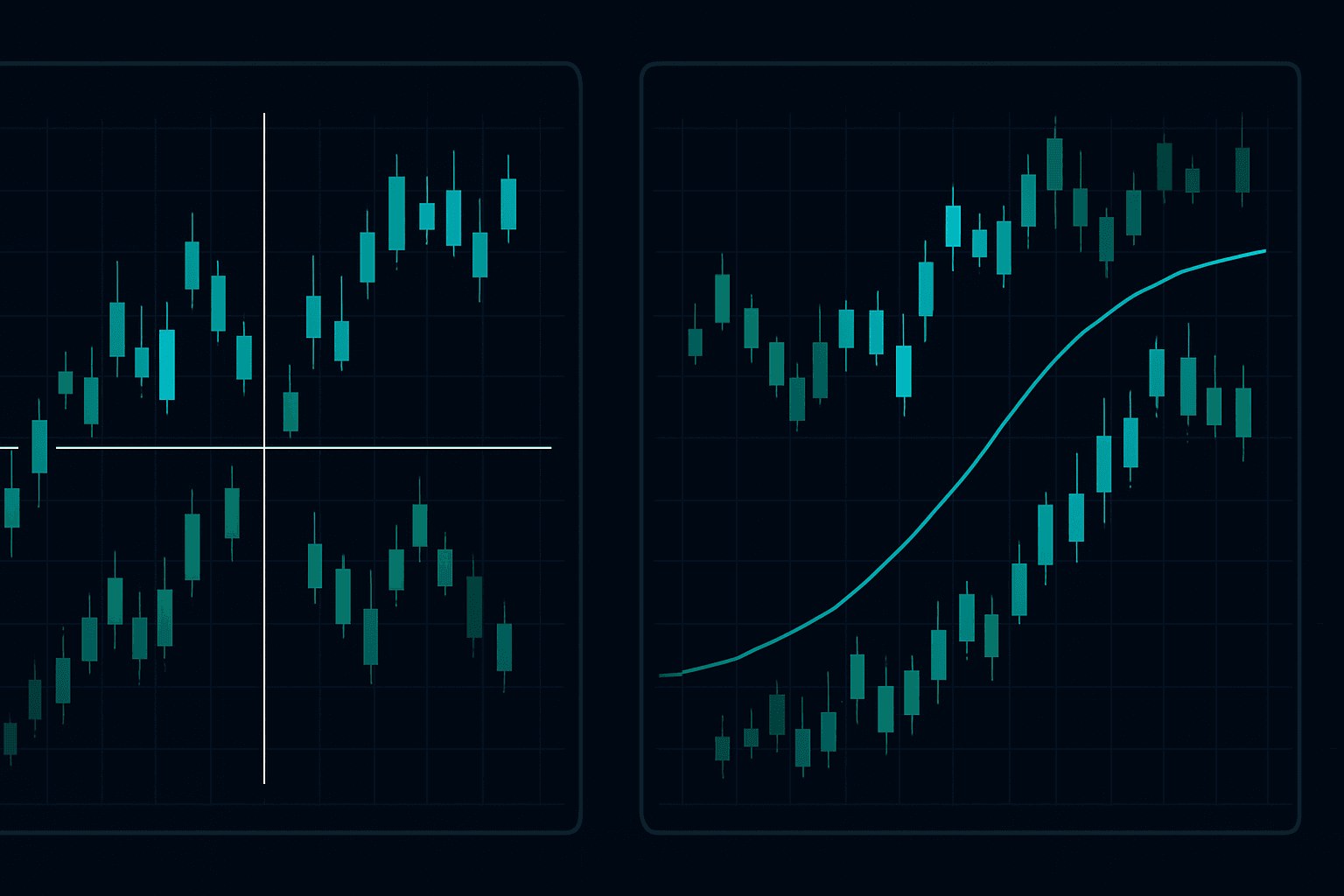

12. EMA Ribbon

A set of EMAs (typically 8 to 21) that create a visual "ribbon" showing trend direction and momentum.

How to Use:- When the ribbon is fanning out upward = strong uptrend

- When the ribbon is converging = trend losing momentum

- Pullbacks to the ribbon in an uptrend are buying opportunities

13. On-Balance Volume (OBV)

OBV tracks cumulative volume flow, showing whether volume is flowing into or out of an asset.

How to Use:- OBV rising with price = confirmed uptrend

- OBV divergence from price = early warning of trend change

- OBV breakouts often precede price breakouts

14. Pivot Points

Pivot Points calculate key support and resistance levels based on the previous period's high, low, and close.

Best For: Day trading, identifying intraday support and resistance Types: Standard, Fibonacci, Camarilla (each uses different calculation methods)15. Market Cipher (Community)

A popular community indicator that combines multiple analyses including waves, momentum, and divergences.

How to Use:- Green dots = potential buy signals

- Red dots = potential sell signals

- Use in conjunction with other analysis, not in isolation

The Best Indicator Combinations

Combination 1: Trend + Momentum + Volume

- SuperTrend (trend direction)

- RSI (momentum and divergence)

- Volume Profile (key price levels)

Combination 2: Smart Money Setup

- FibAlgo AI Indicator (order blocks, FVGs, Fibonacci)

- VWAP (institutional benchmark)

- ATR (volatility-based risk management)

Combination 3: Scalping Setup

- EMA Ribbon (fast trend detection)

- Stochastic RSI (momentum extremes)

- VWAP (intraday direction)

Combination 4: Swing Trading Setup

- Ichimoku Cloud (comprehensive trend view)

- MACD (momentum and divergence)

- Fibonacci Retracement (entry and target levels)

Indicator Settings Optimization Tips

- Do not over-optimize: Fitting settings perfectly to past data leads to poor future performance

- Use default settings first: They are defaults for a reason — widely watched levels are more significant

- Adjust for market: Crypto requires slightly different settings than forex or stocks due to higher volatility

- Test across conditions: Ensure your settings work in trends, ranges, and volatile conditions

- Keep it simple: Using 2-3 well-understood indicators beats using 10 poorly understood ones

Common TradingView Mistakes

- Indicator overload: Using too many indicators creates confusion and conflicting signals

- Ignoring price action: No indicator is more important than raw price action and candlestick patterns

- Not accounting for timeframe: An indicator signal on the 5-minute chart is far less significant than on the daily

- Alert fatigue: Setting too many alerts leads to ignoring important ones

- Curve fitting: Adjusting settings until they perfectly match past performance (this will not predict the future)

Conclusion

The best TradingView indicators for 2025 combine traditional technical analysis with modern AI-powered tools. The key is not finding a single perfect indicator but building a complementary set that covers trend, momentum, volume, and volatility.

For traders who want a single comprehensive solution that combines multiple analyses into one powerful tool, FibAlgo's AI indicator suite integrates Fibonacci analysis, Smart Money Concepts, and machine learning into a system that adapts to changing market conditions.

Learn more about the strategies behind these indicators in our guides on technical analysis, risk management, and Fibonacci trading strategies.