Smart Money Concepts (SMC) have taken the trading world by storm. Originally developed by observing how large institutional players — banks, hedge funds, and market makers — operate in financial markets, SMC provides a framework for understanding the hidden mechanics of price action.

In this comprehensive guide, we will break down every major SMC concept and show you how to apply them in crypto, forex, and stock trading for consistently better results.

What Is Smart Money?

"Smart Money" refers to the capital controlled by institutional investors, central banks, hedge funds, and professional market makers. These entities collectively control the vast majority of market volume and have resources that retail traders can only dream of:

- Information advantage: Access to institutional-grade research, order flow data, and market intelligence

- Capital advantage: Ability to move markets with the sheer size of their orders

- Technology advantage: Cutting-edge algorithms, co-located servers, and AI-driven analysis

- Time advantage: Full-time teams of analysts dedicated to single markets or sectors

Understanding how Smart Money operates gives retail traders a framework for aligning with institutional flow rather than trading against it.

Market Structure: The Foundation of SMC

Before diving into specific SMC concepts, you must understand market structure — the pattern of higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

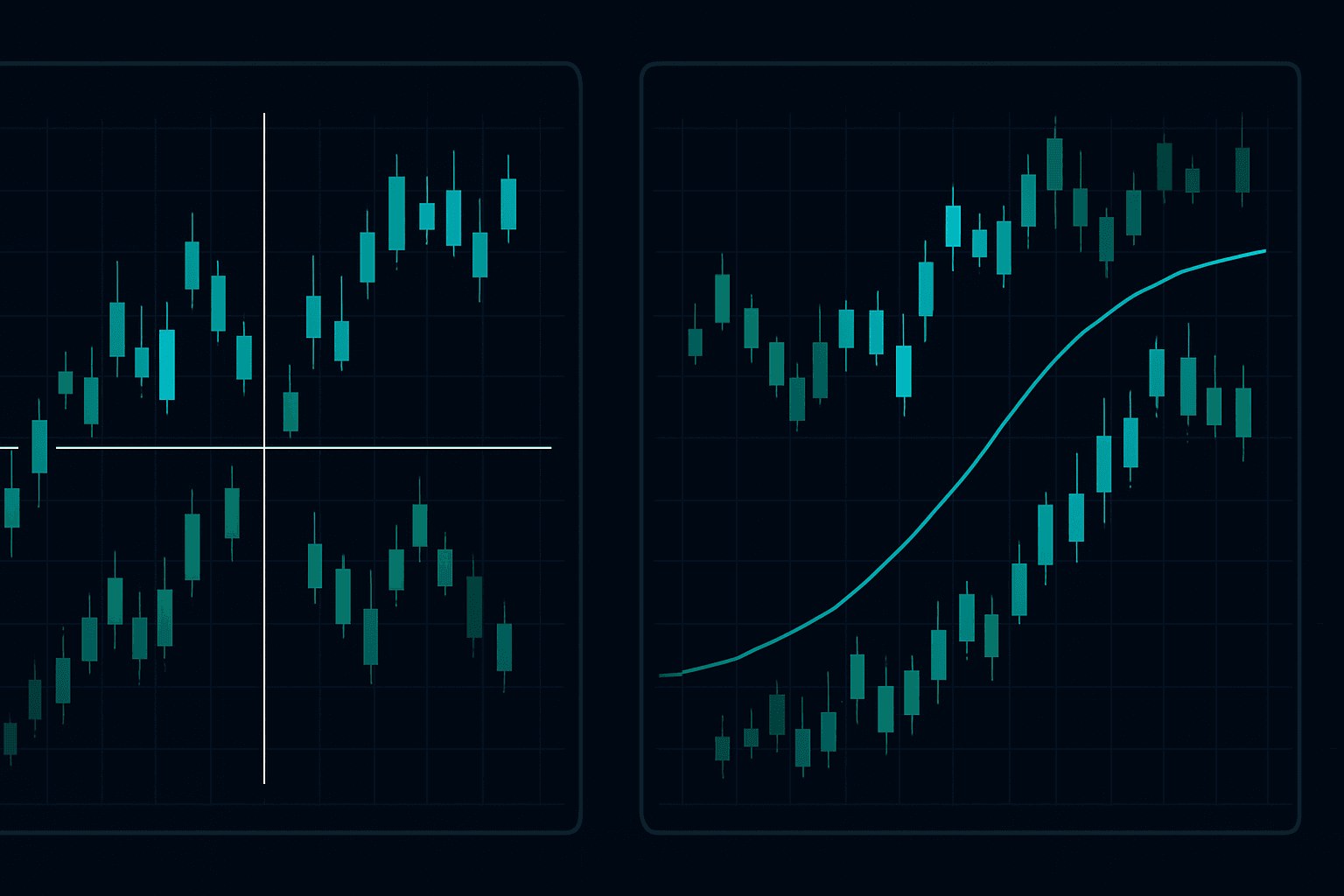

Break of Structure (BOS)

A Break of Structure occurs when price breaks beyond a previous swing high (in an uptrend) or swing low (in a downtrend), confirming trend continuation. BOS is a signal that Smart Money is still committed to the current direction.

Change of Character (ChoCH)

A Change of Character is more significant than a BOS. It occurs when the market structure shifts from bullish to bearish or vice versa. A ChoCH in an uptrend happens when price breaks below the most recent higher low, signaling that institutions may be distributing their positions.

Recognizing ChoCH early gives you a crucial advantage — you can prepare for trend reversals before the majority of retail traders even realize the trend has changed. These structural shifts often align with Fibonacci retracement levels, creating powerful confluence zones.

Order Blocks: Where Institutions Enter

Order blocks are zones on the chart where large institutional orders were placed. They appear as the last opposite-colored candle before a significant move. Order blocks are important because institutions often return to these zones to:

- Fill remaining orders that were not fully executed

- Add to existing positions at favorable prices

- Defend their positions with new buying or selling pressure

How to Identify Bullish Order Blocks

- Look for the last bearish candle before a strong bullish move

- The move should break above the previous swing high (BOS)

- Mark the entire range of that bearish candle (open to close, including wicks)

- This zone becomes a potential support area when price returns

How to Identify Bearish Order Blocks

- Look for the last bullish candle before a strong bearish move

- The move should break below the previous swing low (BOS)

- Mark the entire range of that bullish candle

- This zone becomes a potential resistance area when price returns

Refined Order Blocks

Not all order blocks are created equal. The highest probability order blocks share these characteristics:

- They caused a break of structure

- They have not been previously tested (first touch is strongest)

- They align with higher timeframe institutional zones

- They contain a fair value gap within them

- They coincide with key Fibonacci levels (especially 61.8% and 78.6%)

Fair Value Gaps (FVG): Imbalance in Price Delivery

Fair Value Gaps, also known as imbalances, are three-candle patterns where the wicks of the first and third candles do not overlap. This gap represents an area where price moved so aggressively in one direction that there was inefficient price delivery — not enough orders were filled in that zone.

Why FVGs Matter

Markets tend to rebalance these inefficiencies. Price frequently returns to fill Fair Value Gaps before continuing in the original direction. This behavior creates predictable entry opportunities for informed traders.

Trading FVGs

- Identify the FVG: Look for the gap between the first and third candle wicks

- Wait for price to return: Do not enter immediately; wait for price to pull back into the gap

- Look for reaction: The best trades come when price enters the FVG and shows rejection (e.g., pin bars, engulfing patterns)

- Combine with other concepts: FVGs inside order blocks with Fibonacci confluence are the highest probability setups

For automated detection of these setups across multiple pairs and timeframes, FibAlgo's AI indicators can identify order blocks and FVGs in real-time.

Liquidity: The Fuel That Moves Markets

Understanding liquidity is perhaps the most important concept in SMC. Smart Money needs liquidity to fill large orders, and they actively engineer price to move toward pools of liquidity.

Types of Liquidity

- Buy-side liquidity (BSL): Stop losses from short sellers and buy stops from breakout traders sitting above swing highs

- Sell-side liquidity (SSL): Stop losses from long positions and sell stops sitting below swing lows

- Trend-line liquidity: Orders clustered along obvious trend lines

- Equal highs/lows liquidity: Clusters of orders at areas where price has tested the same level multiple times

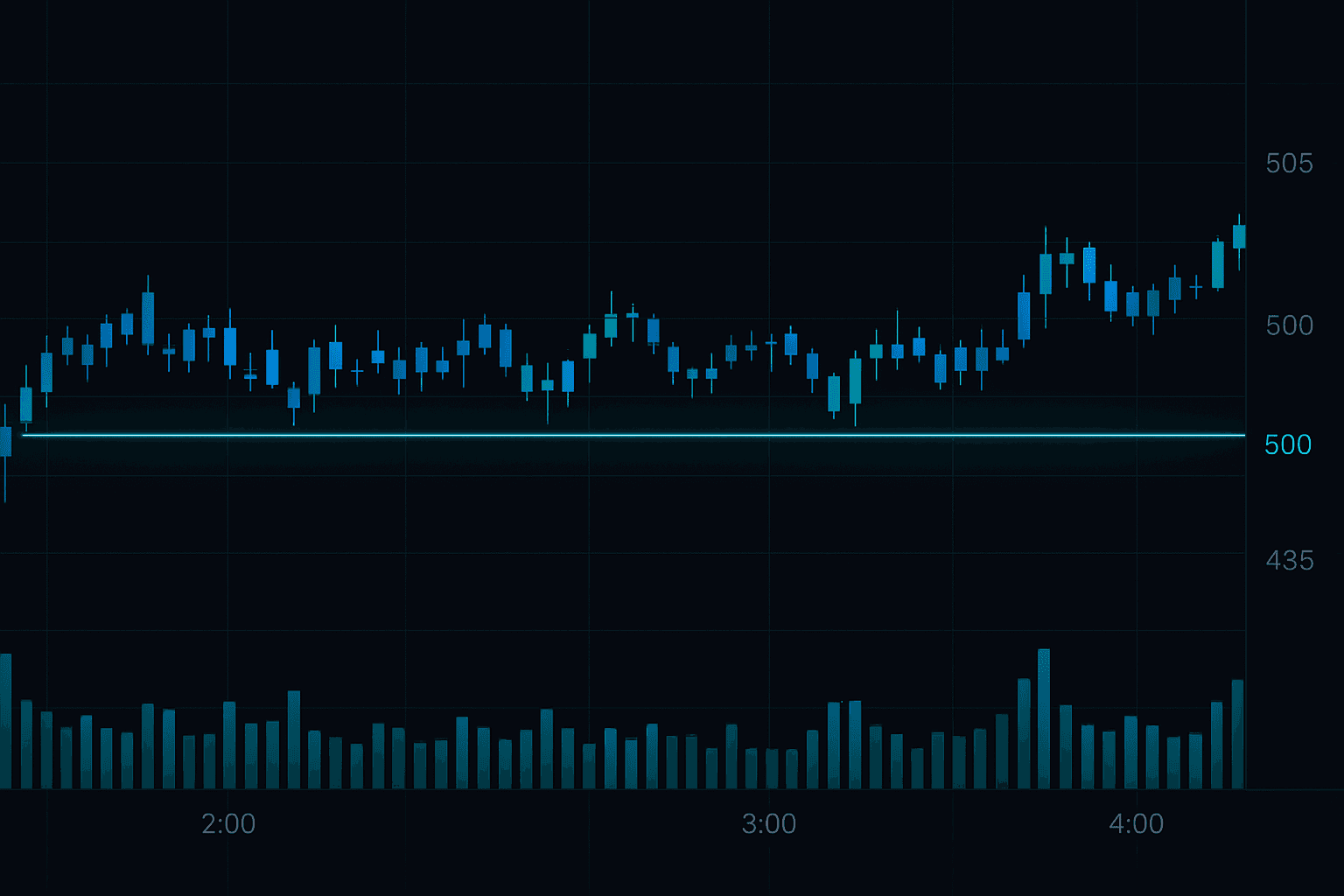

Liquidity Sweeps

A liquidity sweep occurs when price briefly pushes beyond a liquidity level, triggering the clustered orders, before reversing. This is often described as "stop hunting" and is a deliberate institutional maneuver.

Key signs of a liquidity sweep:

- Price spikes beyond a significant high or low

- Rapid reversal after the spike (often within the same candle)

- Increased volume during the sweep

- The sweep targets obvious swing points where retail traders place stops

Learning to identify liquidity sweeps transforms your trading because what appears to be a breakout is actually a trap designed to fuel the next directional move.

Breaker Blocks: Failed Order Blocks That Become Powerful Zones

When an order block fails — meaning price pushes through it rather than bouncing off it — it becomes a breaker block. Breaker blocks are powerful because:

- Traders who entered at the original order block are now trapped in losing positions

- When price returns to the breaker block, these trapped traders exit, creating the very supply or demand that drives price in the new direction

- The failure of the order block itself confirms a shift in institutional intent

Trading Breaker Blocks

- Identify a valid order block that has been broken through

- Wait for price to return to the broken order block zone

- Enter in the direction of the break with a tight stop loss

- Target the next significant liquidity pool

Breaker blocks are especially powerful when they coincide with Fibonacci retracement levels and when they form during a Change of Character.

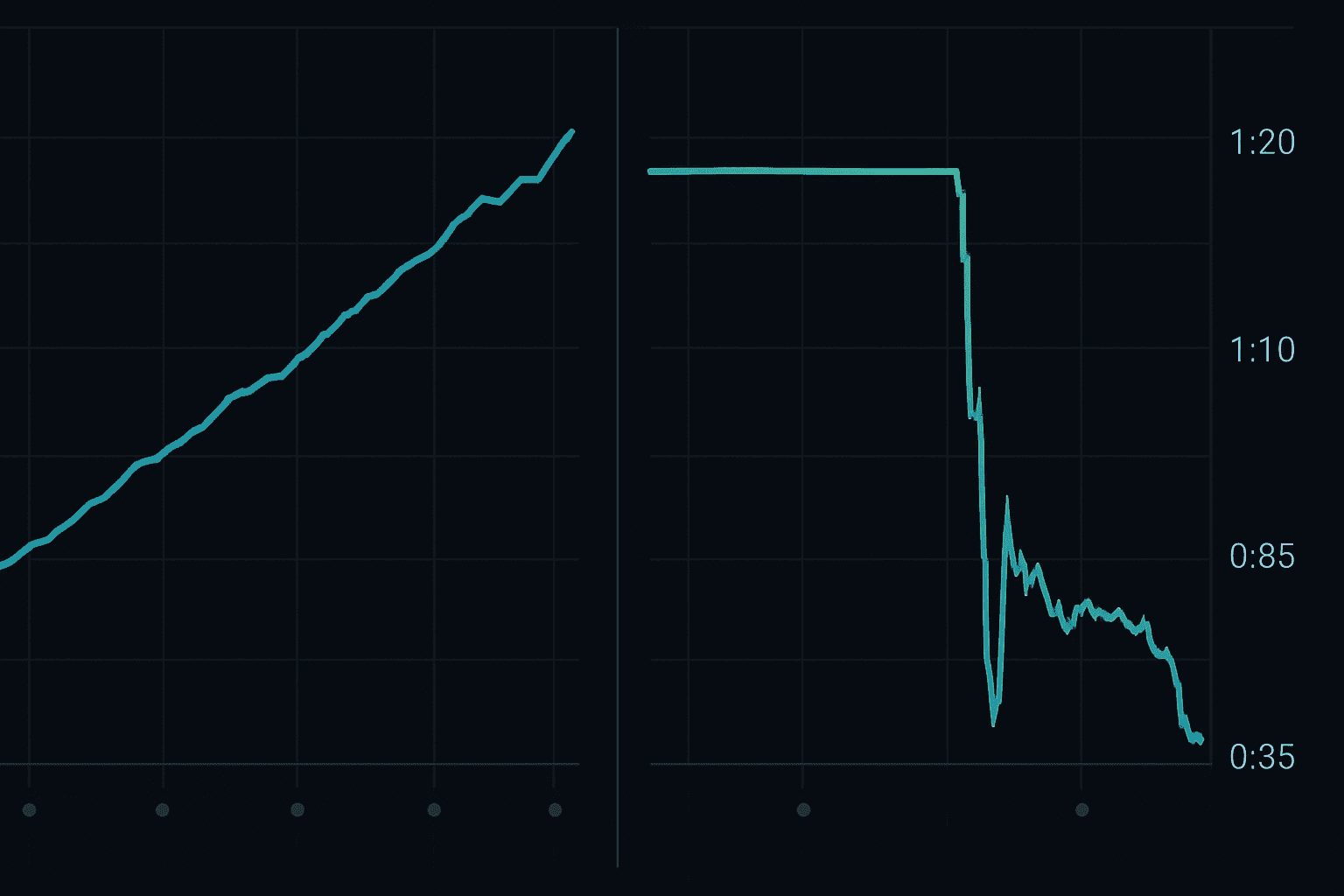

Premium and Discount Zones

Smart Money thinks in terms of premium and discount relative to recent price action:

- Premium zone: The upper 50% of a price range (above the 50% Fibonacci level) — this is where Smart Money sells

- Discount zone: The lower 50% of a price range (below the 50% Fibonacci level) — this is where Smart Money buys

This concept is simple but powerful:

- In an uptrend, look for long entries in the discount zone (at Fibonacci levels 50%, 61.8%, 78.6%)

- In a downtrend, look for short entries in the premium zone (at the same Fibonacci levels applied to the downside)

This framework prevents you from chasing price and ensures you are entering trades at favorable prices where institutions are accumulating.

Combining SMC with Other Methodologies

SMC becomes even more powerful when combined with other forms of analysis:

SMC + Fibonacci Confluence

The combination of SMC order blocks with Fibonacci retracement levels creates some of the highest probability setups in trading. When a bullish order block sits exactly at the 61.8-78.6% Fibonacci retracement of a higher timeframe swing, institutions are almost certainly defending that zone.

SMC + Volume Profile

Volume Profile shows where the most trading activity occurred at each price level. When order blocks align with high-volume nodes, the zone is significantly stronger. Point of Control (POC) levels from Volume Profile that coincide with order blocks are institutional-grade support and resistance.

SMC + AI-Powered Analysis

Modern AI trading tools can automate the identification of SMC concepts across hundreds of charts simultaneously. FibAlgo's indicator suite combines SMC principles with machine learning to generate high-probability signals that would take hours to identify manually.

For more on how AI is transforming trading analysis, read our guide on AI Trading Indicators.

Building a Complete SMC Trading Framework

Here is a step-by-step process for trading with Smart Money Concepts:

- Determine the higher timeframe bias — Is the weekly/daily trend bullish or bearish?

- Identify key liquidity pools — Where are the obvious stop loss clusters?

- Mark institutional zones — Order blocks, FVGs, and breaker blocks on your chart

- Wait for a liquidity sweep — Price runs into a liquidity pool and reverses

- Look for ChoCH on lower timeframes — Confirmation that institutions have shifted direction

- Enter at an order block or FVG — Preferably in the discount zone for longs, premium zone for shorts

- Target the opposite liquidity pool — Your take profit should be at the nearest untested liquidity level

Risk Management in SMC Trading

Even the best SMC setups require disciplined risk management. Our comprehensive risk management guide covers this in detail, but here are SMC-specific rules:

- Stop losses should be placed beyond the order block (not at the edge, but 1-2 ATR beyond)

- Use higher timeframe order blocks for position trades, lower timeframe for scalps

- Never risk more than 1-2% of your account on any single trade

- Manage multiple positions carefully to avoid correlation risk

Conclusion

Smart Money Concepts provide a powerful framework for understanding market mechanics at the institutional level. By learning to identify order blocks, fair value gaps, liquidity pools, and structural shifts, you can align your trades with the most powerful participants in the market.

The key to success with SMC is patience — waiting for high-probability setups where multiple concepts align. When you combine SMC with Fibonacci analysis, AI-powered tools, and disciplined risk management, you have a complete trading system capable of producing consistent results.

Ready to put these concepts into practice with AI-powered tools? Explore FibAlgo's pricing plans and start trading with institutional-grade analysis.