The crypto market is full of opportunity, but it is also full of traps that catch even experienced traders. According to industry research, up to 90% of crypto traders lose money over the long term. The good news? Most losses come from a predictable set of mistakes that are entirely avoidable.

In this guide, we break down the top 10 crypto trading mistakes, explain why they happen, and show you exactly how to fix each one.

Mistake #1: Trading Without a Plan

The single most common mistake is opening a position without a clear plan. This means entering a trade without knowing:

- Why you are entering (what is your edge?)

- Where your stop loss should be

- Where your profit target is

- How much you are risking on this specific trade

- Under what conditions you will exit early

Why This Happens

New traders often see a candle moving and jump in impulsively, driven by FOMO or excitement. Social media amplifies this by showing massive gains without showing the planning that preceded them.

The Fix

Before every trade, write down or mentally confirm:

- Setup: What pattern or signal triggered this trade?

- Entry: Your exact entry price

- Stop Loss: Your exact exit if the trade goes wrong (based on technical levels)

- Take Profit: Your target(s) based on Fibonacci extensions or resistance levels

- Risk: How much you are risking as a percentage of your account

If you cannot answer all five questions, do not take the trade. Using structured indicators like FibAlgo's AI tools can help by providing clear entry, stop, and target levels automatically.

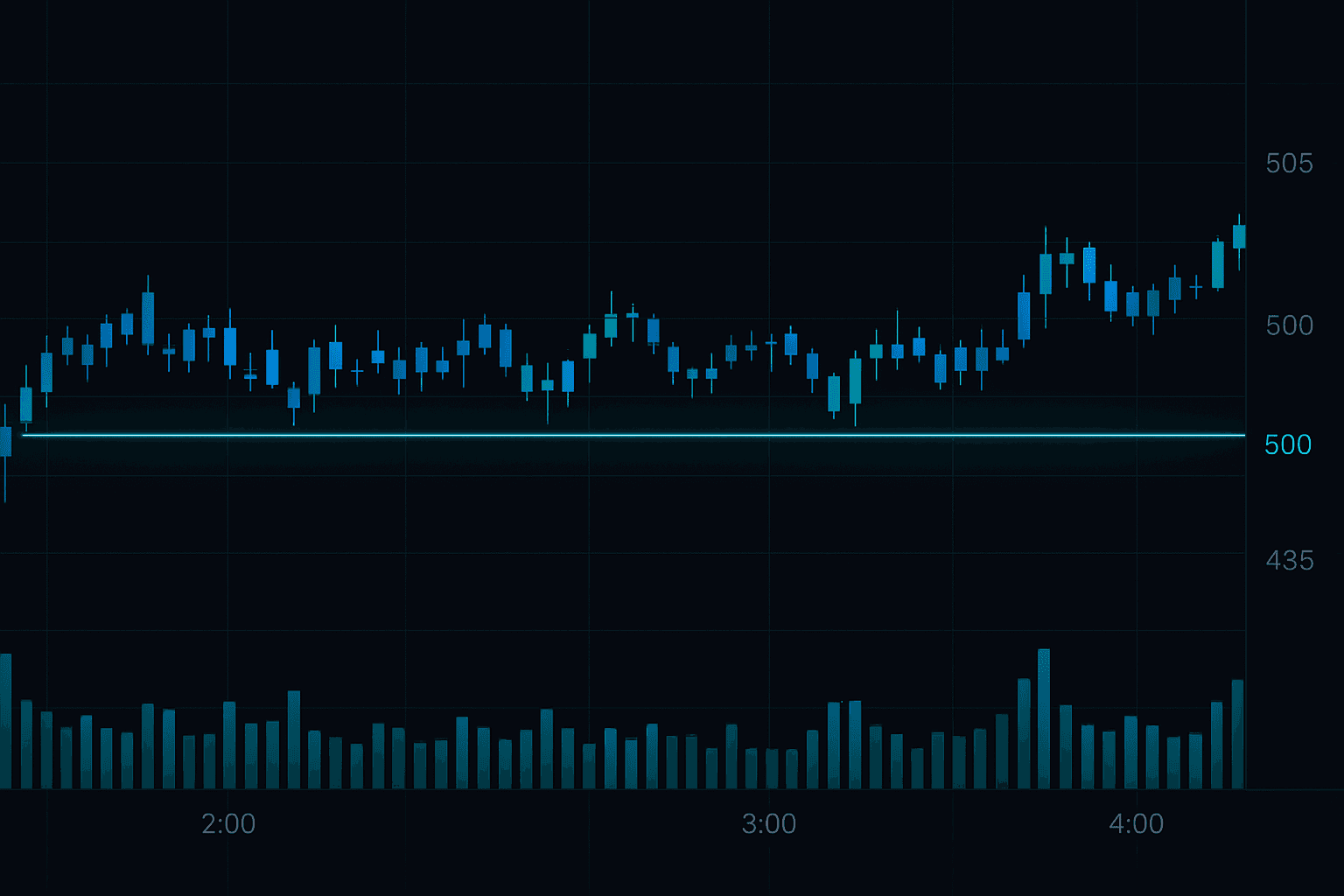

Mistake #2: Over-Leveraging

Leverage is the most dangerous tool available to crypto traders. While it amplifies profits, it equally amplifies losses — and the math is not symmetric.

The Brutal Math

- 10x leverage: A 10% move against you = 100% loss (liquidation)

- 20x leverage: A 5% move against you = 100% loss

- 50x leverage: A 2% move against you = 100% loss

Bitcoin routinely moves 5-10% in a single day. Altcoins can move 20-30%. Using high leverage in these conditions is not trading — it is a fast track to account destruction.

The Fix

- Beginners: Trade spot only, no leverage whatsoever

- Intermediate traders: Maximum 2-3x leverage

- Advanced traders: Maximum 5x, and only on very high conviction setups

- Everyone: Your effective leverage (total position size / account equity) should never exceed 3x

Mistake #3: Ignoring Risk Management

Many traders spend 90% of their time looking for the perfect entry and 10% on risk management. The ratio should be reversed.

Common Risk Management Failures

- No stop loss ("I will just watch it")

- Risking 10-20% of the account on a single trade

- Moving stop losses further away when the trade goes against you

- Adding to losing positions without a structured plan

- Not accounting for correlation between positions

The Fix

Follow the framework in our comprehensive Risk Management Guide:

- Risk maximum 1-2% per trade

- Always use stop losses

- Calculate position size based on stop distance

- Maintain minimum 1:2 risk-to-reward ratios

- Set a daily maximum loss limit (e.g., 3%)

Mistake #4: FOMO (Fear of Missing Out) Buying

You see Bitcoin jump from $80,000 to $90,000 in a day. Twitter is exploding with excitement. Everyone seems to be making money. You cannot stand being left out, so you buy at $90,000. The next day, it drops back to $82,000.

Why FOMO Is So Dangerous

FOMO buying consistently puts you in trades at the worst possible price:

- You are buying after the move has already happened

- You are buying when the crowd is already positioned (who is left to buy?)

- You are buying when smart money may be selling into strength

- Your entry gives you a terrible risk-to-reward ratio

The Fix

- Accept that you will miss moves — There are always more opportunities

- Wait for pullbacks — If Bitcoin pumps, wait for it to retrace to a Fibonacci level before entering

- Use alerts, not emotions — Set price alerts at your pre-planned entry levels

- Remember: The market has been open for over a decade. One day's move is insignificant

- Follow sentiment data — When everyone is euphoric, it is usually too late. Our sentiment analysis guide explains this in detail

Mistake #5: Not Doing Your Own Research (DYOR)

Blindly following influencers, Telegram signal groups, or friends' tips is one of the fastest ways to lose money in crypto.

The Problem with Following Others

- Influencers may be paid to promote projects

- Signal groups often have conflicts of interest

- Someone else's trade fits their account size, risk tolerance, and timeframe — not yours

- You have no exit plan because you did not understand the trade

The Fix

- Learn the fundamentals of technical analysis

- Understand the project's fundamentals before investing

- Use other people's ideas as starting points, then do your own analysis

- Develop your own trading strategy and stick to it

- Use data-driven tools like FibAlgo's indicators instead of opinions

Mistake #6: Overtrading

Overtrading means taking too many trades, often driven by:

- Boredom (the market is not moving, so you force trades)

- Revenge trading (trying to recover losses quickly)

- Dopamine seeking (trading for excitement rather than profit)

- Fear of missing opportunities

The Cost of Overtrading

- Trading fees eat your profits

- More trades = more opportunities for emotional mistakes

- Mental exhaustion leads to poor decision-making

- Each unnecessary trade adds risk to your portfolio

The Fix

- Set a maximum number of trades per day (e.g., 2-3)

- Only trade A+ setups that match all your criteria

- Quality over quantity — one great trade is better than ten mediocre ones

- Take breaks from the screen, especially after losses

- Journal every trade and review weekly to identify overtrading patterns

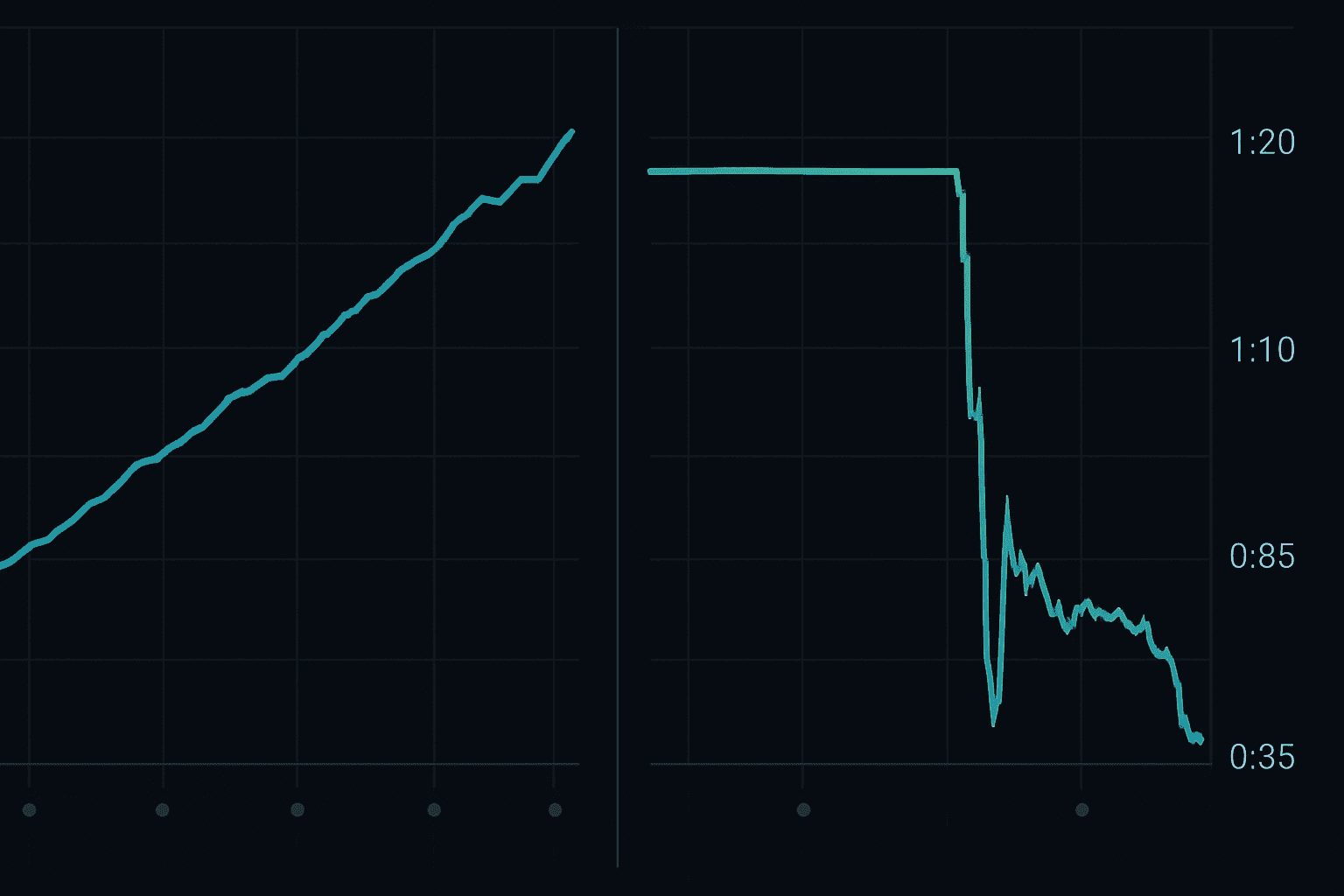

Mistake #7: Holding Losing Positions Too Long

"It will come back" is the most expensive phrase in trading. Holding a losing position without a stop loss turns a small loss into a catastrophic one.

The Sunk Cost Fallacy

Traders hold losers because they cannot accept being wrong. They think, "I have already lost so much, I cannot sell now." This is the sunk cost fallacy — the money you have already lost is gone regardless of whether you hold or sell.

The Fix

- Always use stop losses — set them before entering the trade

- Accept that losing trades are a normal part of trading (even the best traders lose 40-50% of trades)

- Ask yourself: "If I were not already in this trade, would I enter it now at this price?" If the answer is no, exit

- Remember that preserving capital for the next opportunity is more important than recovering on this trade

Mistake #8: Not Keeping a Trading Journal

You cannot improve what you do not measure. A trading journal tracks every trade and reveals patterns in your behavior that you cannot see in real-time.

What to Record

- Date and time

- Asset and timeframe

- Entry and exit prices

- Position size and risk

- Setup type (what was your reason for entering?)

- Emotion at entry (confident, FOMO, uncertain?)

- Outcome (profit/loss)

- What you learned

The Fix

- Use a spreadsheet, dedicated app, or even a notebook

- Review your journal weekly to identify patterns

- Calculate your win rate, average win, average loss, and expectancy

- Identify which setups perform best and focus on those

- Look for emotional patterns (do you perform worse after losses? After wins?)

Mistake #9: Ignoring the Macro Environment

Crypto does not exist in a vacuum. Interest rates, inflation, regulatory decisions, and global economic conditions all affect crypto prices.

Key Macro Factors for Crypto

- Federal Reserve policy: Rate hikes = bearish for risk assets; rate cuts = bullish

- US Dollar strength: Strong dollar typically = weak crypto

- Regulatory developments: New regulations can crash or boost entire sectors

- Global liquidity: More money in the system = higher crypto prices

- Geopolitical events: Wars, elections, and crises can trigger sell-offs or safe-haven buying

The Fix

- Spend 10 minutes daily reviewing macro headlines

- Understand the current rate cycle and its implications for crypto

- Be aware of major upcoming events (FOMC meetings, CPI releases, ETF decisions)

- Reduce position sizes during periods of high macro uncertainty

- Combine macro awareness with sentiment analysis for a complete picture

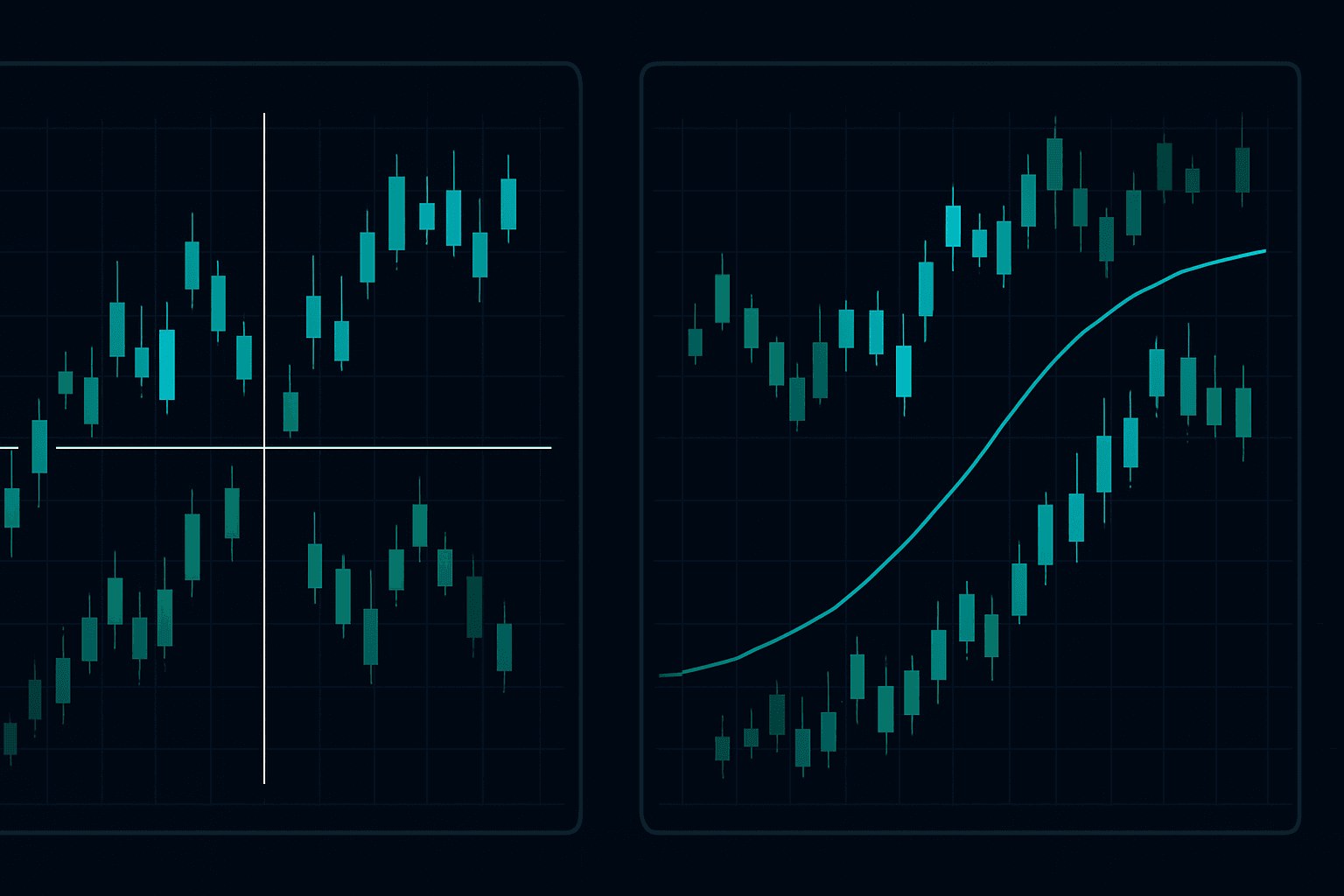

Mistake #10: Using the Wrong Tools

Trading with inadequate tools is like performing surgery with a butter knife. The right tools dramatically improve your results.

Common Tool Mistakes

- Using exchange charts instead of proper charting platforms

- Relying on basic indicators without understanding them

- Not using alerts (leading to missed entries and emotional chasing)

- Manual analysis when AI tools can be faster and more accurate

- Using free tools when premium tools offer genuine edge

The Fix

- Use TradingView or a similar professional charting platform

- Learn to read and use the indicators properly (see our best TradingView indicators guide)

- Set up price alerts at key levels so you do not have to stare at charts

- Consider AI-powered tools like FibAlgo's indicator suite for automated analysis

- Invest in your tools — the return on a good indicator often pays for itself many times over

The Path to Profitable Trading

Avoiding these 10 mistakes will not guarantee profitability, but it will eliminate the most common causes of failure. Profitable trading comes from:

- A tested strategy with a statistical edge

- Disciplined risk management

- Emotional control and consistency

- Continuous learning and adaptation

- The right tools and technology

If you are serious about improving your trading, start by addressing whichever of these mistakes resonates most with you. Fix one at a time, journal your progress, and watch your results improve.

For more trading education, explore our guides on Fibonacci strategies, Smart Money Concepts, and technical analysis fundamentals.