Here is a truth that most trading educators do not tell you: your trading strategy accounts for maybe 30% of your long-term success. The other 70%? That is risk management.

The crypto market is the most volatile major financial market in the world. Bitcoin can move 10% in a single day. Altcoins can surge 300% or crash 80% in a week. Without proper risk management, even the best trading strategy will eventually blow up your account.

This guide covers everything you need to know about managing risk in crypto trading — from basic position sizing to advanced portfolio management techniques used by professional traders.

Why Most Crypto Traders Fail

Studies consistently show that 70-90% of traders lose money. The primary reasons are not bad strategies — they are poor risk management:

- Over-leveraging: Using too much leverage and getting liquidated on normal price fluctuations

- No stop losses: Letting losers run indefinitely, hoping they will recover

- Oversized positions: Betting too much on a single trade

- Averaging down without a plan: Adding to losing positions without a structured strategy

- Emotional trading: Making impulsive decisions based on fear or greed

- No diversification: Putting everything into one coin or one trade direction

Every single one of these problems is a risk management failure, not a strategy failure.

The 1% Rule: Your Foundation for Survival

The most fundamental rule of risk management is simple: never risk more than 1-2% of your total trading capital on any single trade.

What This Means in Practice

If your trading account is $10,000:

- Maximum risk per trade: $100-$200 (1-2%)

- This is the amount you lose if your stop loss is hit

- This is NOT your position size — it is the difference between your entry and stop loss multiplied by your position size

The Math of Ruin

Here is why the 1% rule is so important:

- Losing 10 trades in a row at 1% risk = 9.6% account drawdown (recoverable)

- Losing 10 trades in a row at 5% risk = 40.1% drawdown (very difficult to recover)

- Losing 10 trades in a row at 10% risk = 65.1% drawdown (nearly impossible to recover)

A 50% drawdown requires a 100% return just to break even. A 65% drawdown requires a 186% return. The math is brutal, which is why preserving capital is priority number one.

Position Sizing: How Much to Buy

Position sizing is the practical application of the 1% rule. Here is the formula:

Position Size = Account Risk / (Entry Price - Stop Loss Price)Example

- Account balance: $10,000

- Risk per trade: 1% = $100

- Entry price: $50,000 (Bitcoin)

- Stop loss: $48,500 (3% below entry)

- Risk per unit: $50,000 - $48,500 = $1,500

- Position size: $100 / $1,500 = 0.0667 BTC ($3,335 position)

Notice that your position size ($3,335) is much larger than your risk ($100). This is because your stop loss limits the actual capital at risk. This approach allows you to take meaningful positions while keeping risk controlled.

Dynamic Position Sizing

Advanced traders adjust position size based on:

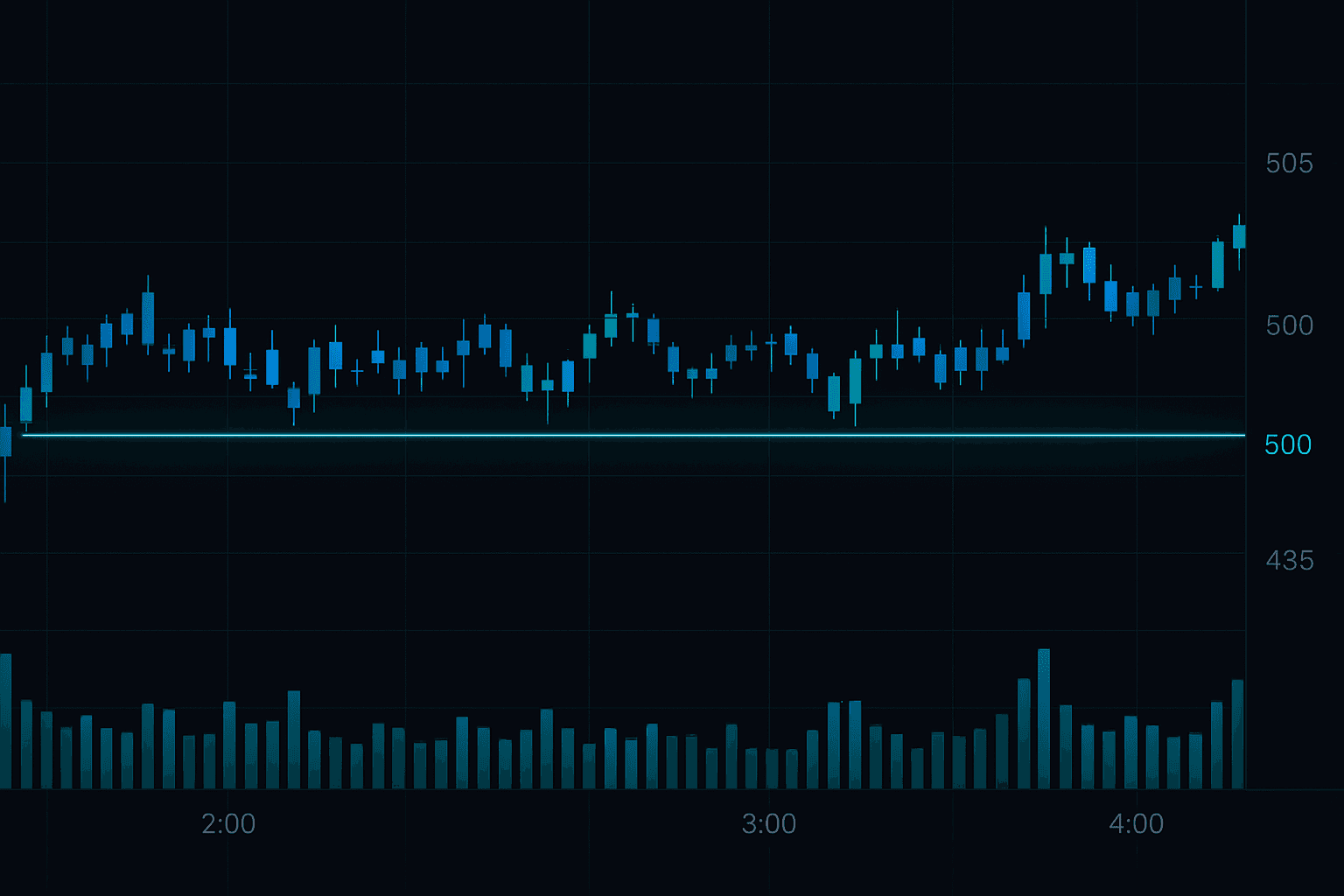

- Volatility: Smaller positions in high-volatility conditions, larger in low-volatility

- Setup quality: Slightly larger positions for high-confluence setups (e.g., multiple Fibonacci levels aligning with order blocks)

- Win rate: If your recent win rate is below average, reduce position sizes until you recover

- Market regime: Bull markets allow slightly larger positions than bear markets

Stop Loss Strategies for Crypto

Stop losses are your insurance policy against catastrophic losses. Here are the most effective stop loss approaches for crypto:

Technical Stop Losses

Place your stop loss at a level where your trade thesis is invalidated:

- Below the order block for long entries at SMC zones

- Beyond the next Fibonacci level for Fibonacci-based entries

- Below the swing low for trend-following trades

- Below the support level for range-trading setups

ATR-Based Stop Losses

The Average True Range (ATR) measures volatility. An ATR-based stop loss automatically adjusts to market conditions:

- Crypto scalping: 1x ATR stop loss

- Crypto swing trading: 2x ATR stop loss

- Crypto position trading: 3x ATR stop loss

Time-Based Stop Losses

If your trade has not moved in your favor within a specified time:

- Scalps: Close after 1-4 hours if no movement

- Day trades: Close by end of trading day

- Swing trades: Re-evaluate after 3-5 days of no progress

Trailing Stop Losses

As your trade moves into profit, trail your stop loss to lock in gains:

- Move stop to breakeven after price moves 1R in your favor

- Trail by 2x ATR or below each new swing low

- At 2R profit, tighten the trailing stop to 1x ATR

Portfolio Allocation and Diversification

Risk management extends beyond individual trades to your entire portfolio:

The Core-Satellite Approach

- Core (60-70%): Major cryptocurrencies (BTC, ETH) — lower risk, lower reward

- Satellite (20-30%): Mid-cap altcoins with strong fundamentals — moderate risk

- Speculative (5-10%): Small-cap tokens with high growth potential — highest risk

Correlation Management

Many altcoins are highly correlated with Bitcoin. If you have long positions in BTC, ETH, SOL, and AVAX, you effectively have one big trade — they all move together. True diversification means:

- Mixing uncorrelated assets

- Including some inverse positions (short hedges)

- Diversifying across timeframes

- Diversifying across strategies (trend following + mean reversion)

Leverage Management

Leverage is the fastest way to blow up a trading account. Here are strict leverage rules for crypto:

- Beginners: No leverage (spot trading only)

- Intermediate: Maximum 3x leverage

- Advanced: Maximum 5-10x leverage, only on high-conviction setups

- Never: 20x+ leverage on crypto (this is gambling, not trading)

Calculating Liquidation Price

Before entering any leveraged trade, know your liquidation price:

- 10x leverage: ~10% move against you = liquidation

- 20x leverage: ~5% move against you = liquidation

- 50x leverage: ~2% move against you = liquidation

In a market where 5-10% daily moves are normal, 20x+ leverage is essentially asking to be liquidated.

Trading Psychology and Emotional Risk Management

The most sophisticated risk management system is worthless if you cannot follow it. Trading psychology is a critical component of risk management:

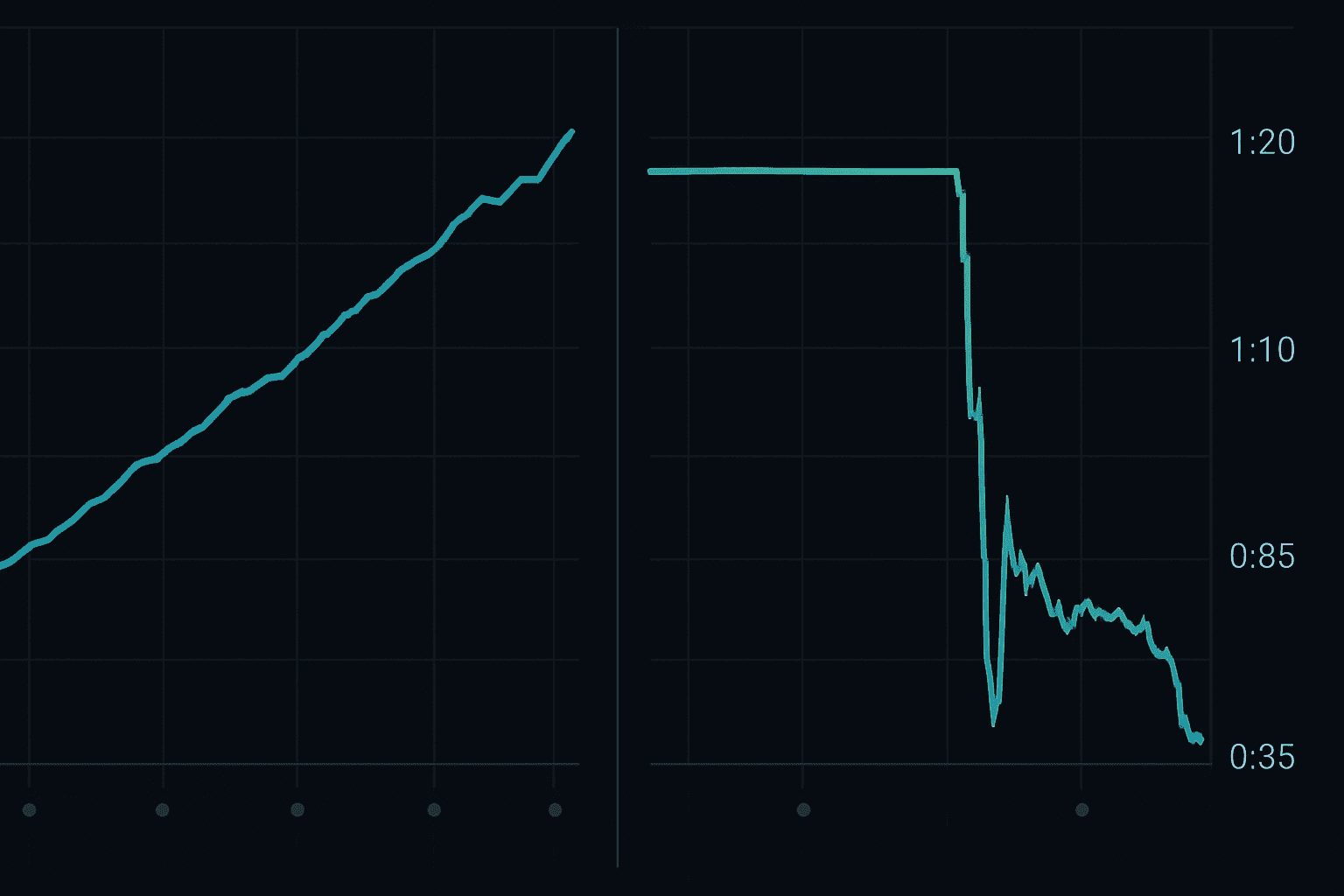

The Revenge Trading Trap

After a loss, the natural impulse is to take a bigger trade to "win it back." This is revenge trading, and it is the single most destructive behavior in trading. Combat it by:

- Having a maximum loss limit per day (e.g., 3% of account)

- Walking away from the screen after hitting your limit

- Keeping a trading journal to identify emotional patterns

- Using AI-powered tools like FibAlgo's indicators to remove emotional bias from entry decisions

FOMO (Fear of Missing Out)

When a coin pumps 50% and you are not in the trade, the urge to buy the top is overwhelming. Protect yourself by:

- Only entering trades that match your predefined setup criteria

- Remembering that there are always more opportunities

- Following the trend, not the hype — use technical analysis to find entries

Overconfidence After Wins

A winning streak can be as dangerous as a losing streak. After several wins:

- Do not increase position sizes to "press your advantage"

- Maintain the same risk parameters regardless of recent results

- Remember that market conditions can change rapidly

Advanced Risk Management Techniques

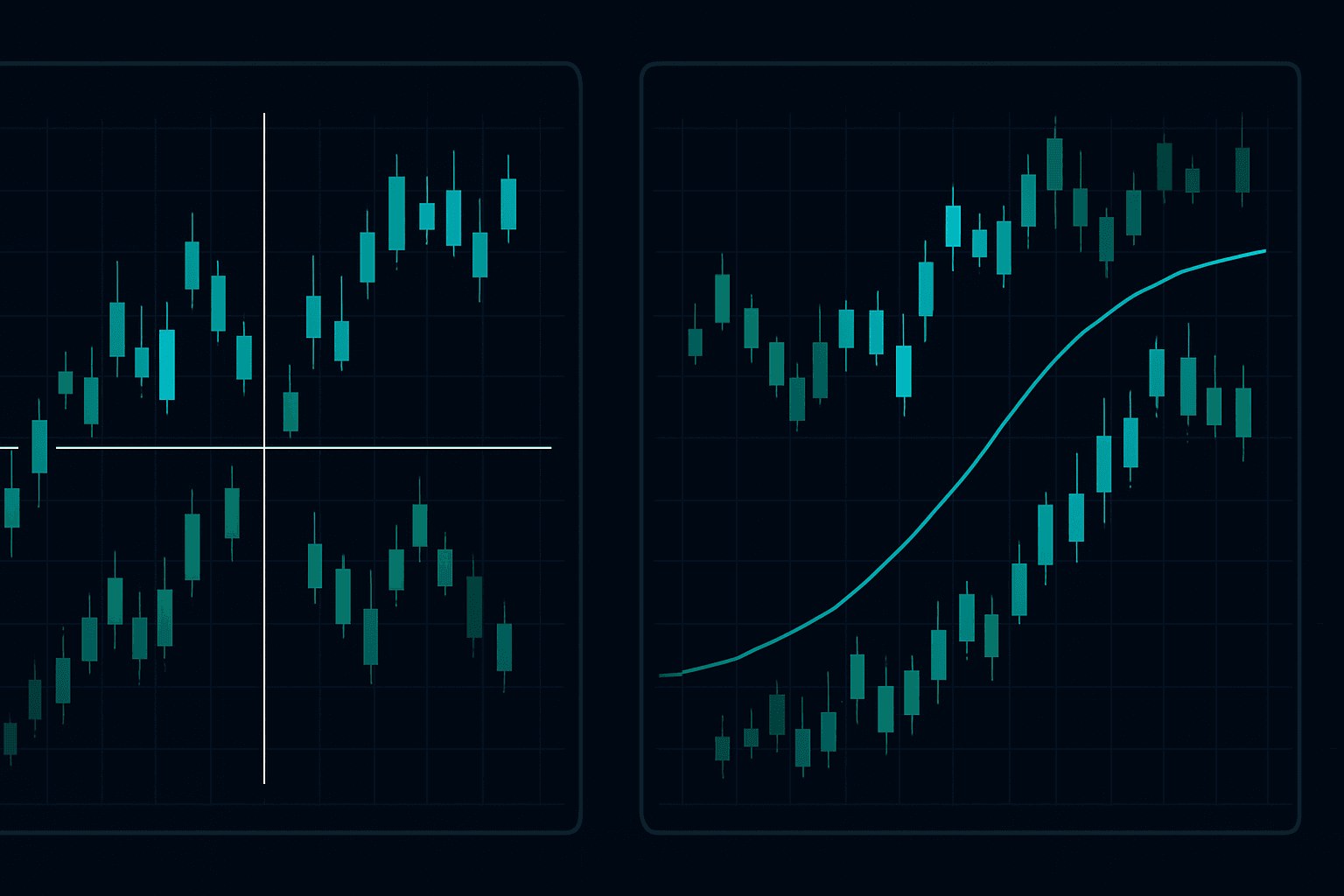

Risk/Reward Analysis Before Every Trade

Before entering any trade, calculate the risk-to-reward ratio:

- Minimum acceptable R:R = 1:2 (risk $1 to make $2)

- Good setups = 1:3 or better

- Excellent setups = 1:5 or better

Using Fibonacci extensions to set profit targets makes this calculation straightforward. Our Fibonacci trading guide explains exactly how to do this.

The Kelly Criterion

The Kelly Criterion is a mathematical formula for optimal position sizing:

Kelly % = Win Rate - (1 - Win Rate) / Reward-to-Risk RatioExample: If your win rate is 55% and your average R:R is 1:2:

Kelly % = 0.55 - (0.45 / 2) = 0.55 - 0.225 = 0.325 = 32.5%

Most professional traders use "Half Kelly" (half the calculated percentage) for additional safety.

Value at Risk (VaR)

VaR calculates the maximum expected loss over a specific time period at a given confidence level. For a $100,000 portfolio:

- Daily VaR at 95% confidence might be $3,000

- This means there is a 95% probability you will not lose more than $3,000 in a single day

Understanding VaR helps you set realistic expectations and prepare for worst-case scenarios.

Building a Risk Management Checklist

Use this checklist before every trade:

- ☐ Have I defined my entry, stop loss, and take profit?

- ☐ Is my position size within the 1-2% rule?

- ☐ Is my risk-to-reward ratio at least 1:2?

- ☐ Does this trade align with the higher timeframe trend?

- ☐ Am I already exposed to correlated positions?

- ☐ Am I in the right emotional state to trade?

- ☐ Have I checked for upcoming high-impact news events?

- ☐ Have I set my stop loss in the trading platform (not just in my head)?

Conclusion

Risk management is not sexy. It does not make for exciting YouTube videos or Twitter threads. But it is the single most important factor in long-term trading success.

The traders who survive and thrive in crypto are not the ones with the best strategies — they are the ones who manage risk most effectively. Implement the principles in this guide, use tools like FibAlgo's AI indicators to identify high-probability setups, and let mathematics protect your capital.

For more trading strategies and analysis techniques, explore our guides on crypto market sentiment and top trading mistakes to avoid.