The landscape of trading has undergone a seismic shift. Gone are the days when traders relied solely on basic moving averages, RSI, and MACD to make decisions. In 2025, artificial intelligence and machine learning have become integral to how the most successful traders analyze markets and execute trades.

This guide explores how AI-powered trading indicators work, why they outperform traditional indicators, and how you can leverage this technology to gain an edge in crypto, forex, and stock markets.

The Evolution from Traditional to AI-Powered Indicators

Traditional technical indicators like RSI, MACD, Bollinger Bands, and Stochastic Oscillator have served traders well for decades. However, they share fundamental limitations:

- Lagging signals: Most traditional indicators are reactive, not predictive

- Fixed parameters: A 14-period RSI uses the same setting regardless of market conditions

- Single-dimensional: They analyze one aspect of price action at a time

- No adaptation: They cannot learn from new data or changing market regimes

AI-powered indicators address every one of these limitations. By processing multiple data streams simultaneously and adapting to changing market conditions, they provide faster, more accurate signals.

How Machine Learning Works in Trading

At its core, machine learning in trading involves training algorithms on historical market data to identify patterns that precede profitable trading opportunities. Here is a simplified breakdown of the process:

Data Collection and Feature Engineering

The first step is gathering relevant data. Modern AI trading systems process:

- Price data: Open, High, Low, Close, Volume across multiple timeframes

- Order book data: Bid/ask depth, large orders, spoofing detection

- On-chain data: Wallet movements, exchange inflows/outflows, whale transactions

- Sentiment data: Social media mentions, news sentiment, fear and greed indexes

- Correlation data: Inter-market relationships, sector rotations, currency correlations

This multi-dimensional data is then transformed into features that the machine learning model can learn from. Feature engineering — deciding which data points to include and how to transform them — is often more important than the choice of algorithm.

Model Training and Validation

Once features are engineered, the model is trained on historical data using techniques like:

- Supervised learning: The model learns from labeled examples (e.g., "this pattern preceded a 5% move up")

- Unsupervised learning: The model discovers hidden patterns and clusters in the data without labels

- Reinforcement learning: The model learns by making trades in a simulated environment and optimizing for profit

The critical challenge is avoiding overfitting — creating a model that performs perfectly on historical data but fails on new data. This is addressed through cross-validation, walk-forward testing, and out-of-sample verification.

Signal Generation

After training, the model generates trading signals in real-time by analyzing current market conditions and comparing them to patterns it has learned. The best AI systems provide:

- Probability scores: Not just buy/sell signals, but the confidence level of each signal

- Multi-timeframe alignment: Signals that account for trends across different timeframes

- Risk-adjusted recommendations: Position sizing and stop loss suggestions based on current volatility

Types of AI Trading Indicators

Pattern Recognition AI

These systems use computer vision and deep learning to identify chart patterns automatically. While a human trader might spend hours scanning charts for head-and-shoulders patterns, double bottoms, or triangle breakouts, AI can scan thousands of charts in seconds with higher accuracy.

Advanced pattern recognition goes beyond textbook patterns to identify subtle formations that human eyes miss. These micro-patterns, invisible on visual inspection, can be statistically significant predictors of future price movement.

Sentiment Analysis AI

Natural Language Processing (NLP) models analyze news articles, social media posts, earnings calls, and regulatory announcements to gauge market sentiment. These systems can:

- Process thousands of news articles per minute

- Detect sentiment shifts before they reflect in price

- Filter out noise and identify truly market-moving information

- Track sentiment trends over time for each asset

When combined with technical indicators, sentiment analysis creates a more complete picture of market dynamics. For crypto traders specifically, sentiment analysis is crucial because crypto markets are heavily sentiment-driven.

Predictive Modeling AI

These are the most sophisticated AI trading tools. Using techniques like LSTM (Long Short-Term Memory) networks, Transformer models, and ensemble methods, they attempt to forecast future price movements.

While no model can predict the future with certainty, well-built predictive models can identify statistical edges — situations where the probability of a move in one direction is significantly higher than the other. Even a model that is correct 55% of the time, when combined with proper risk management, can be highly profitable.

Why AI Indicators Outperform Traditional Ones

Adaptability

Traditional indicators use fixed parameters. An RSI with a 14-period setting behaves the same way in a trending market as it does in a ranging market. AI indicators dynamically adjust their parameters based on current market conditions. In a trending market, they might weight momentum factors more heavily. In a ranging market, they might focus on mean-reversion signals.

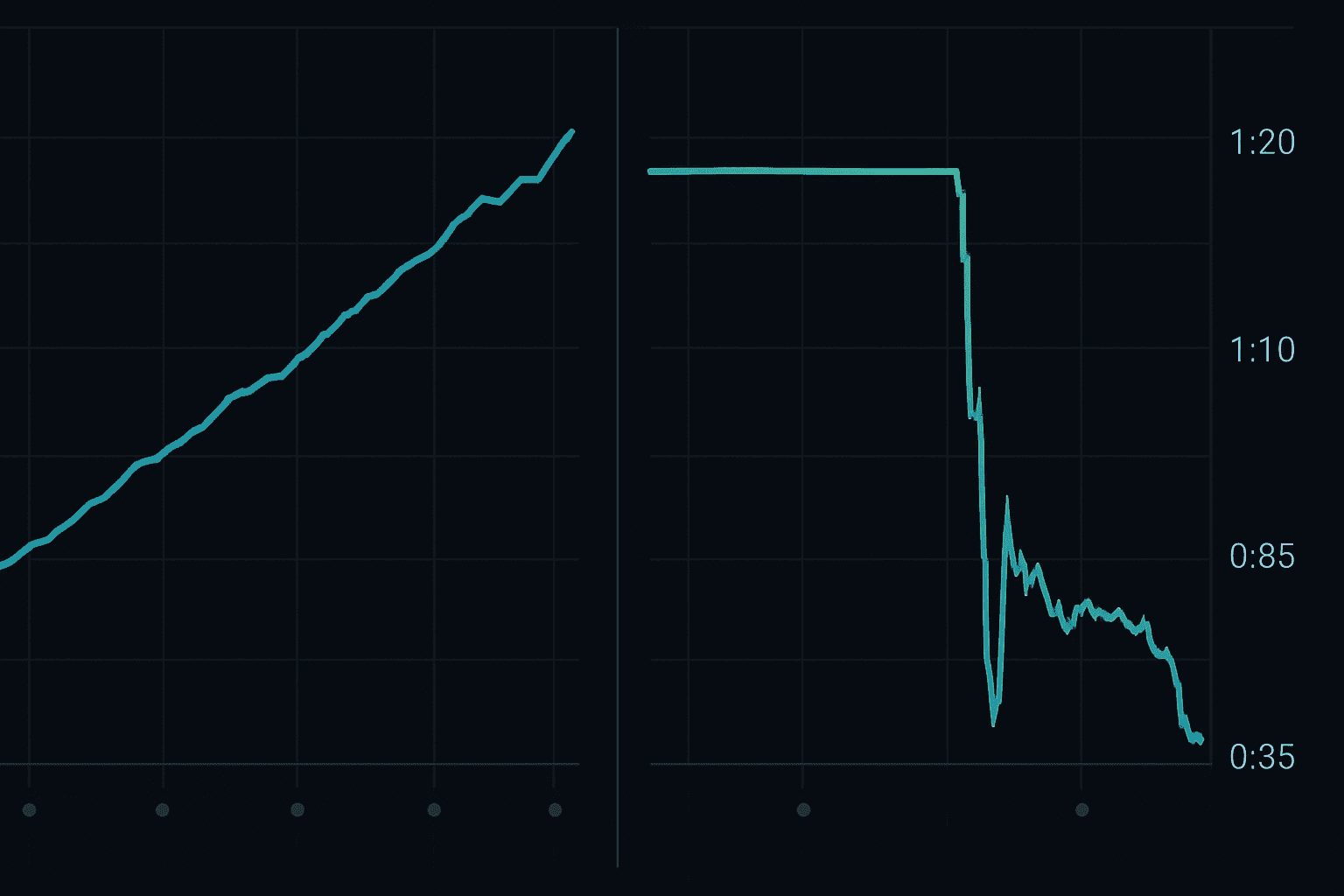

Speed

AI can process and analyze data in milliseconds. While a human trader is still drawing Fibonacci retracements on one chart, an AI system has already analyzed every major pair across every relevant timeframe. This speed advantage is particularly important in fast-moving crypto markets. FibAlgo's AI indicators provide real-time analysis that would take hours to perform manually.

Multi-Dimensional Analysis

A human trader can realistically monitor 3-5 indicators on a single chart. AI systems can simultaneously analyze hundreds of data points, finding correlations and confluences that are impossible for humans to detect.

Emotional Neutrality

Perhaps the biggest advantage of AI trading tools is their complete absence of emotion. They do not experience fear, greed, FOMO, or revenge trading. Every signal is generated based on data, not feelings.

Implementing AI Indicators in Your Trading

Step 1: Choose Your AI Trading Tools

Not all AI indicators are created equal. Look for tools that:

- Provide transparent signal logic (not just black-box "buy" or "sell")

- Have verifiable track records with real market data

- Offer customizable parameters for your trading style

- Work across multiple markets and timeframes

- Include risk management recommendations

Step 2: Backtest Extensively

Before trading with real money, verify any AI indicator's performance across different market conditions:

- Bull markets

- Bear markets

- Sideways/ranging markets

- High-volatility events

- Low-liquidity periods

Step 3: Paper Trade First

Use a demo account to trade with AI signals for at least 2-4 weeks before committing real capital. This allows you to understand the indicator's behavior, its win rate, and typical risk-reward ratios.

Step 4: Start Small and Scale

When you transition to real trading, start with small position sizes and gradually increase as you build confidence in the signals. Never risk more than you can afford to lose, regardless of how accurate an AI system appears.

The Role of AI in Modern Trading Platforms

Modern trading platforms are increasingly integrating AI features. From automated pattern detection to intelligent alert systems, AI is becoming the standard rather than the exception.

FibAlgo's platform represents the next generation of this evolution, combining Fibonacci-based analysis with machine learning to identify high-probability setups that traditional indicators miss. The system analyzes price action, volume, momentum, and market structure simultaneously to generate actionable signals.AI and Risk Management

One of the most valuable applications of AI in trading is risk management. AI systems can:

- Calculate optimal position sizes based on current volatility and account size

- Identify correlated positions that increase portfolio risk

- Predict drawdown periods based on market regime detection

- Automatically adjust stop losses based on changing volatility

Effective risk management is the foundation of long-term trading success. Our detailed guide on risk management in crypto covers essential principles every trader should follow.

The Future of AI Trading

Looking ahead, several trends will shape the future of AI trading:

- More accessible tools: AI trading is becoming available to retail traders, not just institutions

- Better data integration: On-chain analytics, DeFi metrics, and cross-market data will enhance signals

- Regulatory evolution: Regulations will adapt to AI trading, creating new opportunities and constraints

- Hybrid approaches: The most successful traders will combine AI signals with human judgment and market intuition

Common Misconceptions About AI Trading

- "AI will make me rich overnight" — AI provides an edge, not a guarantee. Proper risk management is still essential

- "AI replaces human judgment" — The best results come from humans using AI as a tool, not replacing human oversight entirely

- "All AI indicators are the same" — Quality varies enormously. Look for proven, transparent systems

- "AI cannot adapt to black swan events" — While true for unprecedented events, good AI systems detect unusual market conditions and reduce exposure

Conclusion

AI trading indicators represent a genuine paradigm shift in technical analysis. They process more data, adapt to changing conditions, and eliminate emotional bias from trading decisions. However, they are tools, not magic solutions.

The traders who succeed with AI are those who understand its capabilities and limitations, combine it with sound trading principles, and maintain disciplined risk management. If you are ready to explore how AI can enhance your trading, check out FibAlgo's AI indicator suite and see the difference data-driven analysis can make.

For more on specific strategies that work with AI indicators, read our guides on Fibonacci trading strategies and Smart Money Concepts.