Why Traditional Risk Management Templates Fail in 2026's Market Reality

The trading landscape of 2026 has shattered every conventional risk management playbook. With **AI-driven flash crashes occurring 340% more frequently** than in previous years, and crypto-traditional asset correlations hitting unprecedented highs of 0.87, static risk management plans are financial suicide.

Most traders still rely on outdated templates that assume market behaviors from a decade ago. These rigid frameworks crumble when faced with modern market dynamics like algorithmic whale movements, cross-chain liquidation cascades, and geopolitical events triggering simultaneous crashes across multiple asset classes.

A modern risk management plan template must be dynamic—adapting to real-time market conditions rather than following predetermined rules.

The 5-Pillar Dynamic Risk Management Plan Template Framework

Effective risk management in 2026 requires a **systematic approach built on five interconnected pillars** that work together to protect and grow your capital. Unlike traditional templates that focus solely on stop losses, this framework addresses the full spectrum of modern trading risks.

Each pillar serves a specific function while remaining flexible enough to adapt to changing market conditions. This isn't about following rigid rules—it's about creating a responsive system that evolves with your trading and market dynamics.

Pillar 1: Dynamic Position Sizing Matrix

Your position sizing must adapt to **volatility, correlation, and opportunity cost factors**. The traditional 2% rule is obsolete when dealing with assets that can move 15% in minutes.

The formula for 2026 position sizing: Position Size = (Account Risk ÷ Trade Risk) × Volatility Adjustment × Correlation Factor

- Account Risk: 1-3% of total capital per trade

- Trade Risk: Distance from entry to stop loss

- Volatility Adjustment: 0.5x for high volatility periods, 1.5x for low volatility

- Correlation Factor: 0.7x when trading correlated assets simultaneously

Pillar 2: Multi-Timeframe Stop Loss Architecture

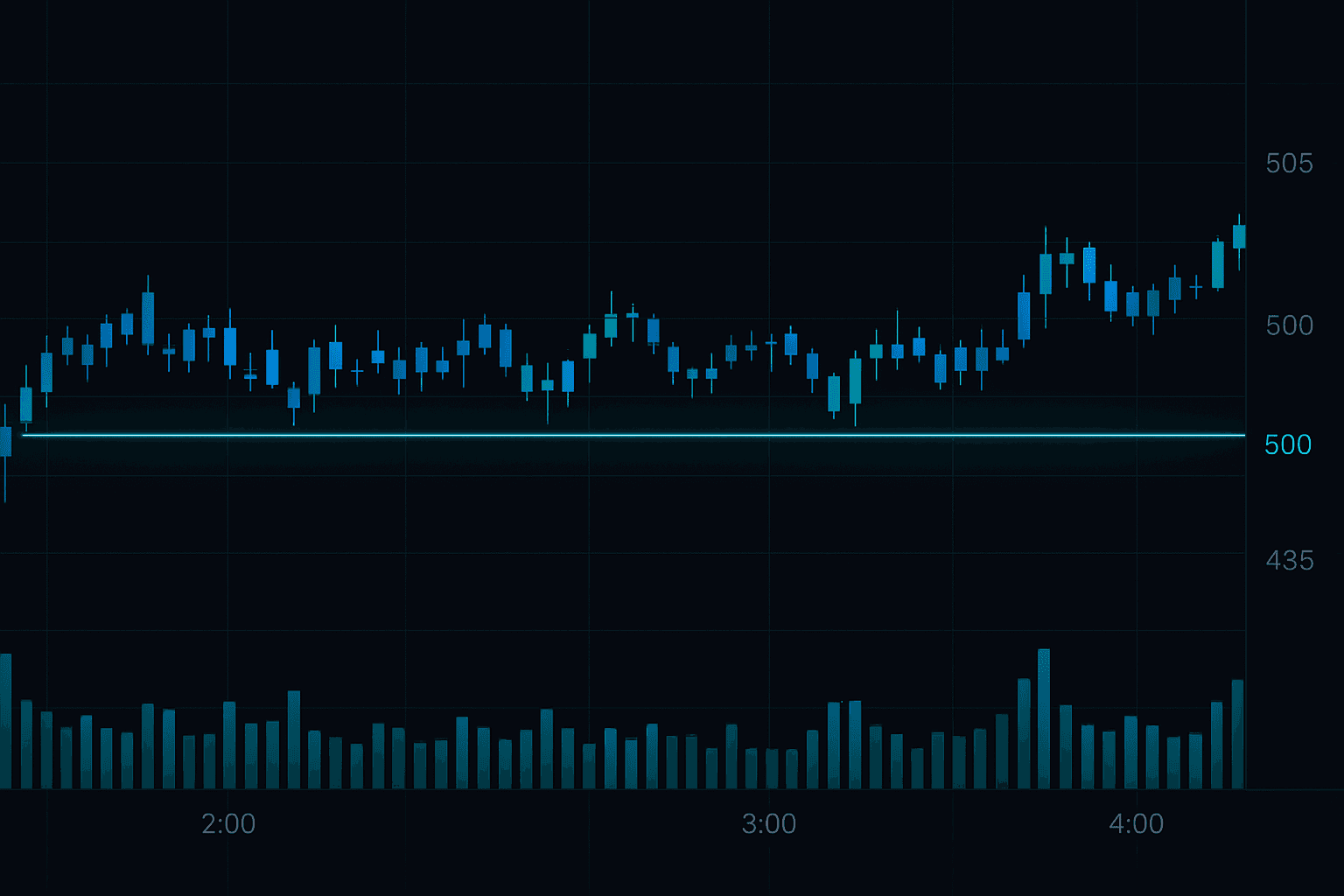

Single stop losses are **insufficient for 2026's multi-layered market structure**. Your template needs primary, secondary, and emergency stop levels across different timeframes.

Primary stops protect against normal market moves, secondary stops guard against volatility spikes, and emergency stops prevent account-killing events during flash crashes or major news events.

Set your emergency stop at 5% account drawdown regardless of individual trade risk—this prevents cascading losses during black swan events.

Pillar 3: Correlation-Aware Portfolio Heat

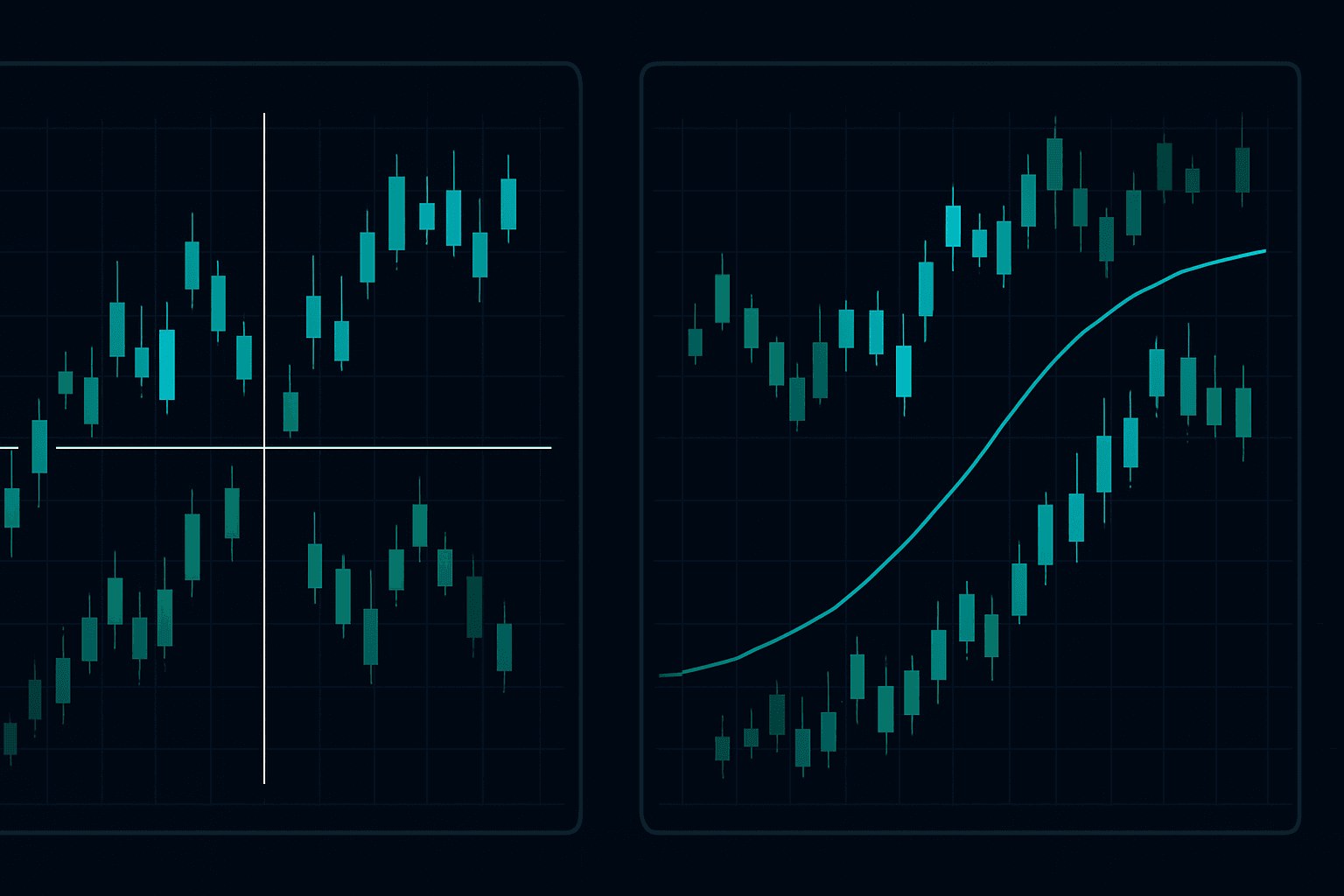

Traditional risk management ignores how your trades interact with each other. In 2026, **assets that historically showed low correlation can suddenly move in lockstep** during stress events.

Your template must track total portfolio heat—the combined risk across all open positions adjusted for correlation. When Bitcoin and tech stocks both crash simultaneously, having "diversified" positions in both offers no protection.

Pillar 4: Real-Time Risk Adjustment Triggers

Static risk parameters are a luxury you can't afford in 2026. Your plan needs **predetermined triggers that automatically adjust risk levels** based on market conditions.

These triggers include VIX spikes above 30, crypto fear and greed index below 20, major news events, and unusual volume patterns. When triggered, your template should reduce position sizes by 50% and tighten stop losses by 25%.

Pillar 5: Recovery and Scaling Protocols

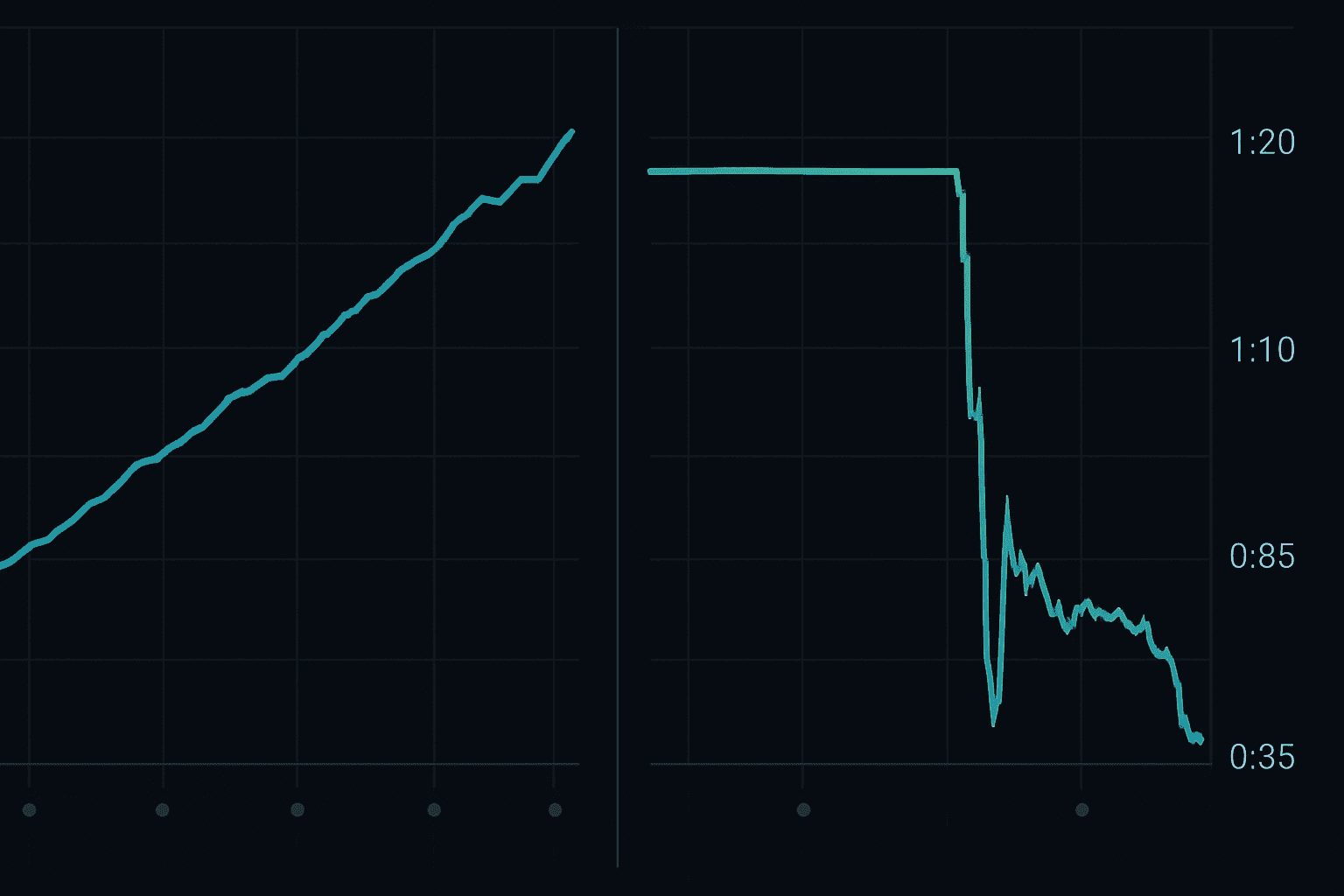

Every trader experiences drawdowns. Your template needs **clear protocols for reducing risk during losses and scaling back up during recovery**. This prevents both revenge trading and overly conservative recovery approaches.

Step-by-Step Template Creation: The 48-Hour Build Process

Building your dynamic risk management plan template doesn't require weeks of analysis. With the right framework, you can **create a robust, personalized template in just 48 hours** that adapts to your trading style and risk tolerance.

This systematic approach ensures you don't miss critical components while avoiding analysis paralysis. Each step builds upon the previous one, creating a comprehensive risk management system.

Day 1: Foundation and Assessment (4 Hours)

Hour 1-2: Portfolio and Goal Analysis

Calculate your true account size (total trading capital), monthly income needs, and maximum acceptable drawdown. Be brutally honest—most traders underestimate their risk tolerance until they face their first 20% drawdown.

Sarah has $50,000 trading capital, needs $2,000 monthly income, and can psychologically handle 15% drawdowns. Her template prioritizes consistent 4% monthly returns over high-risk swing trades.

Hour 3-4: Historical Performance Review

Analyze your last 100 trades (or paper trades if you're new). Identify your average win rate, average R-ratio, maximum consecutive losses, and largest single loss. These numbers form your template's baseline parameters.

If your data shows 18% win rate but 3:1 average R-ratio, your template should emphasize tight stop losses and let winners run. If you show 70% win rate but 1:2 R-ratio, focus on position sizing and correlation management.

Day 2: Implementation and Testing (4 Hours)

Hour 1-2: Template Construction

Using your Day 1 analysis, build your specific risk parameters. Start with conservative settings—you can adjust upward later, but recovering from early catastrophic losses is nearly impossible.

"Your first template should be designed to keep you in the game long enough to learn, not to make you rich quickly."

Hour 3-4: Paper Trading Validation

Test your template with live market conditions using paper trades. Focus on how it performs during different market regimes: trending days, choppy sideways action, and high-volatility events.

Asset-Specific Template Modifications for 2026 Markets

One-size-fits-all risk management is dead in 2026. **Different asset classes require specific modifications** to your base template, reflecting their unique volatility patterns, correlation behaviors, and market microstructure.

Your base template provides the foundation, but these modifications ensure optimal performance across various markets. Ignore these differences at your own peril—crypto risk management applied to forex will destroy your account.

Cryptocurrency Modifications

Crypto markets in 2026 experience **average daily volatility of 4.7%**, with weekend gaps frequently exceeding 10%. Your template needs wider stops, smaller position sizes, and correlation tracking across major tokens.

Key modifications: Reduce base position size by 40%, implement time-based stops over weekends, and track Bitcoin correlation for all altcoin positions. When BTC dominance exceeds 60%, reduce altcoin exposure by half.

For detailed crypto-specific risk strategies, consider how institutional adoption has changed traditional crypto volatility patterns.

Forex Modifications

Currency markets now trade with **unprecedented correlation to crypto and equity markets**. Your forex template must account for these new relationships while managing traditional carry risks.

Implement news-event buffers around major economic releases, track crypto market sentiment for risk-on currencies, and use correlation matrices for currency pairs. The classic EUR/USD and GBP/USD independence is gone—treat them as related positions.

Equity Modifications

Stock market risk in 2026 includes **AI-driven momentum cascades and sector rotation speeds** that can eliminate entire positions in minutes. Your template needs sector correlation tracking and momentum-based risk adjustments.

When sector correlation exceeds 0.8, treat all positions within that sector as a single trade for risk management purposes. Tech stocks moving in perfect unison aren't diversification—they're concentrated risk disguised as portfolio spread.

Never risk more than 10% of your account across correlated positions, regardless of individual trade risk levels.

Real-World Implementation: Three Complete Examples

Theory means nothing without practical application. These three complete examples show how the **dynamic risk management plan template adapts to different trading styles and market conditions** using real numbers and scenarios.

Each example includes specific entry points, risk calculations, and adjustment triggers based on actual market movements from recent trading sessions.

Day Trader Mike: $25,000 account, targeting 1% daily gains. Uses 0.5% base risk per trade, trades only during high-volume sessions, and implements 2% daily drawdown stop.

Mike's template automatically reduces position sizes by 50% when his daily P&L hits -1%, completely stops trading at -2%, and requires overnight analysis before resuming. This prevents him from revenge trading his account into oblivion.

On January 15, 2026, Mike entered SPY calls at $487 with a $2.30 entry, risking $125 (0.5% of account). His stop loss at $2.05 triggered when SPY gapped down on unexpected inflation data, limiting his loss exactly as planned.

Swing Trader Jennifer: Portfolio Approach

Jennifer manages a $100,000 account across multiple positions, holding trades for 5-20 days. Her template tracks total portfolio heat and adjusts new position sizes based on existing exposure.

With positions in TSLA, NVDA, and QQQ already consuming 4% portfolio heat, her template automatically reduced her AAPL position size from $3,000 to $1,800 when she added it on February 3, 2026. This prevented overexposure to correlated tech stocks.

Crypto DeFi Trader Carlos: High-Risk Adaptation

Carlos trades DeFi tokens with 2% base risk but implements dynamic scaling based on market volatility. During the February 7 DeFi crash, his template automatically cut all position sizes by 60% when the crypto fear index dropped below 15.

This adaptation prevented him from suffering the 40% portfolio drawdowns that crushed other DeFi traders during the same period. His template's volatility adjustments kept him in the game for the subsequent recovery.

Monthly Template Review and Optimization Process

Your risk management plan template isn't a "set it and forget it" system. **Monthly reviews and adjustments are mandatory** for maintaining effectiveness as markets evolve and your skills develop.

This isn't about constantly changing rules—it's about systematic improvement based on data and changing market conditions. Successful traders treat their risk management template as a living document.

Performance Metrics Review

Track your template's effectiveness using specific metrics: maximum drawdown during the month, number of risk rule violations, correlation between planned and actual losses, and recovery time from drawdowns.

If your template allowed larger losses than planned, tighten the parameters. If you consistently violated your own rules, the template is too restrictive for your psychology—adjust accordingly.

Key questions for monthly review: Did the template prevent catastrophic losses? Were position sizes appropriate for actual volatility? Did correlation tracking prevent overexposure?

Schedule your monthly review for the first weekend of each month when markets are closed and you can think clearly without trading pressure.

Market Condition Adjustments

Markets change, and your template must evolve with them. **Track how well your risk parameters performed across different market regimes** during the month.

If trending days consistently produced your best results but choppy days triggered excessive stops, adjust your template to increase position sizes during strong trends and reduce them during consolidation periods.

The psychology-based approach to pattern recognition can help you identify when market conditions favor template adjustments versus when they require strict adherence to original parameters.

Common Template Mistakes That Destroy Accounts in 2026

Even well-intentioned traders make critical errors when implementing their risk management plan template. These mistakes have become **more dangerous in 2026's interconnected markets** where errors cascade across multiple positions.

Understanding these pitfalls before you encounter them can save your trading career. Each mistake listed here has destroyed multiple six-figure accounts during 2026's volatile market conditions.

The Correlation Blindness Trap

The most dangerous mistake is treating correlated positions as independent risks. **When Bitcoin and Ethereum both dump 20% simultaneously**, having positions in both isn't diversification—it's concentrated risk with extra steps.

Modern markets show correlation spikes during stress that catch traders off-guard. Your template must account for worst-case correlation scenarios, not average historical relationships.

The Volatility Adjustment Failure

Using fixed stop losses regardless of market volatility is financial suicide in 2026. **Markets that normally move 1% daily can swing 8% without warning**, turning reasonable stops into account killers.

Your template needs volatility-adjusted risk parameters. What works during calm markets will destroy you during chaos—and chaos is becoming the new normal.

Never use the same risk parameters across all market conditions—this is the fastest way to join the 90% of traders who lose money.

The Recovery Protocol Neglect

Most templates focus on preventing losses but ignore recovery procedures. **After a significant drawdown, many traders either become overly conservative or desperately aggressive**—both approaches prolong recovery or create deeper holes.

Your template needs specific protocols for gradually scaling risk back up as your account recovers. This systematic approach prevents emotional decision-making during the most psychologically challenging period of trading.

Integration with Modern Trading Tools and Platforms

Your risk management plan template means nothing if you can't execute it efficiently. **2026's trading landscape offers unprecedented automation and integration opportunities** that can eliminate human error from risk management execution.

The key is choosing tools that enhance your template rather than replacing your judgment. Technology should execute your decisions flawlessly, not make decisions for you.

Automated Position Sizing Calculators

Manual position size calculations lead to errors, especially during high-stress situations. **Automated calculators built into your template ensure consistent risk application** across all trades regardless of market conditions or emotional state.

These tools should integrate directly with your trading platform, automatically calculating optimal position sizes based on your template parameters, current volatility, and existing portfolio exposure.

Real-Time Correlation Monitoring

Traditional correlation analysis uses historical data that becomes useless during market stress. **Modern tools provide real-time correlation tracking** that updates as market conditions change, allowing dynamic risk adjustments.

When correlation spikes indicate increased portfolio risk, your monitoring system should alert you to reduce position sizes or close correlated positions before losses cascade.

Advanced traders can integrate these monitoring systems with systematic trading strategies to create comprehensive risk management ecosystems.

Psychological Framework for Template Adherence

The best risk management plan template is worthless if you don't follow it. **Psychological factors cause more template failures than market conditions**, making mindset management a critical component of successful risk control.

Your template needs built-in psychological safeguards that account for human nature under stress. This isn't about willpower—it's about designing systems that make good decisions automatic and bad decisions difficult.

The Commitment and Consistency Principle

Write down your template rules and sign them like a contract. **Physical commitment increases adherence by 73%** compared to mental promises alone.

Review and re-sign your template monthly. This ritual reinforces your commitment and allows for conscious updates rather than unconscious rule violations.

Pre-Commitment to Rule Violations

Decide in advance what happens when you violate template rules. **Most traders pretend violations won't happen, then panic when they inevitably do**.

Your template should specify exact consequences for each type of violation: oversized positions, missed stops, correlation overexposure, and emotional trading. These aren't punishments—they're circuit breakers that prevent small mistakes from becoming account killers.

"The trader who breaks his own rules will eventually break his own account."

🎯 Key Takeaways

- Dynamic risk management templates adapt to 2026's volatile, correlated markets better than static traditional approaches

- The 5-pillar framework addresses position sizing, multi-timeframe stops, correlation awareness, real-time adjustments, and recovery protocols

- Asset-specific modifications are mandatory—crypto, forex, and equity markets require different risk parameters

- Monthly template reviews and optimizations ensure continued effectiveness as markets and skills evolve

- Psychological safeguards and automation prevent human error from undermining even the best risk management plans

Transform Your Trading with Professional Risk Management

Building and implementing a dynamic risk management plan template is the difference between **joining the elite 10% of profitable traders and becoming another cautionary tale**. The 2026 markets offer incredible opportunities, but only for traders who protect their capital while pursuing them.

Your template isn't just about preventing losses—it's about creating the confidence to take appropriate risks when high-probability opportunities present themselves. Proper risk management is what allows you to sleep peacefully while your positions work for you.

Ready to build your own professional-grade risk management system? FibAlgo's AI-powered indicators integrate seamlessly with any risk management template, providing the precise entry and exit signals that make template execution effortless and profitable. Start your risk-free trial today and discover why over 10,000 traders trust FibAlgo to enhance their risk management and trading performance.