Why Most Traders Fail in Crypto Bull Markets

Here's a shocking truth: **78% of crypto traders actually lose money during bull markets**. While this might sound impossible, it reveals a critical flaw in how most people approach rising markets.

The problem isn't a lack of opportunities—it's using the wrong crypto bull market strategy for each phase of the cycle. In 2026, we're seeing unprecedented institutional adoption and regulatory clarity, creating the most complex bull market environment crypto has ever experienced.

Most traders treat bull markets as a single event, but successful professionals know there are actually **three distinct phases**, each requiring completely different tactics, position sizing, and risk management approaches.

The Three-Phase Bull Market Framework

Think of a crypto bull market like a rocket launch. **Each phase has different fuel requirements, thrust patterns, and navigation systems**. Using accumulation tactics during the euphoria phase is like trying to land a spacecraft with takeoff protocols—it simply doesn't work.

The three phases are:

- Phase 1: Stealth Accumulation (6-12 months) - Smart money enters quietly

- Phase 2: Public Markup (8-18 months) - Mainstream adoption accelerates

- Phase 3: Euphoric Distribution (2-6 months) - Peak excitement and exit planning

Each phase typically sees different asset classes perform. During accumulation, **utility tokens often lead**. In markup, **layer-1 protocols dominate**. During euphoria, **meme coins and speculative plays explode**.

The most profitable crypto bull market strategy isn't about picking the best coins—it's about matching your tactics to the current market phase.

Phase 1: Stealth Accumulation Strategy

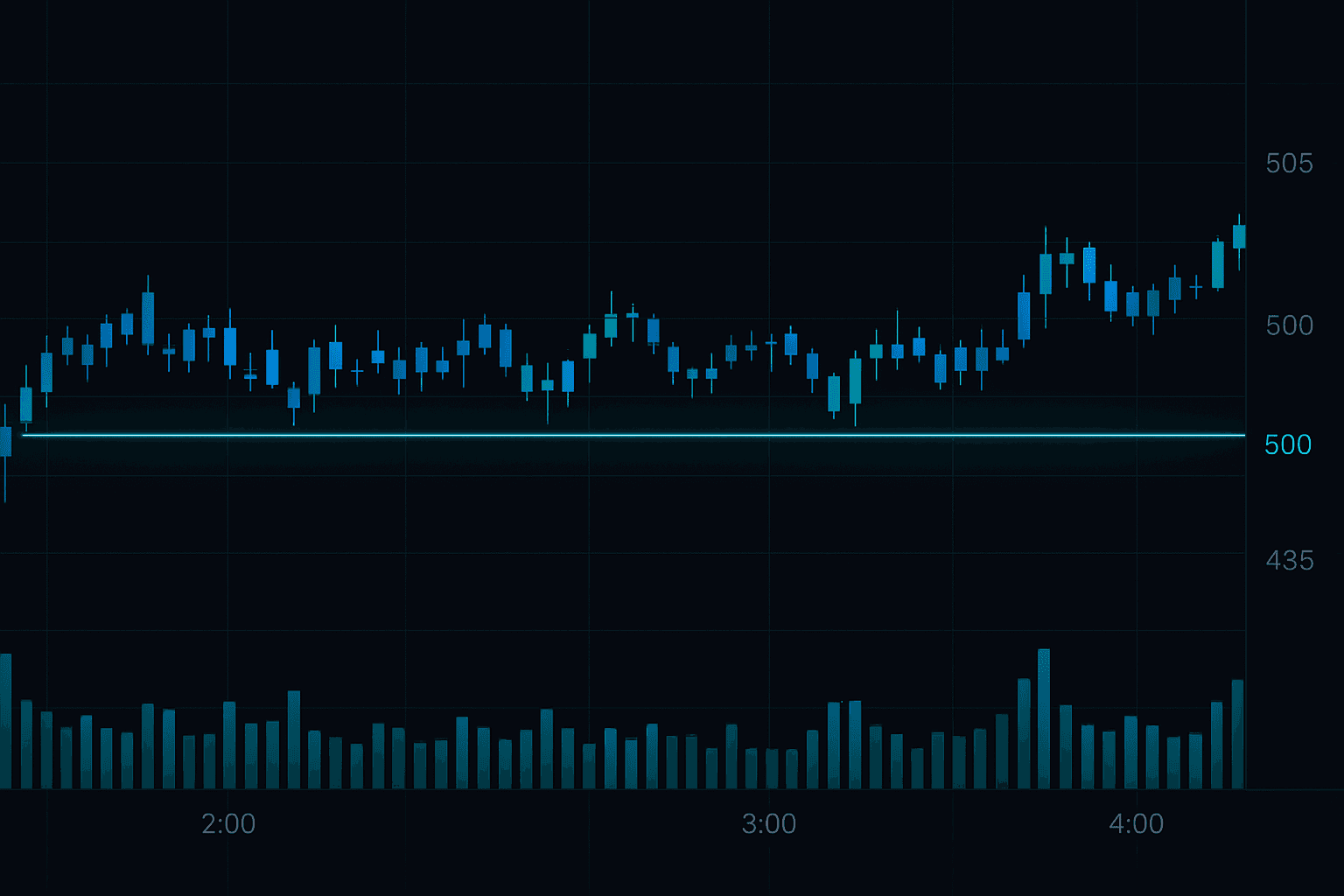

The accumulation phase often feels like a bear market that refuses to die. **Bitcoin might trade sideways between $35,000-$45,000 for months**, while altcoins slowly build bases. This is when institutional money enters quietly.

Your primary strategy during this phase should focus on **systematic accumulation with dollar-cost averaging (DCA)**. Here's the specific approach:

- Allocate 60% to major cryptocurrencies (BTC, ETH)

- 30% to emerging layer-1 protocols with strong fundamentals

- 10% to speculative plays for potential moonshots

For example, if you have a $10,000 portfolio during accumulation, you'd invest $6,000 in Bitcoin and Ethereum, $3,000 in protocols like Solana or Cardano, and $1,000 in smaller cap opportunities.

"The time to buy is when there's blood in the streets"—Baron Rothschild's wisdom applies perfectly to crypto accumulation phases.

Accumulation Phase Tactics

During this phase, **volatility is your friend**. Set up systematic buying on dips using these specific triggers:

- Buy when RSI drops below 30 on weekly charts

- Add positions on 20% pullbacks from recent highs

- Use limit orders 5-10% below current market price

The key is patience. **Accumulation phases can last 12-18 months**, and many traders give up right before the markup begins. This is exactly when institutional players want you to sell.

Track whale wallet movements using on-chain analytics. When large holders stop selling and start accumulating, the next phase is approaching.

Phase 2: Public Markup Strategy

The markup phase begins when **Bitcoin breaks its previous all-time high with conviction**. In 2026, this could mean sustained moves above $75,000 with strong volume. This is when your crypto bull market strategy needs to shift dramatically.

Your position sizing should become more aggressive, but also more selective. **The "buy everything" approach stops working** as correlations between different crypto sectors begin to break down.

Here's your markup phase allocation:

- 40% in sector leaders (strongest protocols in each category)

- 35% in momentum plays (coins breaking out of long consolidations)

- 25% in cash/stablecoins for opportunities and protection

For instance, during the markup phase, you might hold 40% in Ethereum and Solana as DeFi leaders, 35% in newly breaking out layer-2 solutions, and keep 25% in USDC for rapid deployment.

In March 2021, when Bitcoin first broke $60,000, smart money rotated from BTC into Ethereum, which then surged from $1,800 to $4,400 over the following months—a 144% gain while BTC only gained 15%.

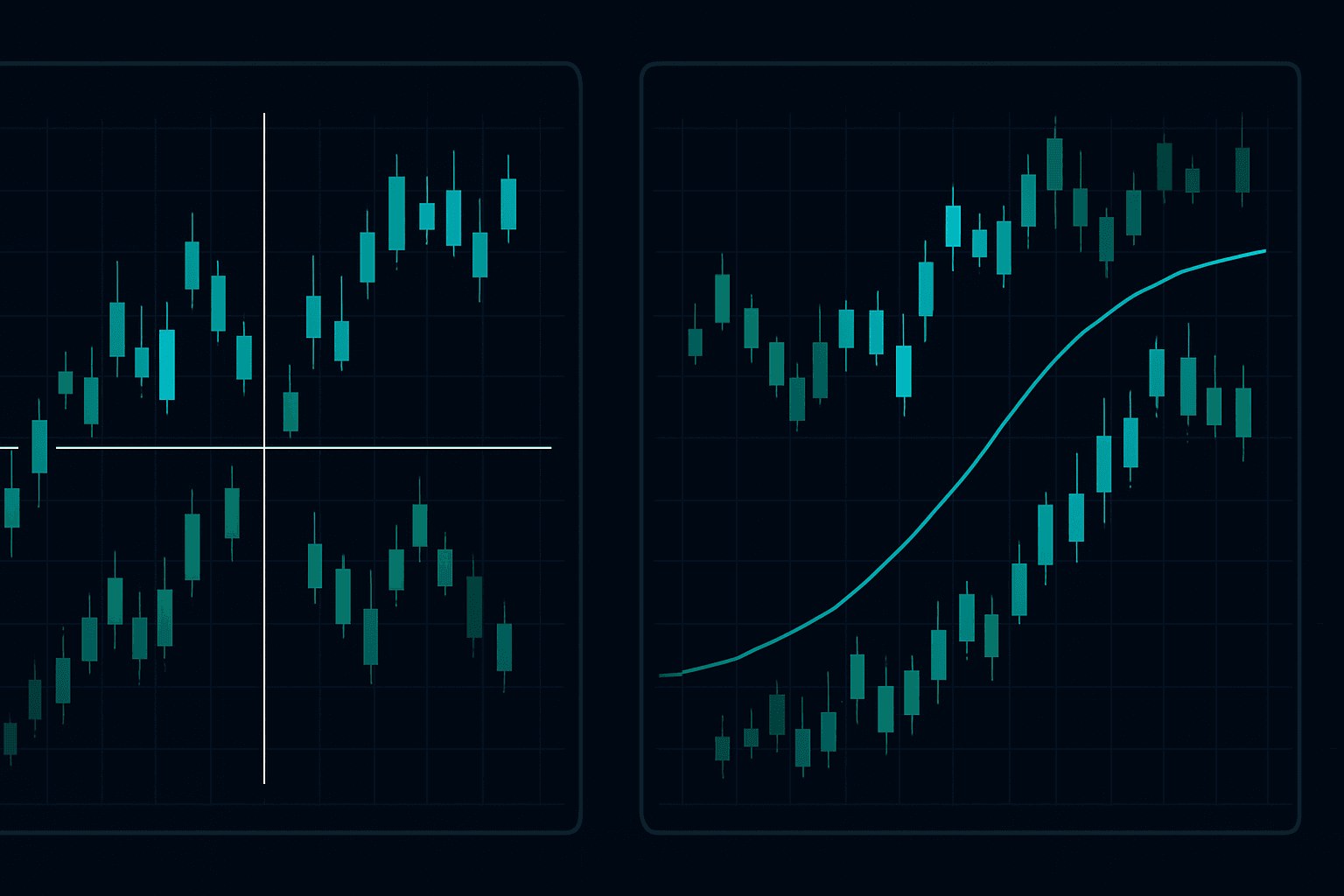

Sector Rotation During Markup

The markup phase is all about **rotating between crypto sectors as they take turns leading**. Typically, the rotation follows this pattern:

- Bitcoin leads initially (store of value narrative)

- Ethereum follows (smart contract platform utility)

- Layer-1 competitors emerge ("Ethereum killers")

- DeFi tokens explode (yield farming and protocols)

- NFT and gaming tokens moon (speculation increases)

Your strategy should **follow this rotation**, not predict it. When DeFi tokens start outperforming Bitcoin by 20% over two weeks, that's your signal to rotate capital.

Phase 3: Distribution Strategy

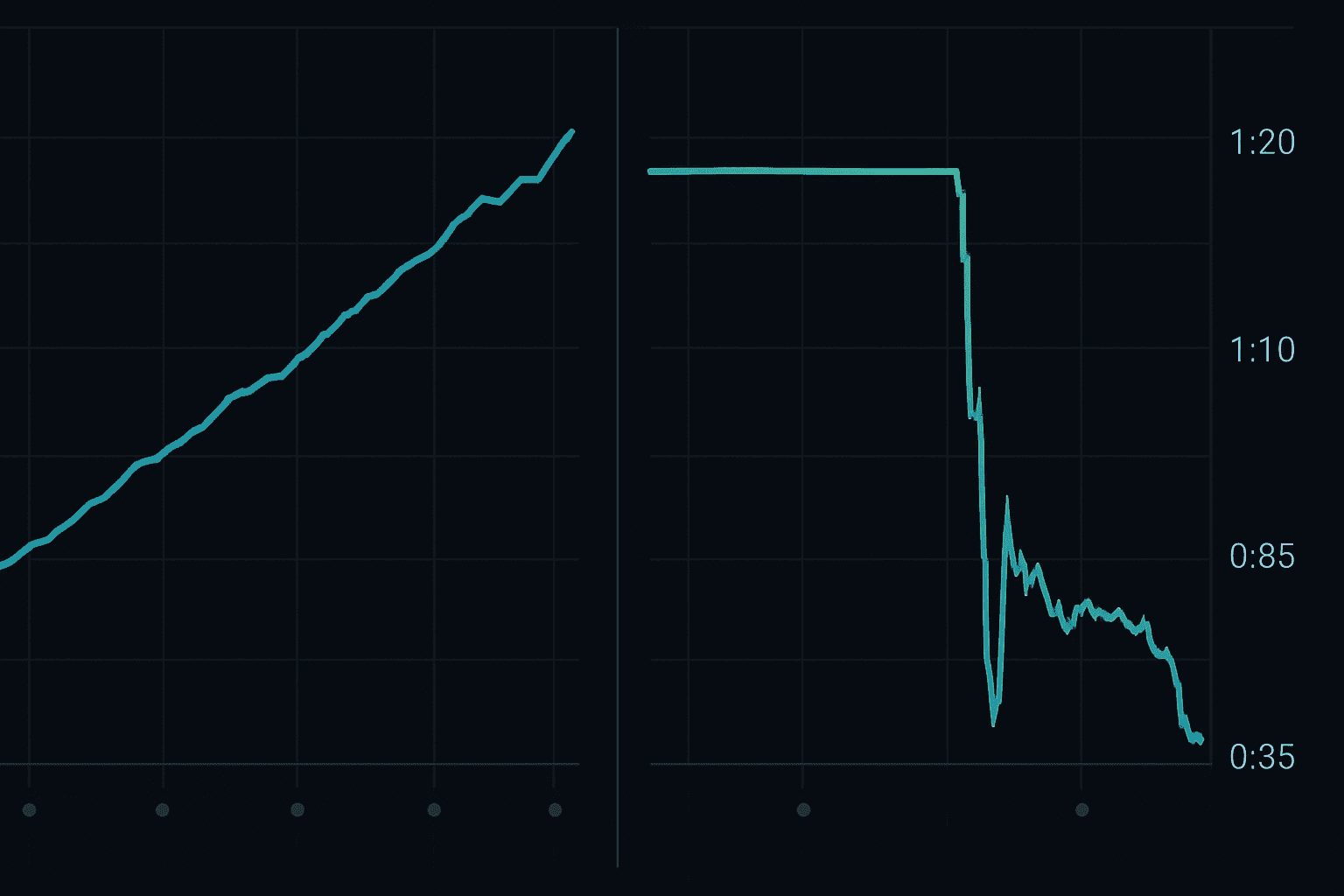

The distribution phase is the most dangerous yet potentially most profitable period. **This is when retail FOMO peaks**, mainstream media runs crypto stories daily, and your barber starts giving you trading advice.

Paradoxically, this is when you need to become most defensive with your crypto bull market strategy. Your primary goal shifts from accumulation to **systematic profit-taking and risk reduction**.

Distribution phase allocation should be:

- 20% in blue-chip crypto (BTC, ETH only)

- 30% in high-conviction alts with stop-losses

- 50% in cash/stablecoins earning yield

During euphoria, it's psychologically hardest to sell when everything is going up. Set predetermined exit rules before emotions take over.

Exit Strategy Framework

Professional traders use **systematic exit strategies** rather than trying to time the perfect top. Here's a proven framework:

The 25-50-25 Rule:

- Sell 25% of each position when it doubles

- Sell another 50% when it triples

- Let the final 25% ride or until technical breakdown

For example, if you bought Solana at $50 during accumulation and it reaches $100 during markup, sell 25%. If it hits $150 during distribution, sell another 50%. Keep the rest with a trailing stop.

Advanced Position Sizing Across Bull Market Phases

Position sizing is **the most overlooked aspect** of crypto bull market strategy. Most traders use the same position size regardless of market phase, which is a critical error.

Here's the professional approach:

Accumulation Phase: Fixed dollar amounts (DCA)

Markup Phase: Fixed percentage of portfolio (5-10% per position)

Distribution Phase: Decreasing position sizes (2-5% per position)

During accumulation with a $10,000 portfolio, you might invest $500 monthly regardless of price. During markup, each new position gets exactly 7% of your portfolio. During distribution, new positions get maximum 3%.

Your position sizing should be inverse to market euphoria—smaller positions as excitement increases.

Sector Rotation Timing Indicators

Knowing when to rotate between crypto sectors can **multiply your returns during bull markets**. Professional traders watch these specific indicators:

Relative Strength Indicators:

- DeFi/Bitcoin ratio above 0.5 = DeFi season

- Alt/Bitcoin ratio trending up = Alt season beginning

- Bitcoin dominance below 45% = Full alt season

For example, when the DeFi Pulse Index outperforms Bitcoin by 15% over 10 days, it's time to increase DeFi exposure and reduce Bitcoin allocation.

On-Chain Metrics for Rotation:

- Active addresses growing faster in specific protocols

- Total Value Locked (TVL) increasing in certain sectors

- Developer activity metrics showing momentum

Managing FOMO and Euphoria Psychology

The biggest threat to your crypto bull market strategy isn't market crashes—it's your own psychology during euphoria phases. **When Dogecoin is up 400% in a week**, every instinct tells you to chase momentum.

Professional strategies to combat FOMO:

- Pre-commit to exit rules when thinking clearly

- Use position sizing to limit damage from mistakes

- Set up automatic selling at predetermined levels

- Track portfolio allocation daily to prevent overconcentration

During May 2021's peak, one trader sold 75% of his positions when his portfolio hit 10x gains, keeping only Bitcoin and Ethereum. While the peak continued for weeks, this discipline saved him from losing 60% in the subsequent crash.

Common Bull Market Mistakes to Avoid

After analyzing thousands of trader accounts during bull markets, **these five mistakes destroy more wealth** than market crashes:

- Holding too long - Not taking any profits during 10x+ moves

- Over-diversification - Owning 50+ different coins

- Ignoring market cap - Expecting $100B coins to 10x

- Emotional buying - FOMOing at local tops

- No exit plan - "HODL forever" mentality

The most successful traders I know **took profits systematically** throughout 2021, rather than holding through the entire cycle. They understood that bull markets are for selling, not just buying.

2026-Specific Bull Market Considerations

The 2026 crypto landscape includes several new factors that previous bull markets didn't have:

Institutional Infrastructure: Bitcoin ETFs, corporate treasuries, and pension fund allocations create **sustained buying pressure** different from retail-driven cycles.

Regulatory Clarity: Clear frameworks in major economies reduce regulatory risk but may also reduce explosive upside potential.

Macro Environment: Post-inflation policy shifts and central bank digital currency (CBDC) development create new correlation patterns with traditional markets.

Your crypto bull market strategy for 2026 must account for these factors by:

- Expecting longer, more sustained trends

- Preparing for reduced volatility in major coins

- Focusing more on utility and adoption metrics

- Building positions in regulation-compliant projects

🎯 Key Takeaways

- Bull markets have three distinct phases requiring different strategies—accumulation, markup, and distribution

- Position sizing should be inverse to market euphoria—larger positions during fear, smaller during greed

- Sector rotation follows predictable patterns—Bitcoin leads, then major alts, then speculative plays

- Systematic profit-taking beats trying to time the perfect top—use the 25-50-25 exit framework

- 2026's institutional involvement creates longer trends but potentially lower volatility spikes

Implementing Your 2026 Bull Market Strategy

Success in crypto bull markets comes from **preparation during quiet periods** and discipline during exciting ones. Start building your systematic approach now, before emotions run high.

Begin by identifying which phase the current market is in. Look at Bitcoin's price action, institutional buying patterns, and mainstream media sentiment. Then align your position sizing, sector allocation, and exit planning accordingly.

Remember, the best crypto bull market strategy is one you can actually execute when your portfolio is up 500% and every coin seems destined for the moon. **Systematic approaches beat emotional decisions** every time.

Ready to implement professional-grade crypto analysis in your trading? Try FibAlgo risk-free and access the same institutional-quality indicators used by professional crypto traders. Our AI-powered signals can help you identify phase transitions and optimal entry points across all market cycles.

For more advanced crypto strategies and market analysis, explore our trading education section and discover how successful traders adapt their approach to different market environments.