The Hidden Problem with Universal OBV Application

On balance volume (OBV) trading strategies dominate technical analysis textbooks with a seductive promise: volume leads price, so tracking cumulative volume flow reveals future price direction. The indicator's creator, Joseph Granville, proclaimed in his 1963 book that

"Volume is the steam in the boiler that makes the choo-choo go."This metaphor worked perfectly for the centralized stock exchanges of the 1960s. Today's fragmented, multi-exchange, 24/7 markets present a radically different challenge.

Most traders apply OBV identically across stocks, forex, and crypto — then wonder why their signals fail. The core issue isn't the indicator itself, but rather the fundamental differences in how volume manifests across market structures. A positive OBV divergence in Bitcoin means something entirely different from the same pattern in EUR/USD or Apple stock. Understanding these distinctions transforms OBV from a frustrating indicator into a precision tool.

This analysis examines how market microstructure impacts OBV reliability and presents specific adaptations for each asset class. The approach challenges the one-size-fits-all mentality that causes most OBV failures.

Why Traditional OBV Assumptions Break Down

Granville designed OBV for a world where the New York Stock Exchange handled virtually all trading in listed stocks. Volume data was clean, centralized, and directly comparable day to day. Modern markets shatter every assumption underlying classical OBV calculation.

Consider how volume fragments across venues. Apple stock trades on dozens of exchanges and dark pools simultaneously. Cryptocurrency volume splits across hundreds of spot exchanges, each with different fee structures and wash trading incentives. Forex volume remains largely invisible, with only futures contracts providing partial visibility into actual flow.

The fragmentation problem creates three critical issues for OBV traders. First, volume totals become arbitrary based on which exchanges your data provider includes. Second, time zone differences mean "daily" volume depends on where you draw the day's boundaries. Third, different market participants concentrate on different venues — institutional forex flow through EBS differs fundamentally from retail flow on MT4 brokers.

Traditional OBV also assumes volume represents genuine buying or selling pressure. This assumption collapses in markets with significant algorithmic trading. High-frequency trading firms might generate 70% of volume in liquid stocks while having minimal directional bias. Crypto exchanges with zero or negative maker fees see massive wash trading that inflates volume without creating real pressure.

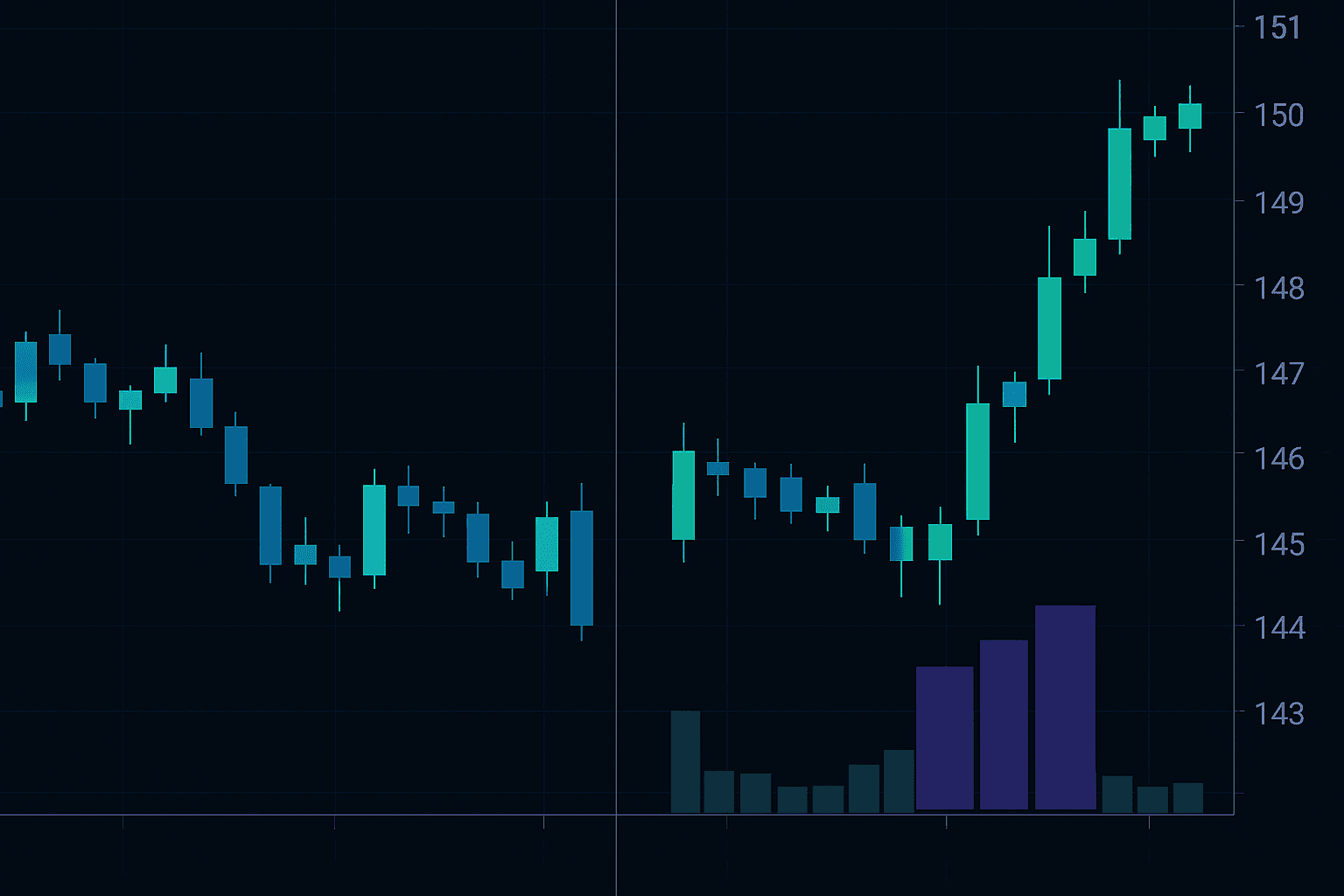

OBV in Fragmented Crypto Markets

Cryptocurrency markets present the most extreme challenge for on balance volume OBV trading due to radical fragmentation and inconsistent data quality. Bitcoin trades on over 400 spot exchanges globally, each reporting different volumes with varying degrees of reliability.

The solution requires aggregating volume from major exchanges while filtering obvious anomalies. Focus on exchanges with real banking relationships and regulatory compliance — Coinbase, Kraken, Bitstamp for USD pairs, Binance for USDT pairs. Ignore exchanges reporting suspiciously round numbers or volumes that spike without corresponding price movement.

Time boundaries matter enormously in 24/7 crypto markets. Traditional daily OBV resets at midnight somewhere, creating artificial breakpoints in continuous trading. Consider this scenario: Ethereum rallies from $2,400 to $2,500 between 11 PM and 1 AM UTC on heavy volume. Daily OBV splits this move across two days, potentially missing the accumulation signal entirely.

The fix involves using rolling time windows instead of fixed daily periods. Calculate OBV over rolling 24-hour periods updated hourly, or use 4-hour candles that align with natural trading sessions (Asia open, London open, New York open). This approach captures volume flows without arbitrary interruptions.

Crypto OBV also requires adjustment for stablecoin dynamics. When Tether or USDC volume spikes, it often signals preparation for major moves rather than the moves themselves. Track OBV separately for USD pairs versus stablecoin pairs to identify these preparatory flows.

Adapting OBV for Forex Session Trading

Foreign exchange markets lack centralized volume data, making traditional OBV calculation impossible for spot pairs. Futures volume from CME provides a partial proxy, but this represents less than 10% of global forex flow according to the Bank for International Settlements' triennial survey.

The solution leverages tick volume as a volume proxy — counting price updates rather than traded amounts. While imperfect, tick volume correlates surprisingly well with actual volume during active sessions. Major banks and liquidity providers update quotes more frequently during high-volume periods, making tick frequency a reasonable proxy.

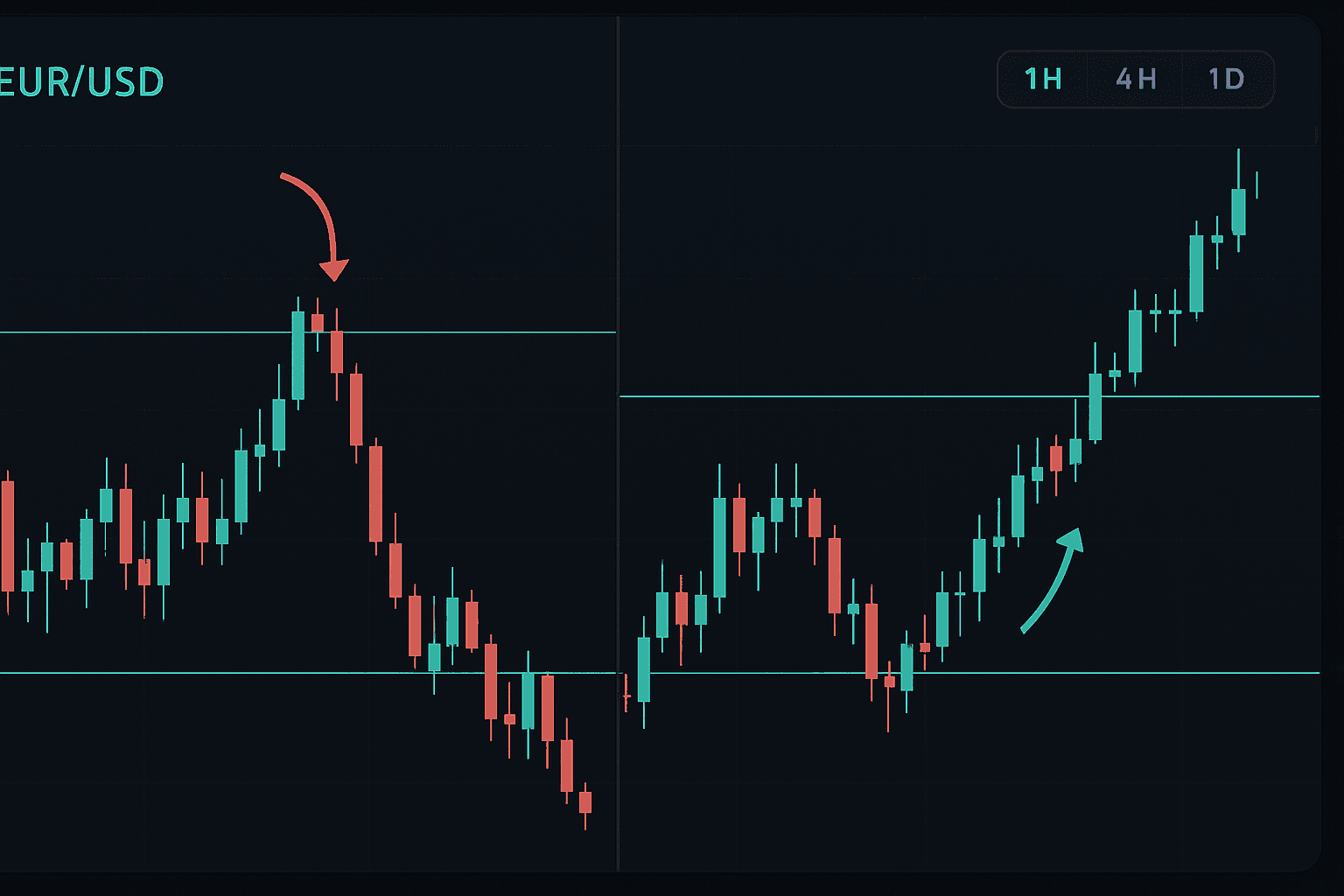

Session-based analysis becomes critical for forex OBV interpretation. EUR/USD volume patterns during London morning differ completely from New York afternoon or Asian overnight sessions. Build separate OBV lines for each major session:

- Asian session OBV (Tokyo 00:00 - 09:00 GMT)

- London session OBV (London 07:00 - 16:00 GMT)

- New York session OBV (New York 12:00 - 21:00 GMT)

When London session OBV rises while price consolidates, it often precedes breakouts during the London-New York overlap. Conversely, rising Asian session OBV with flat prices frequently leads to fakeouts, as lower liquidity makes accumulation patterns less reliable.

Currency pairs require different OBV sensitivity based on their volume profiles. Liquid majors like EUR/USD need longer lookback periods (20-50 candles) to smooth noise. Exotic pairs with sporadic volume work better with shorter periods (10-20 candles) to capture genuine accumulation before it's diluted by quiet periods.

Stock Market OBV: Where Original Design Still Works

Equity markets remain OBV's natural habitat, though modern market structure requires several adaptations. The consolidated tape ensures comprehensive volume data for U.S. stocks, making OBV calculation straightforward. However, pre-market and after-hours trading complicate the picture.

For stocks like Tesla or Apple with significant extended-hours volume, incorporate this data rather than ignoring it. If TSLA drops 3% after-hours on 10 million shares, excluding this from OBV calculation misses critical distribution. Build two OBV lines — one for regular trading hours (RTH) and another including extended sessions. Divergences between them often signal institutional positioning.

Market cap and liquidity tiers demand different OBV approaches. Large-cap stocks with consistent institutional participation show reliable OBV patterns over weeks or months. Small-cap stocks with sporadic volume require shorter timeframes and confirmation from other indicators.

Consider how OBV behaved during the January 2021 meme stock episode. GameStop's OBV exploded higher days before the massive price spike as retail traders accumulated shares. Traditional momentum indicators lagged, but OBV captured the unusual accumulation pattern. This same dynamic appeared in AMC, BlackBerry, and other squeeze targets — OBV led price when genuine accumulation occurred.

Multi-Timeframe OBV Confluence Method

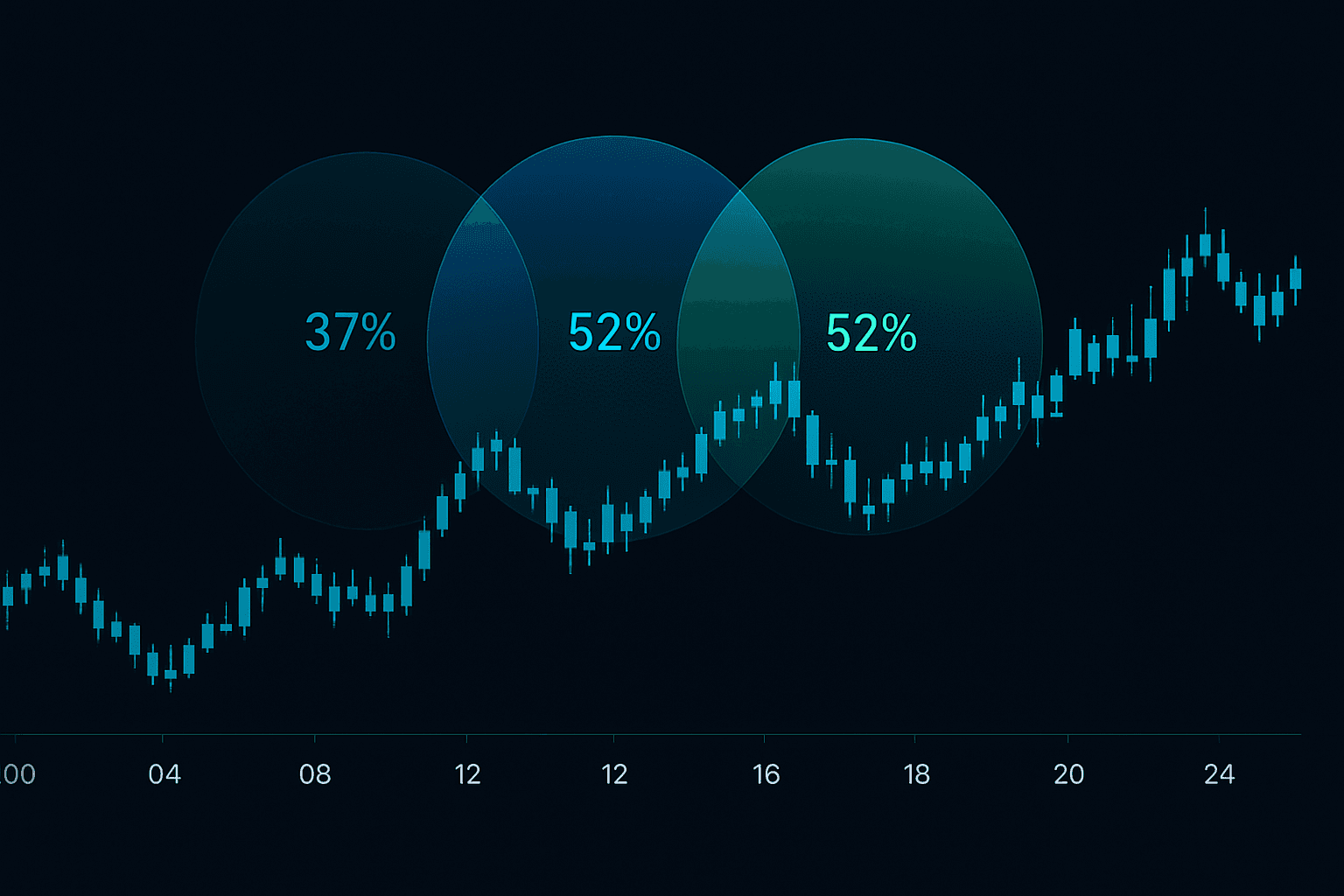

Single timeframe OBV analysis misses crucial context about volume flows across different participant groups. Day traders, swing traders, and investors operate on different timeframes with distinct volume footprints. The solution involves tracking OBV across multiple timeframes simultaneously.

Start with three timeframes following a 4-to-1 ratio. For day trading, use 15-minute, 1-hour, and 4-hour charts. For swing trading, use 4-hour, daily, and weekly. The multi-timeframe approach similar to CCI indicator trading provides context often missing from single timeframe analysis.

Confluence occurs when OBV trends align across timeframes. If 4-hour OBV shows accumulation, daily OBV turns positive, and weekly OBV breaks above its moving average, probability favors upside continuation. Divergence across timeframes warns of potential reversals — rising daily OBV with falling weekly OBV often precedes failed breakouts.

Weight timeframes based on your holding period. Day traders might use 50% weight on 15-minute OBV, 30% on hourly, and 20% on 4-hour. Position traders could weight 50% weekly, 30% daily, and 20% 4-hour. This weighted approach prevents whipsaws from dominating longer-term signals.

Practical Implementation Example

Suppose a trader analyzes Solana (SOL) for a swing trade entry. The 4-hour OBV shows steady accumulation despite price hovering around $95. Daily OBV just crossed above its 20-period moving average. Weekly OBV remains in a downtrend but shows deceleration. This mixed picture suggests early accumulation — not yet confirmed but worth monitoring for entry if weekly OBV turns.

The same analysis on EUR/USD might show 4-hour London session OBV rising sharply, daily OBV flat, and weekly OBV declining. This pattern often appears before short-term bounces that fail at resistance — useful for scalping but dangerous for position trades.

Common OBV Misinterpretations

The most expensive OBV mistakes stem from misreading what the indicator actually measures. OBV tracks cumulative volume flow, not buying or selling pressure directly. This distinction matters because volume can surge for multiple reasons unrelated to directional conviction.

Options expiration regularly distorts stock OBV readings. When monthly options expire, market makers hedge massive positions, generating volume without directional intent. OBV might spike or plummet based purely on mechanical hedging flows. Traders interpreting this as accumulation or distribution enter positions just as the abnormal volume disappears.

Index rebalancing creates similar distortions. When S&P 500 committees add or remove stocks, index funds must trade regardless of price. Tesla's S&P 500 inclusion in December 2020 saw massive volume that had nothing to do with investor sentiment about the company's prospects. OBV spiked on forced buying, not genuine accumulation.

Crypto markets face unique interpretive challenges. Exchange hacks, wallet movements, and stablecoin minting all generate volume spikes that OBV captures as directional signals. When $100 million in Bitcoin moves from Coinbase to cold storage, OBV drops despite no actual selling occurring. Understanding these structural flows prevents false signal interpretation.

The solution requires contextual filtering. Before acting on OBV signals, check for:

- Options expiration dates (third Friday of each month for stocks)

- Index rebalancing schedules (quarterly for most indices)

- Major economic releases or central bank meetings (for forex)

- On-chain wallet movements or exchange maintenance (for crypto)

- Earnings releases or corporate actions (for individual stocks)

Building a Market-Specific OBV System

Effective on balance volume OBV trading requires abandoning the universal indicator mindset and building market-specific systems. Start by documenting how volume behaves in your target market during different conditions.

For crypto traders, this means tracking how volume distributes across exchanges during rallies versus selloffs. Bitcoin accumulation often begins on spot exchanges like Coinbase while derivatives on BitMEX or Binance Futures lag. Distribution shows the opposite — derivatives lead while spot follows. Build separate OBV calculations for spot versus derivatives to capture these dynamics.

Forex traders must map volume patterns to session overlaps and economic releases. GBP/JPY volume during London open differs fundamentally from Tokyo afternoon. Create session-specific OBV templates that account for these patterns. When London morning OBV diverges from price, it carries more weight than overnight accumulation.

Stock traders should categorize OBV patterns by market cap, sector, and liquidity profile. Triangle patterns confirmed by OBV work differently in mega-cap tech stocks versus small-cap biotechs. Large-cap accumulation unfolds over weeks with steady OBV rises. Small-cap accumulation appears as violent OBV spikes followed by consolidation.

Systematic Testing Approach

Rather than assuming OBV works identically across markets, test specific hypotheses. If trading Gold futures, analyze how OBV behaves around FOMC meetings versus non-event days. Document whether rising OBV during Asian hours leads to London breakouts or fakeouts.

Track win rates for different OBV patterns in your market. Does bullish OBV divergence in S&P 500 futures work better during uptrends or downtrends? How many days of divergence typically precede reversals? This systematic approach replaces generic rules with market-specific edge.

Risk management must also adapt to market-specific OBV behavior. Crypto's 24/7 nature means OBV signals can reverse overnight without warning. Use wider stops or smaller positions compared to stocks where overnight gaps are limited. The risk management plan template should incorporate these market-specific adjustments.

Advanced OBV Modifications

Standard OBV calculation treats all volume equally — a problematic assumption in modern markets. Advanced modifications weight volume based on additional factors that improve signal quality.

Price-weighted OBV multiplies volume by the percentage price change, giving more weight to high-conviction moves. If Apple rises 0.1% on 50 million shares, this contributes less to OBV than a 2% move on 30 million shares. The modification better captures genuine accumulation versus noise.

Time-decay OBV applies exponential weighting to recent volume, similar to exponential moving averages. Volume from 20 days ago contributes less than yesterday's volume. This modification improves responsiveness in fast-moving markets while maintaining trend perspective.

Range-adjusted OBV divides volume by the high-low range, normalizing for volatility. Wide-range days with high volume indicate stronger conviction than narrow-range churning. This particularly helps in forex where pip ranges vary dramatically between pairs.

None of these modifications represent universal improvements. Price-weighted OBV works well for trending stocks but fails in ranging markets. Time-decay OBV captures crypto momentum but generates whipsaws in stable forex pairs. Test modifications systematically rather than assuming complexity equals improvement.

The path forward for OBV traders involves specialization rather than generalization. Master how volume flows in your specific market, adapt calculations to match market microstructure, and build systematic rules based on observed behavior rather than textbook theory. For traders ready to implement these market-specific OBV strategies with automated signal detection, platforms like FibAlgo provide customizable volume analysis tools that adapt to different market conditions.