The Underrated Power of CCI Indicator Trading

While most traders obsess over moving averages and RSI, the Commodity Channel Index (CCI) remains one of the most underutilized momentum oscillators in technical analysis. Created by Donald Lambert in 1980, this indicator measures how far price has deviated from its statistical average, giving you a unique perspective on market momentum that other indicators often miss.

Unlike traditional overbought/oversold indicators, CCI operates without fixed boundaries. This characteristic makes it particularly effective for identifying strong trending moves and capturing momentum shifts before they become obvious to the masses.

Today, you'll discover a comprehensive multi-timeframe CCI system that transforms this simple oscillator into a powerful trading engine. We'll cover everything from basic setup to advanced divergence patterns, complete with real-world examples and risk management strategies.

Understanding CCI Beyond the Basics

The CCI indicator trading system relies on measuring price deviation from its moving average, but most traders only scratch the surface of its capabilities. The standard interpretation suggests buying when CCI drops below -100 and selling when it rises above +100.

This basic approach, however, misses the indicator's true strength: identifying momentum acceleration and deceleration across multiple timeframes. When you understand that CCI values above +200 or below -200 indicate extreme momentum, you unlock trading opportunities that other indicators cannot provide.

CCI readings above +300 or below -300 often precede significant trend exhaustion, making them excellent signals for counter-trend positioning.

The mathematical foundation of CCI involves three components: typical price, simple moving average of typical price, and mean deviation. The formula divides the difference between current typical price and its moving average by 0.015 times the mean deviation, creating a normalized oscillator that adapts to market volatility.

The Multi-Timeframe CCI System Framework

Traditional CCI indicator trading focuses on single timeframes, leaving money on the table. Our multi-timeframe approach synchronizes three different timeframes to create high-probability trading setups with superior risk-reward ratios.

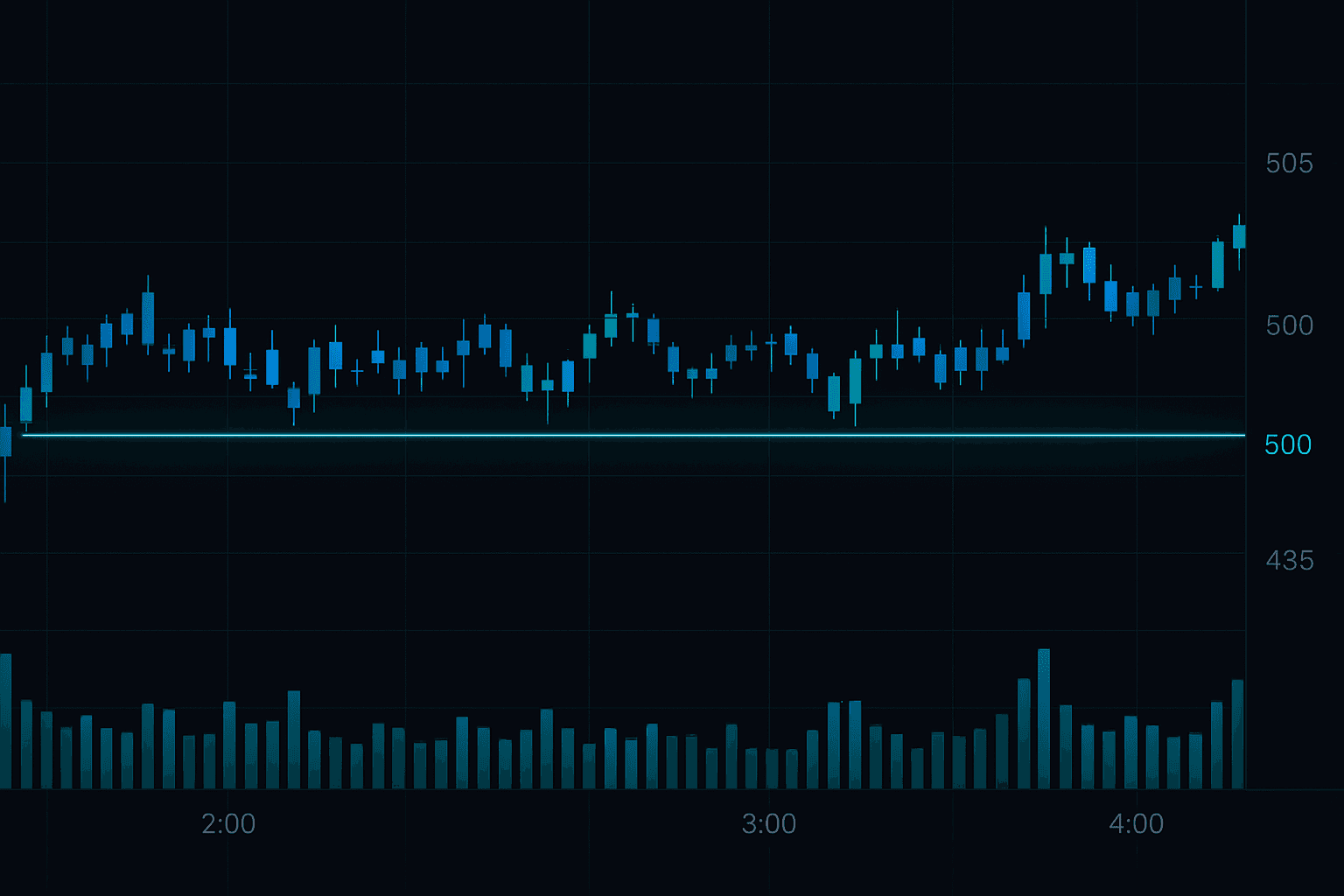

The system uses a 3:1:1 timeframe ratio. If you're trading on the 1-hour chart, you'll monitor the 4-hour chart for trend direction and the 15-minute chart for precise entry timing. This creates a hierarchical structure where each timeframe serves a specific purpose.

The primary timeframe (4H in our example) determines overall market bias. When CCI on this timeframe shows readings above +100 or below -100, it indicates the dominant trend direction. Your trades should align with this bias to maximize success probability.

The secondary timeframe (1H) provides trading signals through CCI divergences, overbought/oversold conditions, and momentum shifts. This is where you'll identify specific entry and exit opportunities within the broader trend context.

The tertiary timeframe (15M) fine-tunes your entries and exits. CCI readings on this timeframe help you enter positions at optimal prices and avoid the common mistake of entering trades at the worst possible moments.

Step-by-Step Multi-Timeframe CCI Setup

Setting up your multi-timeframe CCI system requires careful attention to detail. Here's exactly how to configure your charts for maximum effectiveness:

Step 1: Configure Your Primary Timeframe

Open your 4-hour chart and add a CCI indicator with a 14-period setting. This longer timeframe CCI will show you the overall market sentiment and trend direction. Look for sustained readings above +100 for bullish bias and below -100 for bearish bias.

Step 2: Set Up Secondary Timeframe Analysis

Switch to your 1-hour chart and add CCI with the same 14-period setting. This timeframe generates your actual trading signals through divergences, momentum shifts, and overbought/oversold conditions. Pay special attention when CCI crosses the zero line on this timeframe.

Step 3: Add Tertiary Timeframe for Precision

Configure your 15-minute chart with CCI (14 periods). This shortest timeframe helps you time your entries precisely and avoid getting caught in temporary price spikes or dips that could trigger your stop-loss unnecessarily.

Use different CCI color schemes for each timeframe - blue for 4H, green for 1H, and red for 15M to avoid confusion during fast-moving markets.

Step 4: Establish Alert Levels

Set alerts for CCI crossing above +200 and below -200 on all timeframes. These extreme readings often precede significant price movements and provide early warning signals for position adjustments.

CCI Divergence Trading Strategies

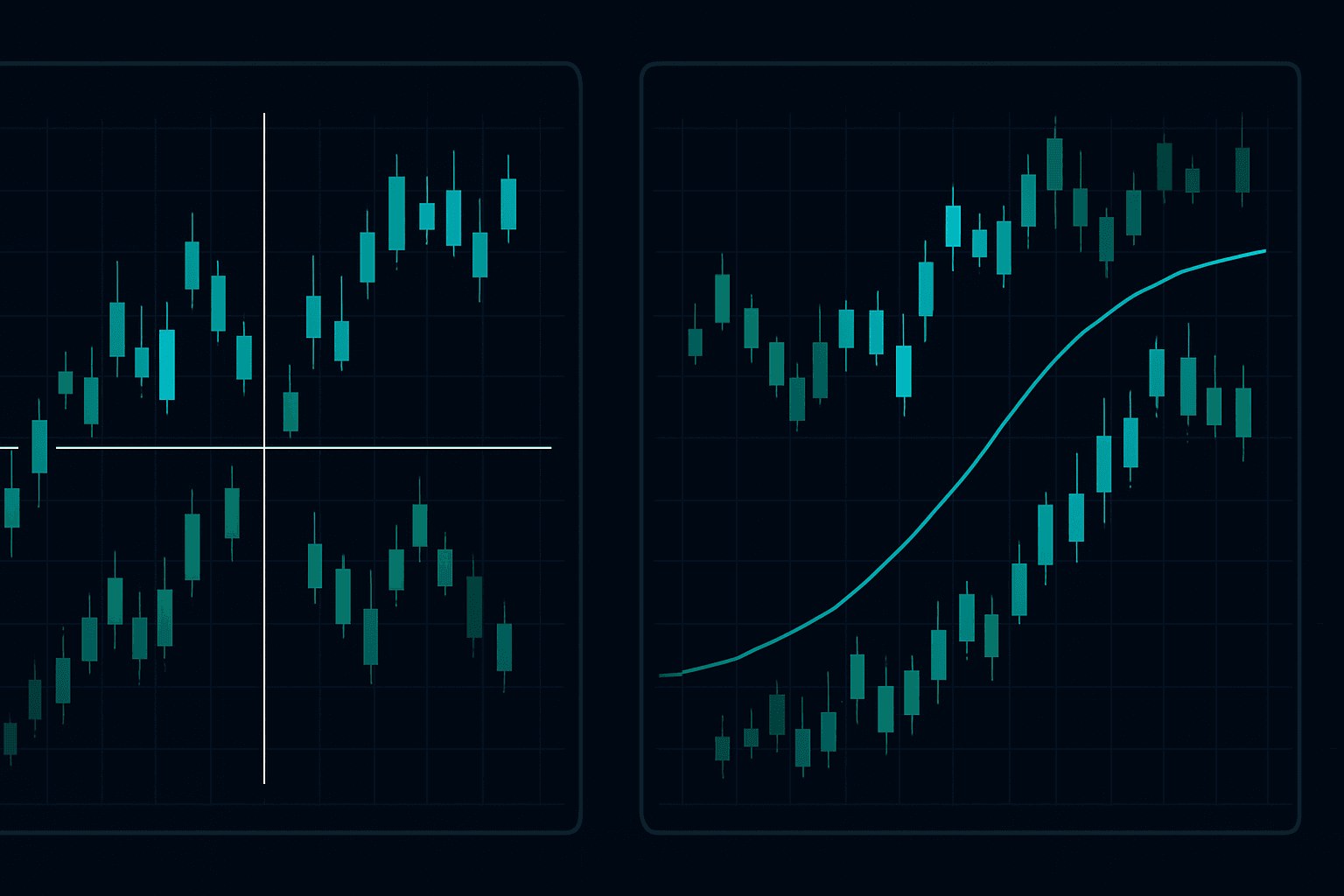

Divergences between CCI and price action create some of the most reliable trading opportunities available. When price makes new highs but CCI fails to confirm with higher readings, bearish divergence signals potential trend exhaustion.

Regular bullish divergence occurs when price creates lower lows while CCI forms higher lows. This pattern suggests underlying strength despite surface weakness and often precedes significant upward moves. Look for this setup particularly when the primary timeframe shows oversold conditions.

Hidden divergences offer even more powerful signals for trend continuation trades. Hidden bullish divergence appears when price makes higher lows while CCI creates lower lows, indicating strong underlying momentum in an uptrend.

On January 15, 2026, EUR/USD showed bearish divergence on the 1H chart while CCI dropped from +180 to +120 as price moved from 1.0450 to 1.0470. The subsequent 150-pip decline validated the signal over the next three days.

The key to successful divergence trading lies in confirmation across multiple timeframes. When your 1-hour chart shows divergence and your 4-hour CCI supports the directional bias, your probability of success increases dramatically.

For those interested in comprehensive pattern recognition, our guide on Triangle Pattern Trading: The Complete Psychology-Based Guide provides excellent complementary analysis techniques for confirming CCI divergence signals.

Risk Management in CCI Indicator Trading

Effective risk management transforms CCI from a discretionary tool into a systematic trading approach. The oscillating nature of CCI provides natural stop-loss placement opportunities that many traders overlook.

Position sizing should reflect CCI extremes on your primary timeframe. When 4-hour CCI shows extreme readings above +250 or below -250, reduce your position size by 50% as these levels often precede increased volatility and potential trend reversals.

Never enter trades when all three timeframes show conflicting CCI signals - wait for alignment to improve your success probability.

Stop-loss placement using CCI follows a simple rule: place stops beyond the most recent CCI extreme on your secondary timeframe. If CCI reached -180 before your buy signal, place your stop-loss at the price level corresponding to that CCI reading minus a small buffer.

The dynamic nature of risk management becomes crucial during trending markets. Trail your stops using CCI zero-line crosses on your tertiary timeframe to maximize profits while protecting capital. When 15-minute CCI crosses back below zero during an uptrend, consider tightening your stop-loss or taking partial profits.

Implementing proper risk management requires understanding correlation with other indicators, which is thoroughly covered in our Dynamic Risk Management Plan Template for 2026 Markets that provides complementary position sizing strategies.

Advanced CCI Pattern Recognition

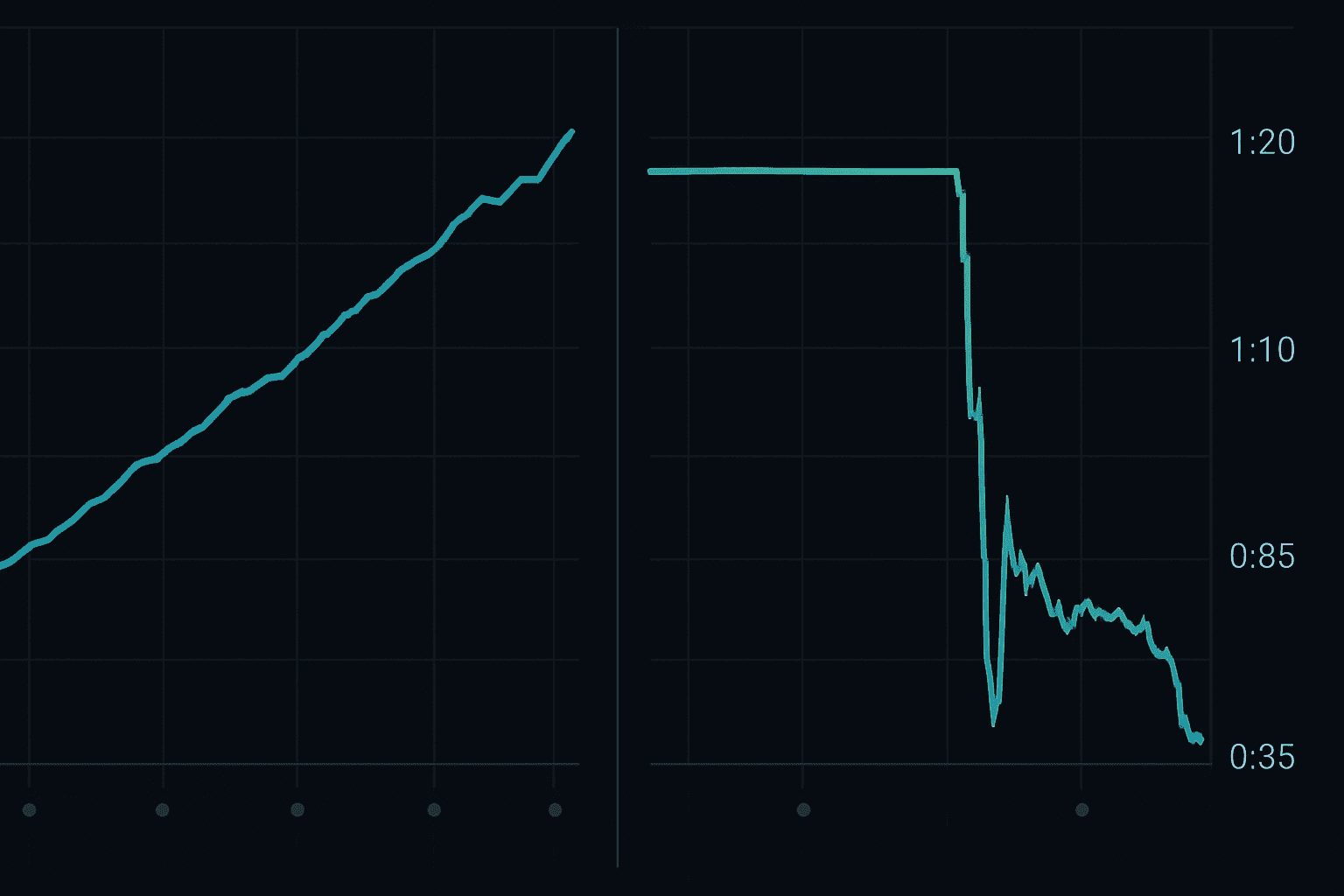

Beyond basic divergences, CCI creates recurring patterns that offer consistent trading opportunities. The CCI hook pattern occurs when the indicator makes a sharp reversal from extreme levels, often signaling imminent price direction changes.

Double-top and double-bottom formations in CCI frequently precede similar price patterns. When CCI creates twin peaks above +200 or twin valleys below -200, expect corresponding price movements within 24-48 hours on intraday timeframes.

The CCI trend-line break strategy provides exceptional risk-reward opportunities. Draw trend lines on CCI just as you would on price charts. When CCI breaks these trend lines while price continues in the original direction, prepare for significant moves in the direction of the CCI break.

Channeling techniques work exceptionally well with CCI. When the indicator consistently bounces between specific levels (such as +150 and -150), trade the channel boundaries with tight stops and clear profit targets. This approach works particularly well in ranging markets.

The CCI momentum acceleration pattern deserves special attention. When CCI rises from +100 to +200 in fewer than five periods, it indicates accelerating momentum that often continues for several more periods before exhaustion sets in.

Real-World Trading Examples

Let's examine specific CCI indicator trading scenarios to illustrate these concepts in practice. Consider a $2,000 trading account focused on major forex pairs using our multi-timeframe system.

On February 3, 2026, GBP/USD presented a perfect setup. The 4-hour CCI showed bullish bias at +120, while 1-hour CCI displayed bullish divergence from -160. The 15-minute timeframe confirmed the entry when CCI crossed above zero at 1.2580. Using 1% risk, this setup justified a 40-pip stop-loss and 120-pip target, achieving a 3:1 risk-reward ratio.

A Bitcoin trader using our CCI system on January 28, 2026, caught BTC's move from $42,000 to $45,500. The 4H CCI broke above +200 while 1H showed hidden bullish divergence, generating $1,750 profit on a $500 position.

The beauty of systematic CCI trading lies in its reproducibility. When you follow the same process for setup identification, entry timing, and risk management, your results become increasingly consistent over time.

Seasonal patterns enhance CCI effectiveness significantly. During historically volatile periods like March options expiration or December year-end rebalancing, CCI extreme readings carry additional weight and often produce more reliable signals.

Combining CCI with Smart Money Analysis

Modern CCI indicator trading benefits tremendously from incorporating smart money concepts. When institutional order flow aligns with CCI signals, the probability of successful trades increases substantially.

Look for CCI divergences that coincide with liquidity grabs or failed breakouts. These combinations often represent smart money positioning against retail sentiment, creating high-probability reversal opportunities.

The integration of volume analysis with CCI provides additional confirmation for trade entries. Rising volume during CCI extreme readings suggests institutional participation and increases the reliability of subsequent signals.

Understanding these advanced concepts becomes easier when you explore our comprehensive guide on Smart Money Concepts, which provides detailed explanations of institutional trading behavior patterns.

Common CCI Trading Mistakes

The biggest mistake traders make with CCI is treating it like RSI with fixed overbought and oversold levels. CCI's strength lies in its adaptability to different market conditions, not rigid interpretation rules.

Another critical error involves ignoring the broader timeframe context. Trading CCI signals on lower timeframes while higher timeframes show conflicting momentum often results in whipsaws and unnecessary losses.

Overtrading during low-volatility periods represents another common pitfall. CCI works best during periods of moderate to high volatility when price movements create meaningful deviations from average levels.

CCI's effectiveness diminishes significantly during major news events when price movements become erratic and technical analysis takes a backseat to fundamental factors.

Position sizing mistakes plague many CCI traders. Using the same position size regardless of CCI extremes ignores the indicator's valuable information about potential volatility and trend strength.

Optimizing CCI for Different Market Conditions

Market conditions dramatically affect CCI indicator trading effectiveness. During strong trending markets, focus on CCI zero-line crosses and hidden divergences rather than traditional overbought/oversold signals.

Range-bound markets favor different CCI strategies. In sideways price action, traditional +100/-100 levels become more reliable for fade trades and mean reversion strategies. The key lies in recognizing which market condition you're facing.

Volatile markets require CCI parameter adjustments. Consider using longer periods (21 or 30) instead of the standard 14 during high-volatility environments to reduce false signals and noise.

Low-volatility periods benefit from shorter CCI periods (7 or 10) to maintain sensitivity to price movements. However, be prepared for increased signal frequency and potential whipsaws during these conditions.

🎯 Key Takeaways

- Use multi-timeframe CCI analysis with 3:1:1 ratio for superior trade timing and directional bias confirmation

- Focus on CCI divergences and extreme readings above +200 or below -200 for high-probability setups

- Implement dynamic risk management using CCI levels for stop-loss placement and position sizing adjustments

- Combine CCI signals with smart money concepts and volume analysis for institutional-grade trade selection

- Adapt your CCI strategy to current market conditions - trending, ranging, or volatile environments require different approaches

Taking Your CCI Trading to the Next Level

Mastering CCI indicator trading requires consistent practice and continuous refinement of your approach. The multi-timeframe system presented here provides a solid foundation, but your individual trading style and risk tolerance will ultimately shape your implementation.

The most successful CCI traders combine technical precision with disciplined risk management and psychological control. They understand that no indicator works in isolation and that CCI's true power emerges when integrated with broader market analysis.

Technology plays an increasingly important role in modern CCI trading. Advanced platforms now offer automated CCI scanning, alert systems, and backtesting capabilities that can significantly enhance your trading effectiveness.

For traders serious about leveraging cutting-edge technology in their CCI analysis, FibAlgo's advanced AI trading tools provide sophisticated pattern recognition and signal confirmation that complement traditional CCI analysis perfectly. Our platform integrates seamlessly with your existing workflow while adding institutional-level analytical capabilities to your trading arsenal.