March 16, 2020: The Gap That Changed Everything

S&P futures were locked limit down. Again. My Bloomberg terminal showed -5% before the cash open, VIX kissing 83, and every correlation model we'd built over the previous decade was failing spectacularly. That morning, I watched junior traders frantically trying to fade the gap—the same strategy that had printed money for years.

By 10:30 AM, half of them were stopped out. The other half would blow up by noon.

Here's what fourteen years of trading gaps taught me that morning: everything you think you know about gap trading becomes worthless during capitulation. The comfortable 87% gap fill statistic? Dead. The morning fade setup? A widowmaker. The measured move targets? Fantasy.

But here's the beautiful part—once you understand how fear rewrites gap mechanics, these chaotic openings become some of the highest probability trades you'll ever take. Let me show you exactly how we traded them at the desk.

Why Fear Markets Break Every Gap Trading Rule

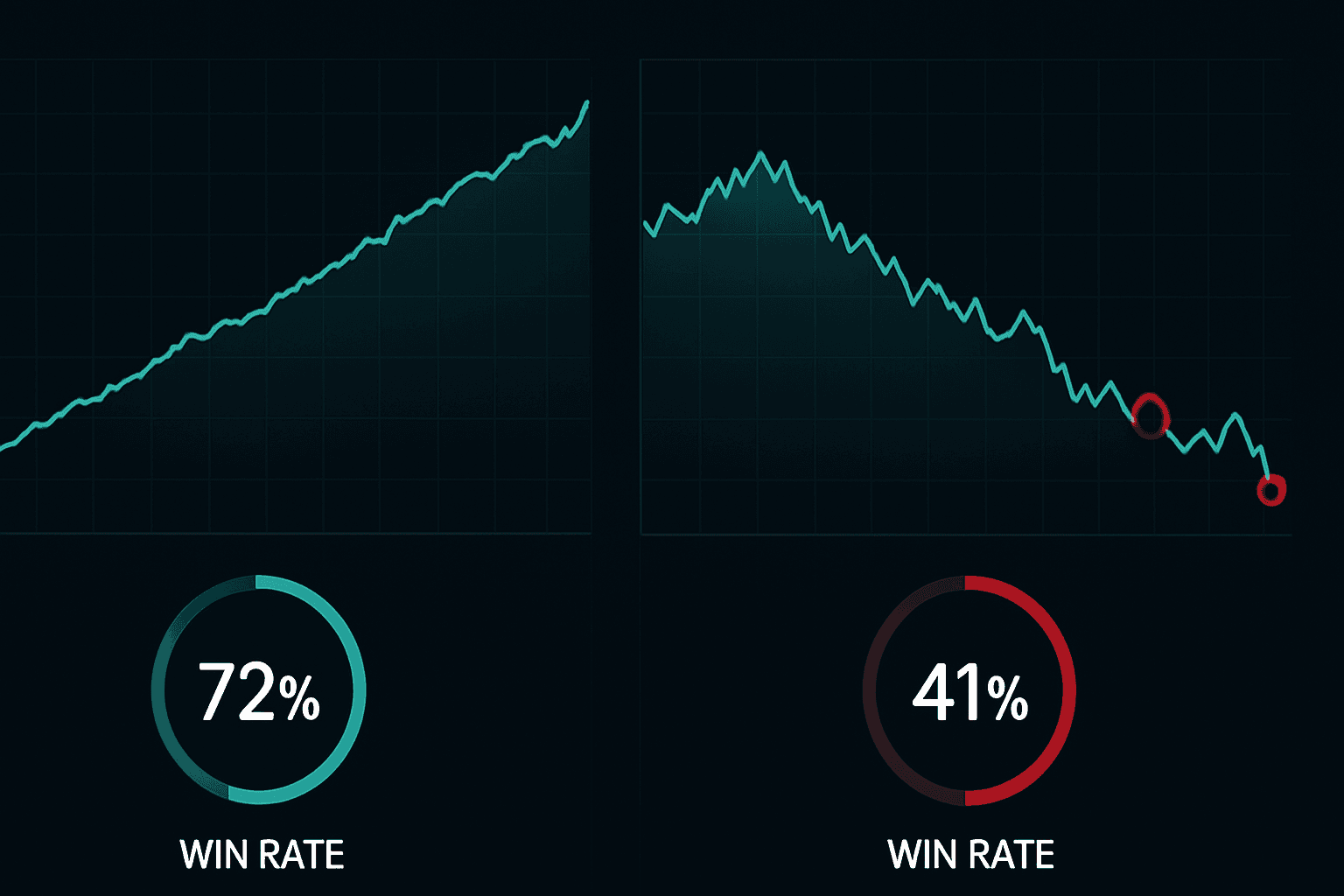

During my time on the FX desk at JPMorgan, we tracked gap behavior obsessively. In normal conditions, the statistics were boringly predictable. EUR/USD gaps over 20 pips? 84% filled by London close. S&P gaps over 0.5%? That magic 87% number held true quarter after quarter.

Then came the fear markets. March 2020. August 2015. February 2018. October 2008. Each time, we watched the same pattern: gap statistics inverted completely.

Our data from March 2020 showed only 34% of gaps filled within five trading days. Even more striking—gaps that did fill took an average of 73 hours versus the usual 4.5 hours. The entire microstructure changed.

Why? Three critical factors transform during capitulation:

- Liquidity evaporates: Market makers pull quotes, spreads widen to absurd levels

- Forced selling overwhelms dip buyers: Margin calls create waves of mechanical selling

- Correlations go to 1: Everything moves together, removing natural gap-fill pressure

This isn't theory. I watched it happen in real-time, position after position. The head of our desk lost $2.3 million in one morning trying to fade a gap using the same VWAP-anchored strategy that had worked for five straight years.

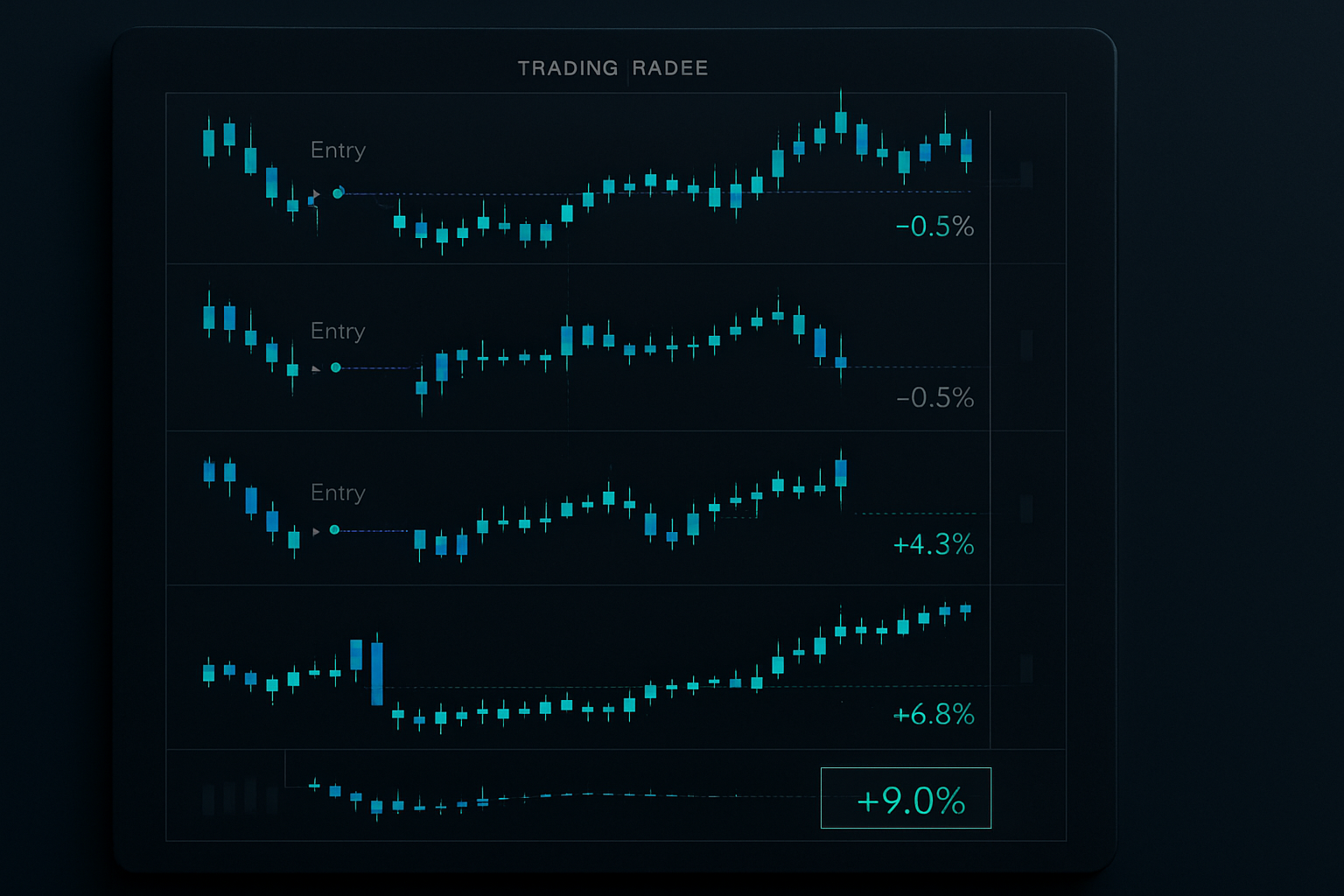

The Three-Gap Sequence Pattern

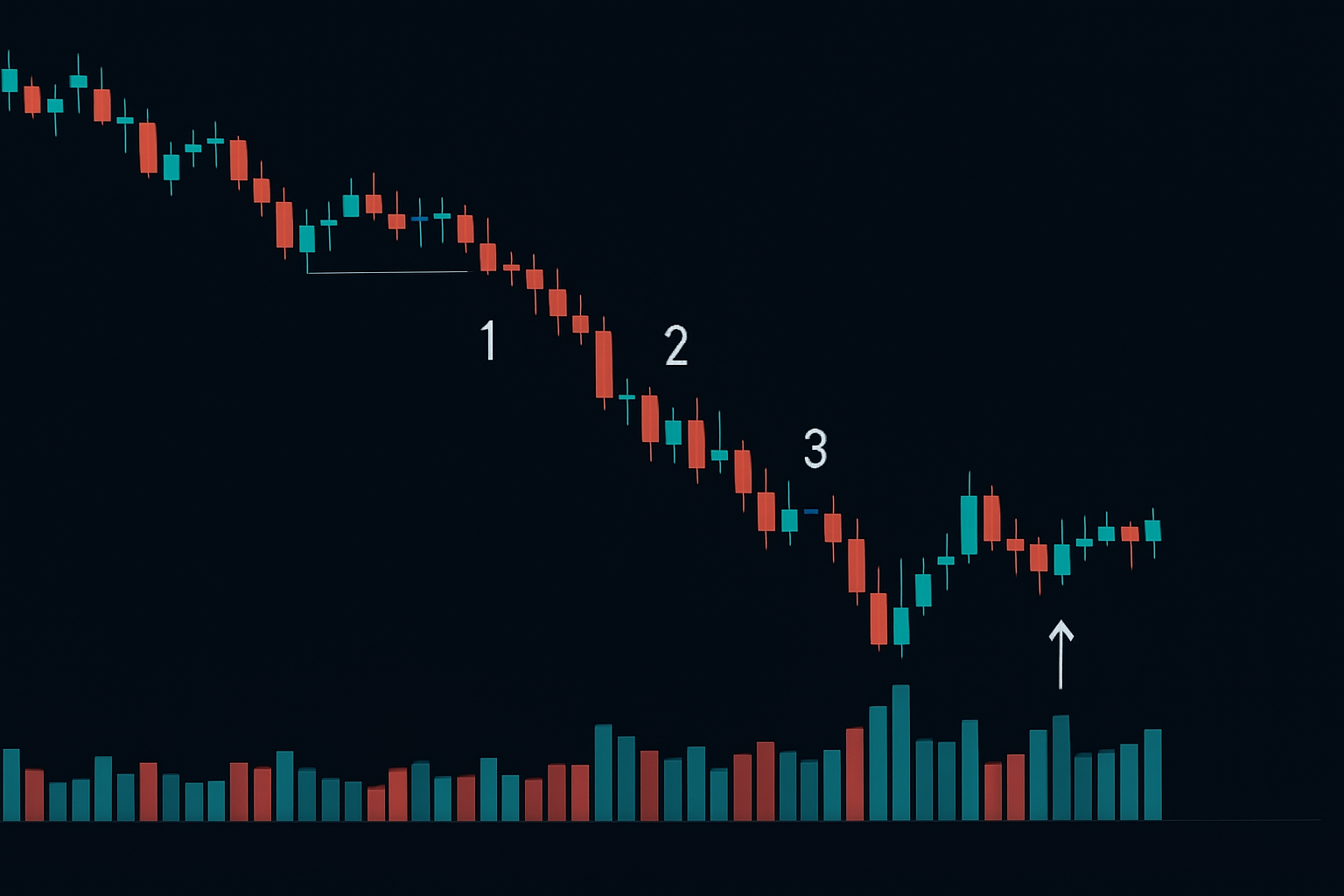

Here's what saved my book during those fear periods: capitulation follows a predictable three-gap sequence. Once you recognize it, you'll never trade fear gaps the same way.

Gap 1: The Shock Gap

This catches everyone off guard. News breaks—pandemic, banking crisis, geopolitical shock—and markets gap 2-3% lower. Characteristics:

- Happens on elevated but not extreme volume

- RSI drops from 50+ to 30-40 range

- Attempted fills fail around 50% retracement

- Sets the fear narrative in motion

Gap 2: The Acceleration Gap

The killer. This is where overleveraged longs capitulate and the real damage occurs. I've seen this gap destroy more accounts than any other setup:

- Volume spikes to 3-5x average

- RSI plunges below 20

- No fill attempts—pure one-way action

- Often accompanies circuit breakers or trading halts

Gap 3: The Exhaustion Gap

Your opportunity. This gap looks terrifying but marks the capitulation climax:

- Happens after 3-5 consecutive down days

- Volume reaches euphoric levels (5-10x average)

- RSI shows clear positive divergence

- Pre-market shows first signs of two-way action

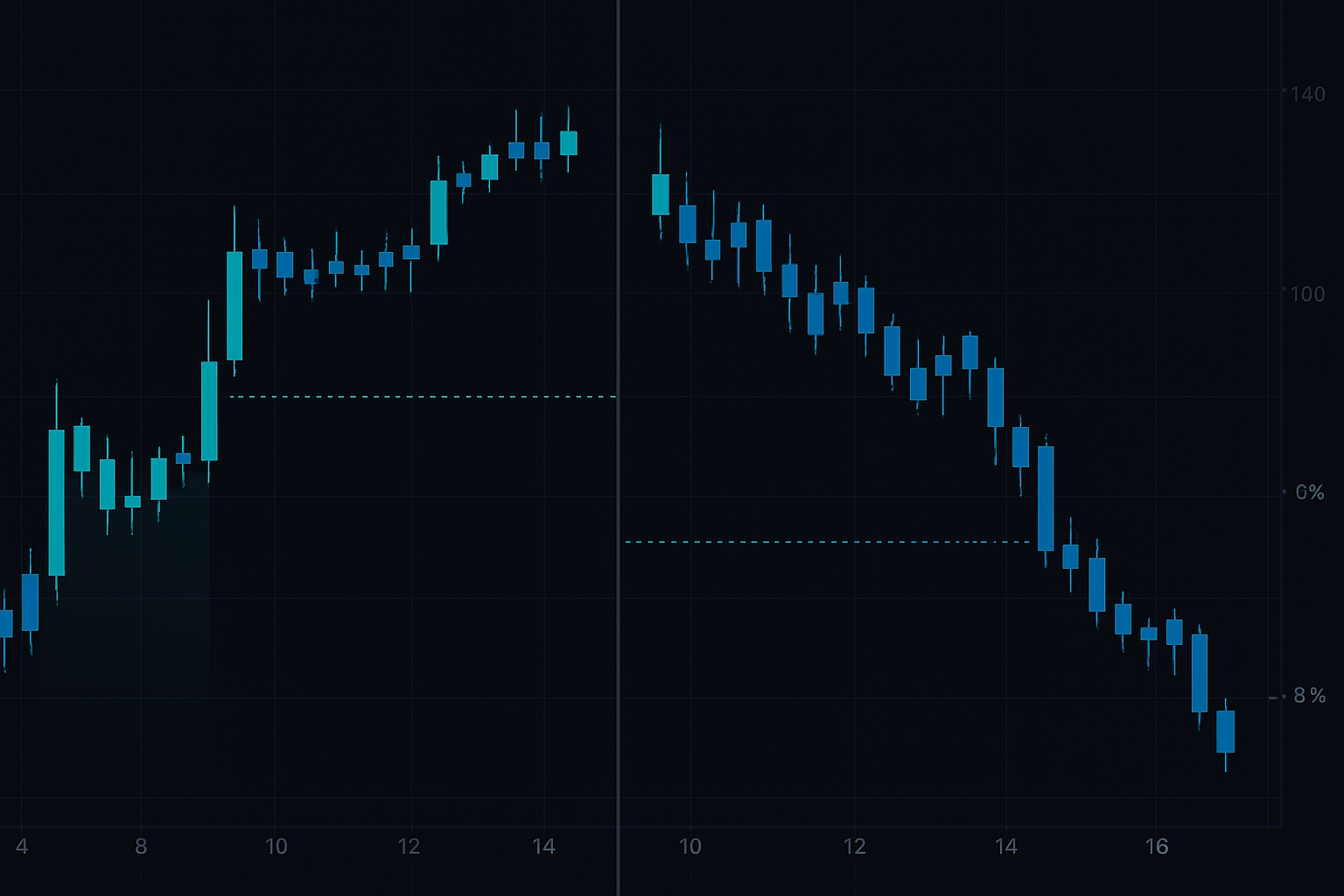

March 2020 followed this pattern perfectly. Gap 1 hit on March 9th. Gap 2 murdered longs on March 12th. Gap 3—the exhaustion gap on March 16th—marked the exact low before a face-ripping 20% rally over the next three weeks.

The Capitulation Gap Entry Framework

Forget everything you know about fading opening gaps. In fear markets, you need completely different entry criteria. Here's the exact framework we developed after analyzing hundreds of fear market gaps:

Pre-Market Reconnaissance

Start 90 minutes before the open. You're looking for:

- Pre-market volume exceeding 50% of previous day's total volume

- Breadth extremes: Less than 5% of stocks above their 20-day moving average

- VIX term structure inversion (spot VIX > 3-month VIX)

- Currency correlations breaking down (safe havens diverging)

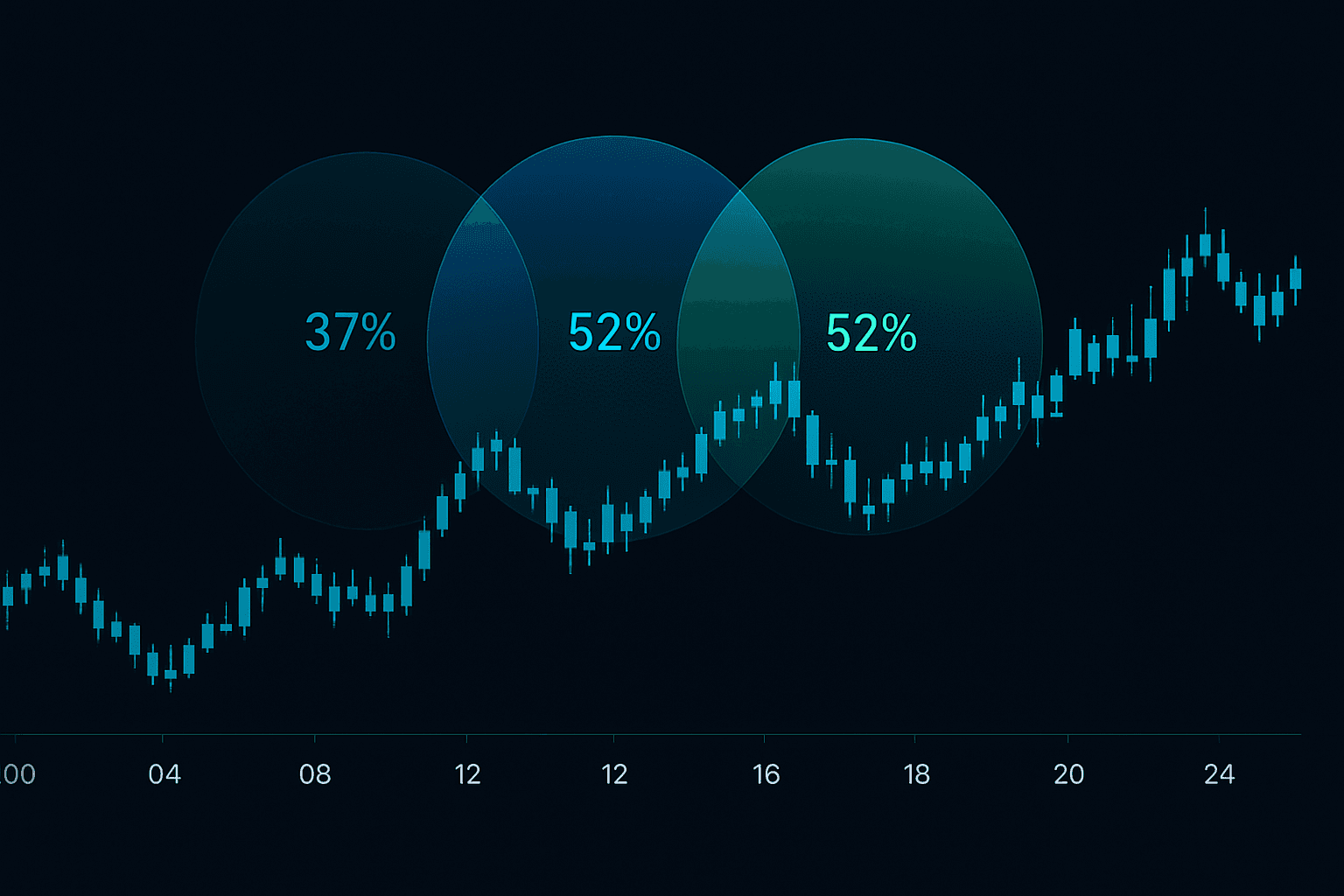

The 15-Minute Confirmation

Never enter on the open. Ever. Wait 15 minutes and assess:

- Has the gap extended beyond 1.5x its initial size?

- Is volume running at 400%+ of average?

- Are market internals showing any divergence? (TICK, ADD, VIX)

- Has smart money started accumulating? Check dark pool prints

If you get three of four confirmations, prepare for entry. If not, stay flat. This discipline saved me countless losses.

The Three-Push Entry Rule

Even with confirmations, don't catch the falling knife. Wait for three pushes lower:

1. Initial gap extension (usually first 30 minutes)

2. European open push (3:00-4:00 AM EST)

3. Exhaustion push with volume climax

Entry comes on the first 15-minute close above the third push low. Stop loss goes 0.5 ATR below that low. Yes, it's wide. That's the cost of trading fear.

Position Sizing for Nuclear Gaps

This is where retail traders destroy themselves. They see a 5% gap down, think "oversold bounce," and go all-in. Then the gap extends to 8% and they're finished.

During capitulation, I cut my standard position size by 75%. If I normally traded 100 lots of EUR/USD, fear gaps got 25 lots. Maximum. This isn't cowardice—it's survival.

Here's our exact position sizing formula for fear gaps:

- Base risk: 0.25% of capital (versus normal 1%)

- Wider stops: 2-3x normal ATR

- Scaling entries: 3 tranches of 0.25% each

- Maximum position: 0.75% risk even if all signals align

Example on a $100,000 account:

- Normal trade risk: $1,000

- Fear gap risk per entry: $250

- Total maximum risk if scaled 3x: $750

- Stop distance: 150-200 pips (FX) or 2-3% (equities)

This defensive sizing let us survive the -10% days and capture the +15% reversals.

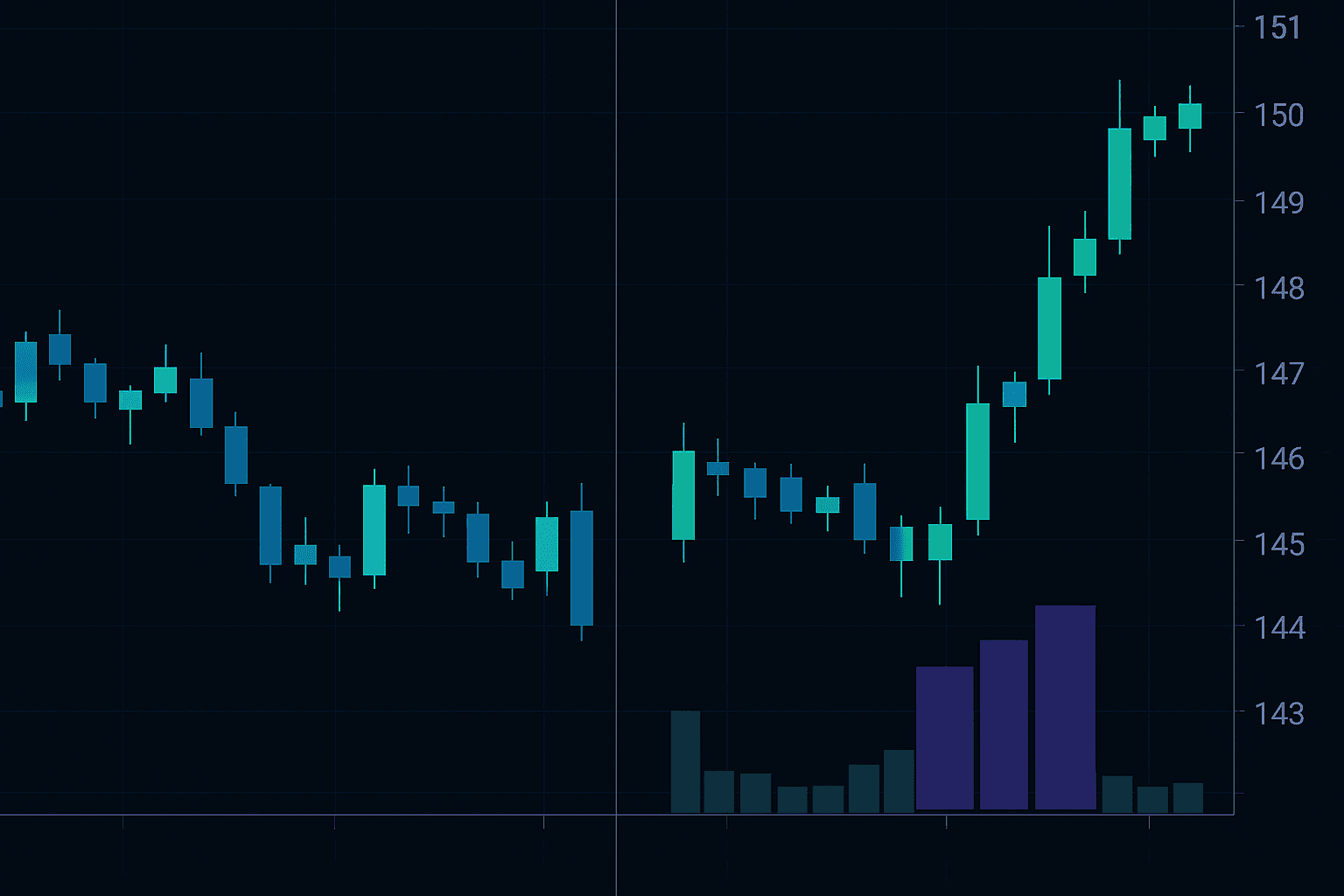

Reading the Rebound Mechanics

The beauty of exhaustion gaps? They create the most violent reversals you'll ever trade. But timing the turn requires reading subtle shifts in market mechanics.

Volume Divergence Signals

Watch for this pattern:

- Gap down on massive volume

- First hour: continued selling but volume decreasing

- Second hour: price makes new low on notably lower volume

- Third hour: failed breakdown with volume picking up on bounces

This volume divergence preceded every major fear market bottom I've traded.

Breadth Thrust Confirmation

The rebound isn't real until breadth confirms. Monitor:

- NYSE up volume vs down volume flips positive

- Advancing issues outnumber declining 2:1

- New lows stop expanding despite lower prices

- Sector rotation from defensives to risk-on

March 24, 2020 gave us all these signals. We loaded up on gap longs and rode SPY from 220 to 260 in eight sessions.

The Recovery Phase Playbook

Once fear exhaustion hits, gap behavior inverts again. Now you're trading recovery gaps—equally profitable but requiring different tactics.

Recovery Gap Characteristics

- Morning gaps UP after fear climax

- Light pre-market volume (institutions accumulating quietly)

- Gaps hold above VWAP all day

- Pullbacks find support at gap origin

These gaps rarely fill for days or weeks. The same traders who lost fortunes fading fear gaps down now lose fading recovery gaps up. The psychology flips completely.

Trading Recovery Gaps

1. Buy programs trigger at exact gap levels

2. Use prior day's high as your support line

3. Trail stops below ascending value area

4. Hold until gap fill attempts show volume > 2x average

We caught five consecutive gap-and-go days in late March 2020 using this approach. Each gap looked "too extended" but ground higher into the close.

Risk Management When Gaps Go Nuclear

Let me be crystal clear: gap trading in fear markets can end your career if mismanaged. I've seen it happen. Smart traders with decades of experience, wiped out trying to apply normal gap strategies to abnormal markets.

Non-negotiable rules that kept me solvent:

- Hard stop at 2% portfolio loss per day—no exceptions

- Correlation limits—maximum 3 gap positions across correlated assets

- Time stops—if a gap trade doesn't work within 2 hours, exit

- Scale economics—add only on new lows with volume exhaustion

During March 2020's wildest week, I hit my 2% stop three days straight. Frustrating? Absolutely. But it kept me alive for the recovery gaps that followed.

Technology Stack for Fear Gap Trading

You cannot trade modern gap strategies without proper tools. Here's my essential setup:

- Pre-market screeners: Track gaps forming in futures and global markets

- Volume analytics: Real-time dark pool and block trade monitors

- Correlation matrices: Watch when normal relationships break

- News aggregation: Understand what's driving the gap

For retail traders, FibAlgo's multi-timeframe analysis helps identify when gaps align with larger Fibonacci support levels—often the exact spots where exhaustion reversals begin.

Common Gap Trading Delusions in Fear Markets

These beliefs will bankrupt you during capitulation:

- "Gaps always fill" — Not in fear markets. Only 34% fill within a week.

- "Fade every gap over 2%" — This is how you blow up during gap 2 acceleration.

- "Double down on gap positions" — Adding to losers in fear markets = account suicide.

- "Use normal position sizes" — 75% size reduction is mandatory, not optional.

- "Trust the 87% statistics" — Those numbers are worthless during capitulation.

I learned each of these lessons expensively. One -7% gap in USD/JPY during the 2011 intervention cost me $400,000 before I adapted.

From Theory to Profitable Fear Gap Trading

The traders who survived and thrived during March 2020, August 2015, and February 2018 understood one thing: fear gaps operate by completely different rules. They require different entry criteria, different position sizing, and different hold times.

But once you master fear gap mechanics, these trades offer the best risk/reward setups in all of trading. A properly timed exhaustion gap can return 10-20% in days. Recovery gaps compound those gains as markets normalize.

The key is recognizing which gap you're trading. Use the three-gap sequence framework. Wait for exhaustion signals. Size positions for nuclear scenarios. And never, ever try to catch gap 2—let someone else be the hero.

The next fear market is coming. It always does. When futures lock limit down and your Twitter feed screams capitulation, you'll know exactly which gaps to fade and which to respect. More importantly, you'll know why that distinction makes all the difference between profit and ruin.

Mind the gap. Especially when everyone else is losing their minds.