The $2 Billion Cross-Chain Bridge Lesson

Cross-chain bridges have become the **backbone of multi-chain DeFi**, enabling traders to move assets between different blockchains seamlessly. Yet the same technology that unlocks incredible opportunities has also become a prime target for exploits.

The numbers tell a sobering story. Bridge protocols have lost billions in total value locked due to security vulnerabilities, smart contract bugs, and sophisticated attacks. But here's what most traders miss: **the biggest risk isn't the bridges themselves—it's using them without a proper framework**.

This cross chain bridge guide introduces a risk-first approach that prioritizes security while maximizing efficiency. Instead of hoping for the best, you'll learn to systematically evaluate, execute, and monitor bridge transactions like an institutional trader.

Decoding Cross-Chain Bridge Architecture

Think of cross-chain bridges as **digital customs checkpoints** between sovereign blockchain nations. Each blockchain operates with its own rules, consensus mechanisms, and token standards. Bridges create temporary agreements that allow value to move between these separate ecosystems.

There are three primary bridge architectures you need to understand:

- Lock-and-Mint Bridges: Lock your original tokens on the source chain and mint equivalent tokens on the destination chain

- Burn-and-Mint Bridges: Destroy tokens on one side while creating them on the other

- Atomic Swaps: Direct peer-to-peer exchanges without intermediary custody

The bridge architecture determines your risk profile—atomic swaps eliminate custody risk but limit liquidity, while lock-and-mint bridges offer better liquidity at higher security costs.

Understanding these mechanics helps you **choose the right bridge for each situation**. A $500 test transaction might warrant different security considerations than moving $50,000 of your portfolio.

The Risk-First Bridge Selection Framework

Most traders select bridges based on convenience or gas fees alone. Professional traders use a **systematic evaluation framework** that considers six critical factors before every bridge transaction.

Security Score Assessment

Start by evaluating each bridge's security fundamentals. Look for bridges that have undergone multiple audits by reputable firms, maintain bug bounty programs, and demonstrate transparent security practices. **Time in operation matters tremendously**—bridges that have operated for over a year without major incidents carry lower risk profiles.

Never use a bridge that launched less than 3 months ago, regardless of the team's reputation or backing.

Liquidity Depth Analysis

Insufficient liquidity creates slippage and failed transactions. Before bridging, verify that your transaction size represents less than 5% of the bridge's total liquidity for that asset pair. For example, if you're bridging $10,000 USDC from Ethereum to Polygon, ensure the bridge holds at least $200,000 in total USDC liquidity.

Large transactions might require **splitting across multiple bridges** to minimize market impact and reduce single-point-of-failure risk.

Cost Structure Optimization

Bridge costs extend beyond simple transaction fees. Calculate the total cost including:

- Source chain gas fees for the initial transaction

- Bridge protocol fees (typically 0.05% to 0.3%)

- Destination chain gas fees for claiming tokens

- Opportunity cost of transaction time

Suppose you want to bridge $5,000 USDC from Ethereum to Arbitrum. Bridge A charges 0.1% fees but requires $80 in Ethereum gas. Bridge B charges 0.3% fees but only $30 in gas. Bridge A total cost: $80 + $5 = $85. Bridge B total cost: $30 + $15 = $45. Bridge B wins despite higher percentage fees.

Step-by-Step Secure Bridge Transaction Process

Executing bridge transactions safely requires **methodical preparation and execution**. This process has protected millions in assets across thousands of transactions.

Pre-Transaction Security Checklist

Before initiating any bridge transaction, complete this essential checklist:

- Verify the bridge's official website URL through multiple sources

- Check recent community reports for any ongoing issues

- Confirm destination address format matches the target blockchain

- Test with a small amount first (1-5% of intended transaction)

Always bookmark official bridge URLs and never access bridges through search engine results or social media links.

Transaction Execution Protocol

Start by connecting your wallet to the source blockchain and navigating to the verified bridge interface. **Double-check every parameter** before submitting: source token, destination token, receiving address, and network selection.

Set appropriate gas limits based on network congestion. During high congestion periods, consider waiting unless the transaction is time-sensitive. Failed transactions still consume gas fees without completing the bridge.

The most expensive bridge transaction is the one that fails halfway through, leaving your funds temporarily locked while requiring additional gas to resolve.

Post-Transaction Monitoring

Track your transaction through completion using the bridge's native explorer. Most bridges provide transaction hashes for both source and destination chains. **Save these references** for future troubleshooting.

Sophisticated traders maintain transaction logs with timestamps, amounts, fees, and bridge providers. This data becomes invaluable for tax reporting and identifying the most cost-effective bridges for regular routes.

Advanced Cost Optimization Strategies

Professional traders treat bridge selection as a **continuous optimization problem**. Gas fees fluctuate throughout the day, bridge liquidity changes, and new protocols launch with competitive rates.

Timing-Based Fee Arbitrage

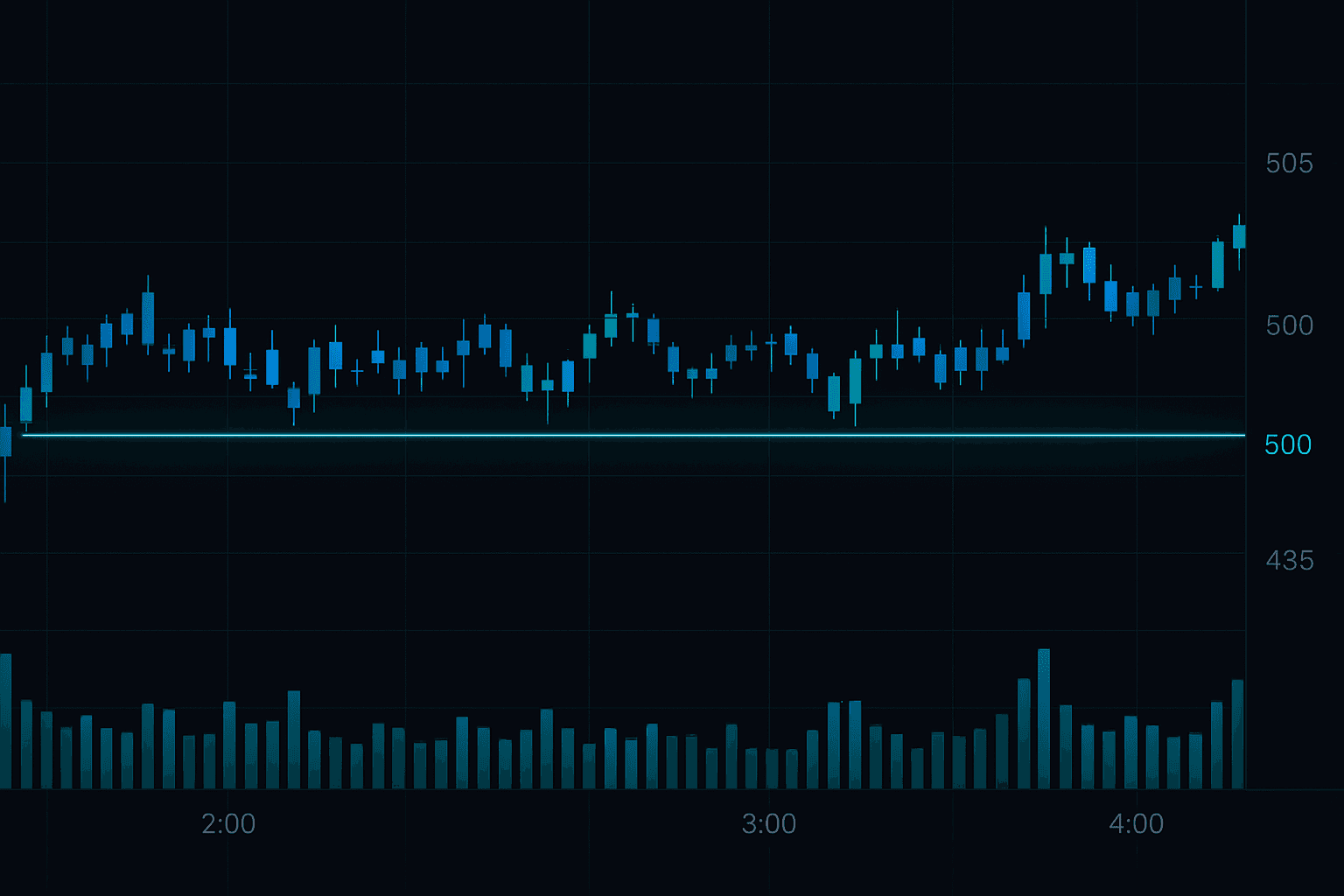

Ethereum gas fees typically reach daily lows between 2-6 AM UTC and peaks during US/Europe overlap hours. Plan non-urgent bridge transactions during these low-fee windows to reduce costs by 50-70%.

Some bridges offer **dynamic fee structures** that adjust based on network congestion. Monitor these patterns to identify optimal transaction windows.

Route Optimization

Direct bridges aren't always the cheapest option. Sometimes routing through intermediate chains reduces total costs. For instance, moving assets from Ethereum to Avalanche might cost less by routing through Polygon as an intermediate step.

Imagine you want to move $20,000 from Ethereum to Fantom. Direct routing costs $120 in total fees. Ethereum → Polygon costs $45, then Polygon → Fantom costs $8. Total routing cost: $53, saving $67 while adding minimal time.

Advanced traders use AI trading indicators to optimize their multi-chain strategies, incorporating bridge costs into their overall portfolio management framework.

Emergency Response Protocols

Even with perfect preparation, bridge transactions sometimes encounter problems. **Having a response plan prevents panic decisions** that often worsen situations.

Common Issues and Solutions

Transaction delays represent the most frequent bridge problem. While concerning, most delays resolve within 24-48 hours as validators process the cross-chain messages. Avoid the temptation to initiate duplicate transactions, which creates additional complications.

If a transaction appears stuck for over 72 hours, contact the bridge's official support channels with your transaction hash. Most reputable bridges maintain dedicated support for stuck transactions and can expedite resolution.

Bridge Failure Recovery

In rare cases where bridges experience technical failures or security incidents, **immediate action is required**. Monitor official communications from bridge teams and be prepared to quickly move remaining assets if recommended.

Maintain emergency contact lists for major bridge protocols and follow their official Twitter accounts for real-time updates during incidents.

Multi-Chain Portfolio Management

Sophisticated traders don't just use bridges reactively—they integrate bridge planning into their **overall portfolio strategy**. This approach, detailed in our crypto bull market strategy, treats cross-chain movements as strategic portfolio rebalancing tools.

Strategic Asset Distribution

Consider maintaining base positions across multiple chains rather than concentrating everything on one blockchain. This distribution strategy reduces bridge dependency during volatile market conditions while providing access to chain-specific opportunities.

Diversifying across chains isn't just about reducing smart contract risk—it's about maintaining operational flexibility when individual networks experience congestion or issues.

Plan asset distributions based on your trading patterns. If you frequently trade specific altcoins only available on certain chains, maintain base liquidity there to minimize bridge transactions during time-sensitive opportunities.

Rebalancing Automation

Some traders establish **systematic rebalancing rules** that trigger bridge transactions when chain-specific allocations drift beyond predetermined ranges. For example, if Ethereum positions exceed 60% of total portfolio value, automatically bridge excess funds to other chains.

This systematic approach removes emotional decision-making from bridge timing while ensuring portfolio balance across ecosystems.

Common Mistakes That Drain Profits

Learning from others' expensive mistakes can save you significant capital. These errors account for millions in lost funds annually among retail traders.

The Rush Transaction Trap

FOMO-driven bridge transactions during market volatility often result in **excessive fees and failed transactions**. When markets move rapidly, traders panic-bridge assets without considering costs or optimal timing.

Instead, maintain predetermined allocation targets and emergency funds on each chain to avoid rushed decisions. As outlined in our dynamic risk management plan template, preparation prevents costly reactive moves.

Let's say BTC suddenly drops 15% and you want to buy the dip, but your stablecoins are on Ethereum while the opportunity is on Arbitrum. Instead of paying $150 in rush fees to bridge $5,000 immediately, having just $1,000 pre-positioned on Arbitrum lets you capture some opportunity while avoiding panic fees.

Ignoring Destination Chain Requirements

Each blockchain has unique requirements for receiving bridged assets. Some require minimum balances for transaction fees, specific wallet configurations, or additional token approvals. **Failing to prepare destination wallets** results in delayed access to bridged funds.

Research destination chain requirements before initiating bridge transactions, especially when exploring new networks or protocols.

Single Bridge Dependency

Relying exclusively on one bridge protocol creates unnecessary risk. Bridge downtime, maintenance, or security issues can temporarily strand your funds or force you to use suboptimal alternatives.

Maintain familiarity with at least 2-3 reliable bridge options for each chain pair you use regularly. This redundancy ensures continued operations during individual bridge issues.

Future-Proofing Your Cross-Chain Strategy

The bridge landscape evolves rapidly with new protocols, improved security models, and enhanced user experiences. **Staying current with developments** ensures you maintain access to the best tools and avoid obsolete protocols.

Emerging Technologies

Zero-knowledge proof bridges represent the next evolution in cross-chain infrastructure. These protocols offer enhanced security guarantees while reducing trust assumptions. While still early-stage, several ZK bridge protocols show promising development.

Intent-based bridges are also gaining traction, allowing users to specify desired outcomes while solvers compete to provide optimal execution paths. This approach can reduce complexity and improve pricing for end users.

Regulatory Considerations

Cross-chain transactions may face increased regulatory scrutiny as governments develop clearer cryptocurrency frameworks. **Maintain detailed transaction records** and consider the compliance implications of complex routing strategies.

Some bridges implement KYC requirements or transaction limits in response to regulatory pressure. Stay informed about policy developments that might affect your preferred bridges.

Building Your Cross-Chain Expertise

Mastering cross-chain bridges requires **ongoing education and practical experience**. Start with small transactions across major bridge protocols to understand their interfaces, timing, and cost structures.

Join bridge-specific community channels where users share experiences, report issues, and discuss optimization strategies. These communities often provide early warnings about problems and updates about new features.

Consider this cross chain bridge guide as your foundation, but continue expanding your knowledge through hands-on experience and community involvement.

The multi-chain future of DeFi demands sophisticated bridge management skills. Traders who develop these competencies early will have significant advantages as the ecosystem continues evolving.

🎯 Key Takeaways

- Use a risk-first framework to evaluate bridges based on security, liquidity, and costs before convenience

- Always test with small amounts before executing large bridge transactions

- Monitor gas fee patterns to optimize transaction timing and reduce costs

- Maintain assets across multiple chains to reduce bridge dependency during volatile periods

- Keep detailed transaction records and follow official bridge communications for security updates

Ready to implement these cross-chain strategies in your trading? Get Started Free with FibAlgo's advanced multi-timeframe indicators that work across all major blockchain networks, helping you make informed decisions whether you're trading on Ethereum, Polygon, or any other chain.