Why 90% of Carry Traders Fail (And How to Join the 10%)

The **forex carry trade strategy** has quietly generated billions in profits for institutional investors, yet retail traders consistently lose money attempting it. The reason? Most approach carry trading like a simple "buy high-yield, sell low-yield" equation, ignoring the sophisticated risk management that separates professionals from amateurs.

In 2024's volatile currency markets, successful carry trading requires a **systematic, risk-first approach** that most educational resources completely ignore. This isn't about chasing yield spreads—it's about building a sustainable income stream while protecting capital through multiple market cycles.

Institutional carry traders typically risk only 0.5-1% per trade and maintain 15-20 concurrent positions to smooth volatility—the opposite of retail traders who bet big on single pairs.

The Evolution of Modern Carry Trading

Traditional carry trading died in 2008. What emerged from the financial crisis is a **more sophisticated strategy** that adapts to today's unpredictable central bank policies and flash crash environments.

Modern carry traders focus on three pillars: **risk-adjusted returns, portfolio diversification, and dynamic hedging**. Unlike the old "set and forget" approach, today's successful strategies require active monitoring and adjustment based on volatility regimes.

Consider this: the average carry trade used to last 6-12 months. Today's institutional traders often hold positions for just 2-8 weeks, capitalizing on shorter-term interest rate differentials while avoiding major trend reversals.

The 3-Pillar Risk Management Framework

Every profitable carry trade strategy must incorporate these three risk management pillars before considering potential returns:

Pillar 1: Volatility-Adjusted Position Sizing

Traditional position sizing fails in carry trading because it ignores currency volatility. A position in **USD/JPY requires different sizing than EUR/TRY** due to vastly different volatility profiles.

Use this formula: Position Size = (Account Risk %) ÷ (Currency Pair Volatility × Stop Loss Distance). For example, if you risk 1% on a $10,000 account with USD/JPY at 12% annual volatility and a 200-pip stop, your position size should be approximately 4,167 units, not the standard lot size most traders use.

Calculate the 90-day realized volatility of your target currency pair and adjust position sizes monthly—this single change can improve risk-adjusted returns by 40-60%.

Pillar 2: Correlation-Based Diversification

**Most carry traders unknowingly concentrate risk** by trading highly correlated pairs. AUD/JPY, NZD/JPY, and CAD/JPY often move in tandem, creating false diversification.

Build a correlation matrix of your intended positions. Keep correlation coefficients below 0.7 between any two positions. This might mean choosing between AUD/JPY and NZD/JPY rather than trading both simultaneously.

Pillar 3: Dynamic Hedging Strategies

Static stop losses don't work in carry trading due to overnight gaps and weekend risk. Successful traders use **dynamic hedging through currency futures or options** to protect against sudden reversals.

In March 2020, COVID-19 crashed carry trades overnight. Traders using static 2% stops lost 8-12% due to gaps, while those with dynamic hedges (purchasing JPY call options) limited losses to 1-3%.

Step-by-Step Carry Trade Setup Process

Here's the **systematic approach professionals use** to identify and execute carry trades:

Step 1: Interest Rate Differential Analysis

Don't just look at current rates—analyze the **trajectory of rate changes**. A 2% differential that's narrowing is less attractive than a 1.5% differential that's widening.

Create a spreadsheet tracking: current rates, 3-month forward expectations, central bank meeting dates, and recent policy statements. Update this weekly.

Step 2: Economic Momentum Screening

Carry trades work best when the high-yield currency has **stronger economic fundamentals** than the funding currency. Screen for:

- GDP growth differential (target +1% minimum)

- Employment trends (unemployment direction)

- Inflation differentials (moderate inflation favors carry currencies)

- Current account balances (surplus countries generally stronger)

Step 3: Technical Confirmation

Never enter a carry trade against a strong technical trend. Wait for either: **trend alignment with the carry direction, or sideways consolidation** that suggests trend exhaustion.

Use weekly charts for trend analysis. If the weekly trend opposes your carry direction, wait for either trend reversal signals or enter smaller positions with tighter risk management.

Avoid carry trades during the first week of any month—economic data releases create excessive volatility that can trigger stops regardless of underlying carry trade fundamentals.

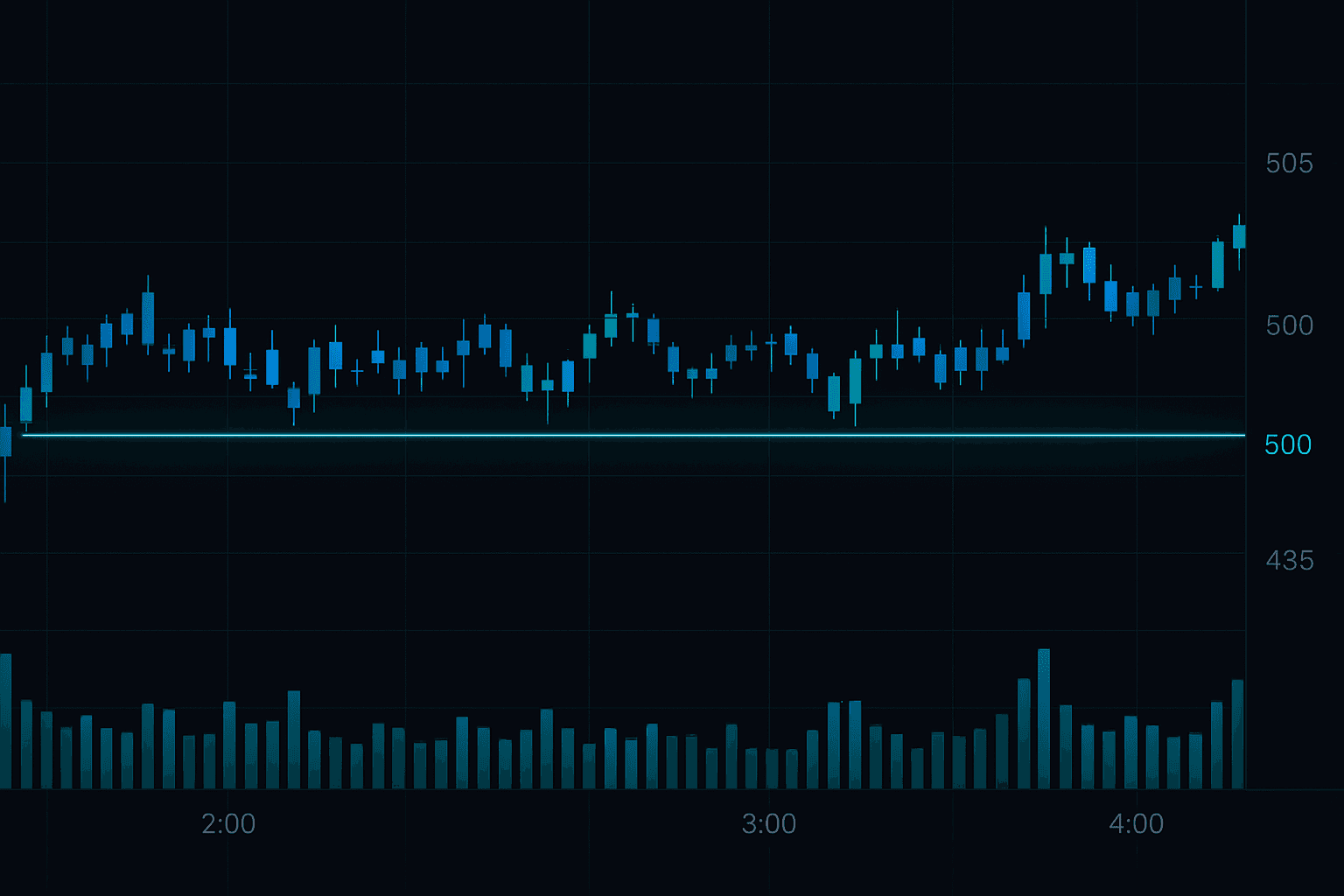

Step 4: Entry Timing and Execution

Enter carry trades during **low volatility periods**, typically Tuesday through Thursday during London/New York overlap. Avoid Mondays (weekend gap risk) and Fridays (position squaring).

Use limit orders placed 10-20 pips away from current price to avoid paying spreads. Your target entry should align with minor technical support/resistance levels.

Advanced Position Sizing and Portfolio Management

Position sizing separates amateur from professional carry traders. The key is **risk-adjusted position sizing based on carry efficiency**, not just interest rate differentials.

The Carry Efficiency Formula

Carry Efficiency = (Interest Rate Differential - Transaction Costs) ÷ Annualized Volatility

This formula helps you compare different carry opportunities on a risk-adjusted basis. For example:

- AUD/JPY: (3.5% - 0.3%) ÷ 16% = 0.20 efficiency ratio

- USD/TRY: (15% - 0.8%) ÷ 45% = 0.32 efficiency ratio

Despite USD/TRY's higher yield, both pairs offer similar risk-adjusted returns, but AUD/JPY provides better sleep-at-night factor.

Portfolio Heat Management

Never risk more than **5% of your account on all carry positions combined**. Professional traders often limit total carry exposure to 3% to allow for other opportunities.

Use position heat monitoring: if any single position reaches 1.5% unrealized loss, reduce size by 50%. If total portfolio heat exceeds 3%, close your worst-performing position immediately.

The most profitable carry traders maintain 8-12 positions simultaneously, each risking 0.3-0.6% of capital—this diversification smooths volatility and improves risk-adjusted returns.

Exit Strategies That Actually Work

**Exit strategy matters more than entry** in carry trading. Here are the four exit triggers professionals use:

1. Interest Rate Environment Changes

Close positions immediately when central banks signal unexpected policy shifts. Don't wait for rate changes—**market expectations move faster than actual policy**.

Monitor central bank communication daily. Keywords like "considering," "reviewing," or "monitoring" often precede policy changes by 4-8 weeks.

2. Technical Breakdown Signals

Use weekly chart breakdowns as exit triggers. When weekly support breaks with volume, close the position within 24 hours regardless of fundamental outlook.

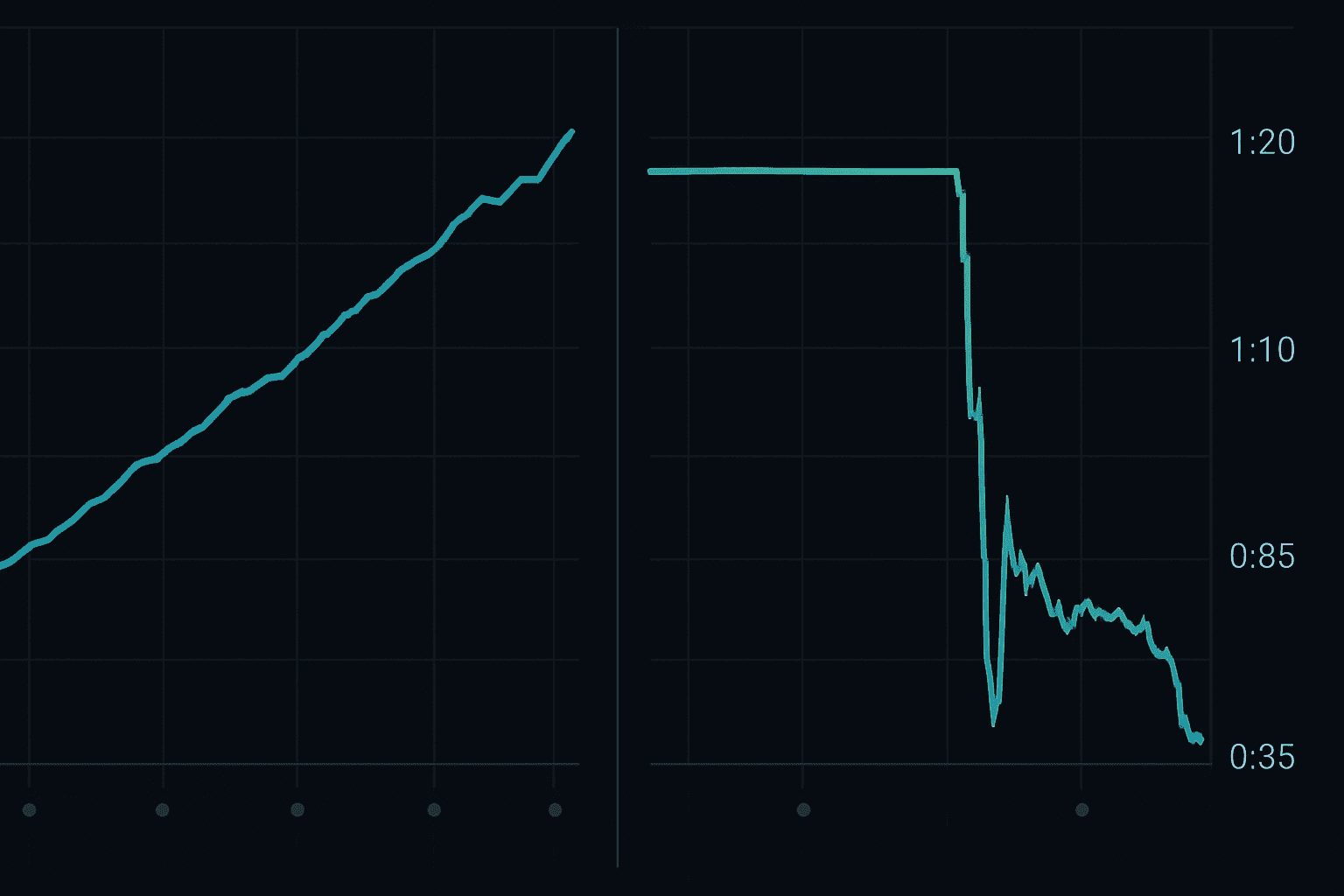

3. Volatility Expansion

When a currency pair's 30-day volatility exceeds its 90-day average by 50%, reduce position size by half. When it exceeds by 100%, close entirely.

4. Time-Based Exits

Professional carry traders rarely hold positions longer than 12 weeks. Set calendar reminders to review each position monthly and close any position older than 3 months unless it's significantly profitable.

Currency Pair Selection for 2024-2025

Not all currency pairs are suitable for carry trading in today's environment. Focus on these **three categories** based on current market conditions:

Tier 1: Core Carry Pairs (Recommended)

- **AUD/JPY**: Stable 3.0% differential, moderate volatility

- **NZD/JPY**: Higher yield (3.5%), slightly more volatile

- **CAD/JPY**: Commodity-linked, good for diversification

Tier 2: Opportunistic Pairs (Advanced Traders)

- **USD/CHF**: Low volatility, modest returns

- **GBP/JPY**: Higher returns but requires active management

- **EUR/CHF**: Stable but limited upside potential

Tier 3: High-Risk/High-Reward (Experts Only)

- **USD/TRY**: Exceptional yields but extreme volatility

- **AUD/CHF**: Good efficiency ratio but illiquid

- **NZD/CHF**: Decent returns, lower liquidity

Start with Tier 1 pairs and only progress to higher tiers after achieving consistent profitability for at least 6 months—the increased complexity isn't worth it for most traders.

Technology Tools for Modern Carry Trading

Successful carry trading requires **systematic monitoring and execution** that's impossible without proper tools. Here's the technology stack professionals use:

Essential Tools

Economic calendar integration is critical. Use platforms that automatically flag central bank meetings, rate decisions, and key economic releases for your target currencies.

Volatility monitoring tools help you adjust position sizes dynamically. FibAlgo's AI-powered indicators can help identify when volatility regimes are changing, giving you early warning signals for position adjustments.

Automation and Alerts

Set up automated alerts for: interest rate changes, correlation breakdowns between your positions, and volatility expansion beyond your predetermined thresholds.

Many successful carry traders use semi-automated systems that flag opportunities but require manual confirmation before execution. This balance prevents emotional decisions while maintaining human oversight.

The Five Deadliest Carry Trade Mistakes

Learn from others' expensive mistakes. These five errors destroy more carry trade accounts than market crashes:

Mistake 1: Ignoring Carry Trade Seasonality

**September through November historically shows the worst carry trade performance** due to institutional rebalancing and tax considerations. Reduce position sizes during these months or avoid new positions entirely.

Mistake 2: Overleveraging During Calm Periods

Low volatility tempts traders to increase leverage, but this is when professionals do the opposite. **Calm periods often precede volatile breakouts**—maintain consistent position sizing regardless of recent volatility.

Mistake 3: Neglecting Overnight and Weekend Risk

Major carry trade reversals often begin during market closures. Never hold more than you can afford to lose to gap risk. Consider reducing positions by 25-50% before major holidays and long weekends.

Mistake 4: Chasing High-Yield Exotic Currencies

Turkish Lira, South African Rand, and Brazilian Real offer tempting yields but **destroy more capital than they create**. Stick to major and minor currency pairs until you've mastered the strategy.

Mistake 5: Inadequate Diversification

Trading multiple JPY crosses isn't diversification—it's concentration. Ensure your funding currencies include JPY, CHF, and USD, while your target currencies span different economic regions.

In January 2019, a trader with 5 AUD/JPY positions thought he was diversified. When the Australian housing market concerns emerged, all positions moved against him simultaneously, creating a 7.2% account loss in three days.

Case Study: Building a $10,000 Carry Trade Portfolio

Let's walk through building a **diversified carry trade portfolio** with $10,000 starting capital:

Portfolio Allocation Strategy

Target allocation: 60% core pairs, 30% opportunistic pairs, 10% cash buffer for opportunities. Maximum total risk: 3% of account value.

Position 1: **AUD/JPY** - $2,000 notional, 0.6% account risk

Position 2: **NZD/CHF** - $1,500 notional, 0.5% account risk

Position 3: **CAD/JPY** - $1,800 notional, 0.6% account risk

Position 4: **GBP/JPY** - $1,200 notional, 0.8% account risk

Cash Reserve: $3,500 for new opportunities

Expected Performance Metrics

Conservative estimate: **8-12% annual return with 6-9% volatility**. This assumes average 2.5% carry yield minus 1% transaction costs and 1-2% from favorable currency movements.

Monthly monitoring targets: Maximum 2% monthly loss, target 0.8% monthly gain, with quarterly rebalancing based on changing interest rate environments.

Professional carry traders often achieve 15-20% annual returns, but they're targeting risk-adjusted returns (Sharpe ratio above 1.5) rather than absolute returns—focus on consistency over big wins.

Integration with Other Trading Strategies

Carry trading works best as **part of a diversified trading approach**. Here's how to integrate it with other strategies:

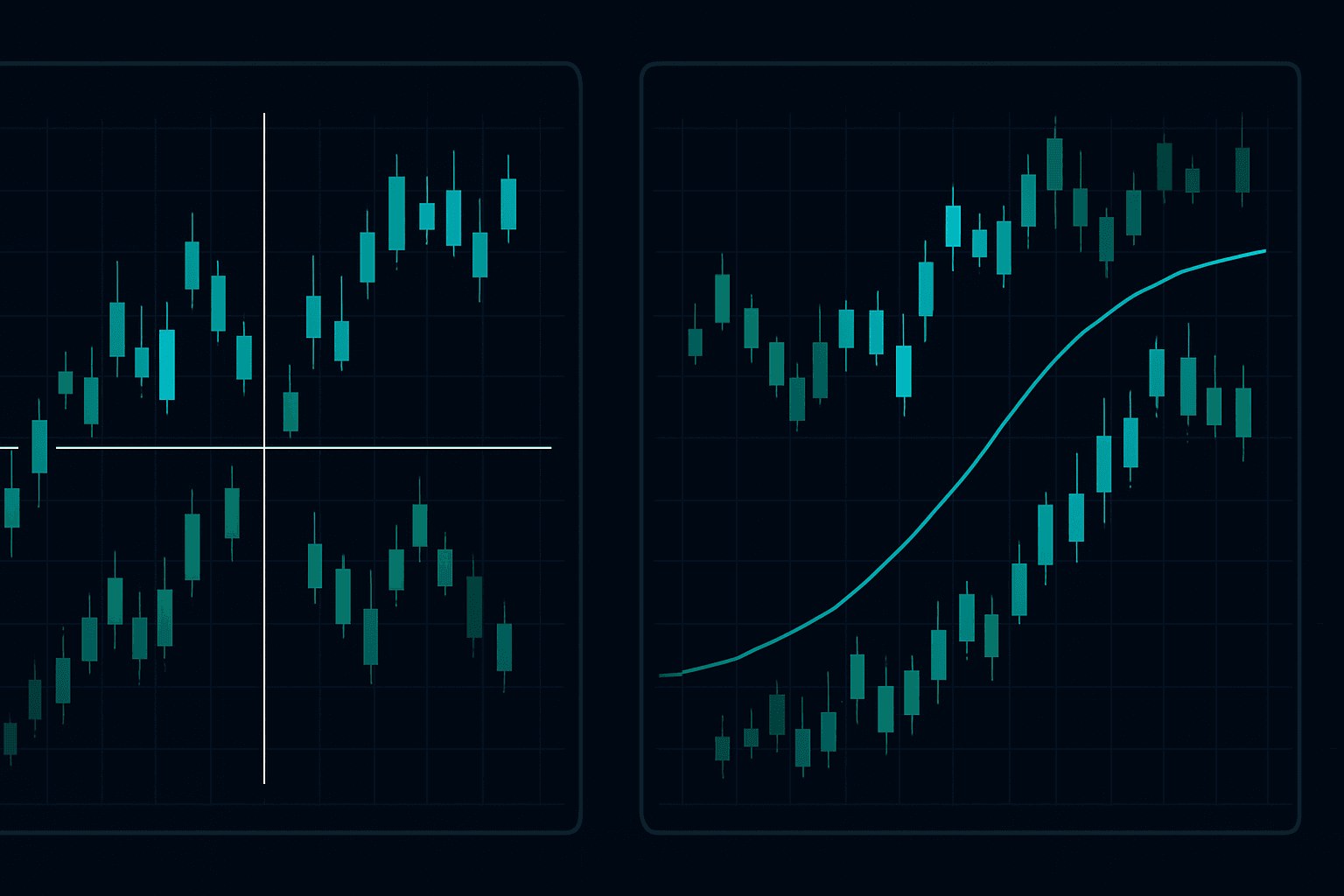

Combining with Technical Analysis

Use carry trades as your base positions, then add shorter-term technical trades in the same direction. This creates a "core-satellite" approach where carry positions provide steady income while technical trades boost returns.

When your carry trade direction aligns with major technical trends, consider increasing position sizes by 25-50%. When they conflict, maintain smaller carry positions and focus on technical opportunities.

Seasonal Pattern Integration

Combine carry trading with seasonal trading patterns for enhanced timing. Many currency pairs show seasonal tendencies that can improve carry trade entry and exit timing.

For example, AUD/JPY typically strengthens from April to July due to Japanese fiscal year-end flows—this creates favorable timing for AUD/JPY carry trades during this period.

Risk Management Synergies

Use insights from technical pattern recognition to time carry trade entries and exits. Triangle breakouts often coincide with major trend changes that can enhance or threaten carry positions.

🎯 Key Takeaways

- Modern carry trading requires sophisticated risk management—focus on risk-adjusted returns over absolute yields

- Use volatility-adjusted position sizing and maintain correlation below 0.7 between positions

- Build portfolios with 8-12 positions risking 0.3-0.6% each rather than concentrating in few large positions

- Set up systematic monitoring for interest rate changes, volatility expansion, and technical breakdowns

- Avoid exotic currencies and seasonal weak periods (September-November) until you master the basics

Taking Your Carry Trading to the Next Level

**Mastering the forex carry trade strategy** requires patience, discipline, and systematic execution. The difference between successful and failed carry traders isn't market knowledge—it's consistent application of risk management principles.

Start small, focus on major currency pairs, and gradually build complexity as you gain experience. Remember, the goal isn't to maximize returns immediately but to build a sustainable income stream that survives multiple market cycles.

Ready to implement these advanced carry trade strategies? FibAlgo's AI-powered indicators can help you identify optimal entry and exit points while managing the complex risk factors that make or break carry trade success. Join 10,000+ traders who are already using systematic approaches to generate consistent profits in today's volatile markets.