The $4.2 Trillion Secret: Why Seasonal Trading Patterns Control Market Flow

Every January, **$4.2 trillion flows into global equity markets** as pension funds and institutional investors rebalance their portfolios. This massive capital movement isn't random—it's part of predictable seasonal trading patterns that smart money has exploited for decades.

While retail traders chase daily price movements, institutional players follow a different playbook. They understand that certain times of year consistently produce specific market behaviors, creating **profit windows that repeat with clockwork precision**.

The most successful traders don't just trade charts—they trade calendars.

Seasonal patterns aren't about predicting exact prices, but about understanding when probability shifts in your favor across different asset classes.

The January Effect: When $500 Billion Moves Markets

The January Effect remains one of the most documented seasonal trading patterns in financial markets. **Small-cap stocks outperform large-caps by an average of 2.8%** during the first month of the year, according to 30 years of market data.

But here's what most traders miss: the effect actually starts in mid-December. Smart money begins positioning on December 15th, when tax-loss selling pressure peaks and institutions start their year-end rebalancing.

"The January Effect isn't about January—it's about understanding the December setup that creates January's opportunity."

In January 2023, the Russell 2000 (small-caps) gained 8.1% while the S&P 500 gained 6.2%. A $10,000 investment in small-cap ETF IWM on December 15th would have outperformed the S&P 500 by $190 in just 5 weeks.

The mechanics are simple but powerful:

- December tax-loss selling creates artificial downward pressure

- Institutional rebalancing begins December 15-20

- Fresh capital flows accelerate January 2-15

- Momentum peaks around January 20th

Earnings Season Goldmines: The 73% Win Rate Strategy

Corporate earnings seasons create some of the most reliable seasonal trading patterns, but the real opportunity isn't in individual stocks—it's in **sector rotation patterns that repeat every quarter**.

Historical analysis reveals that certain sectors consistently outperform during specific earnings periods. Technology stocks, for example, show **73% positive performance** in the two weeks leading up to their earnings announcements during Q4.

The Earnings Calendar Trading Blueprint

Here's the quarterly earnings rotation pattern that institutional traders follow:

- Pre-earnings (2 weeks before): Technology and growth stocks rally on anticipation

- Early earnings week: Financial sector typically reports first, creating volatility in banking stocks

- Mid-earnings: Industrial and consumer discretionary stocks see increased volume

- Late earnings: Defensive sectors (utilities, consumer staples) often provide stability

Track the earnings calendar 3 weeks ahead and position in sector ETFs rather than individual stocks to reduce company-specific risk while capturing sector-wide seasonal moves.

Cryptocurrency's Hidden Seasonal Rhythms

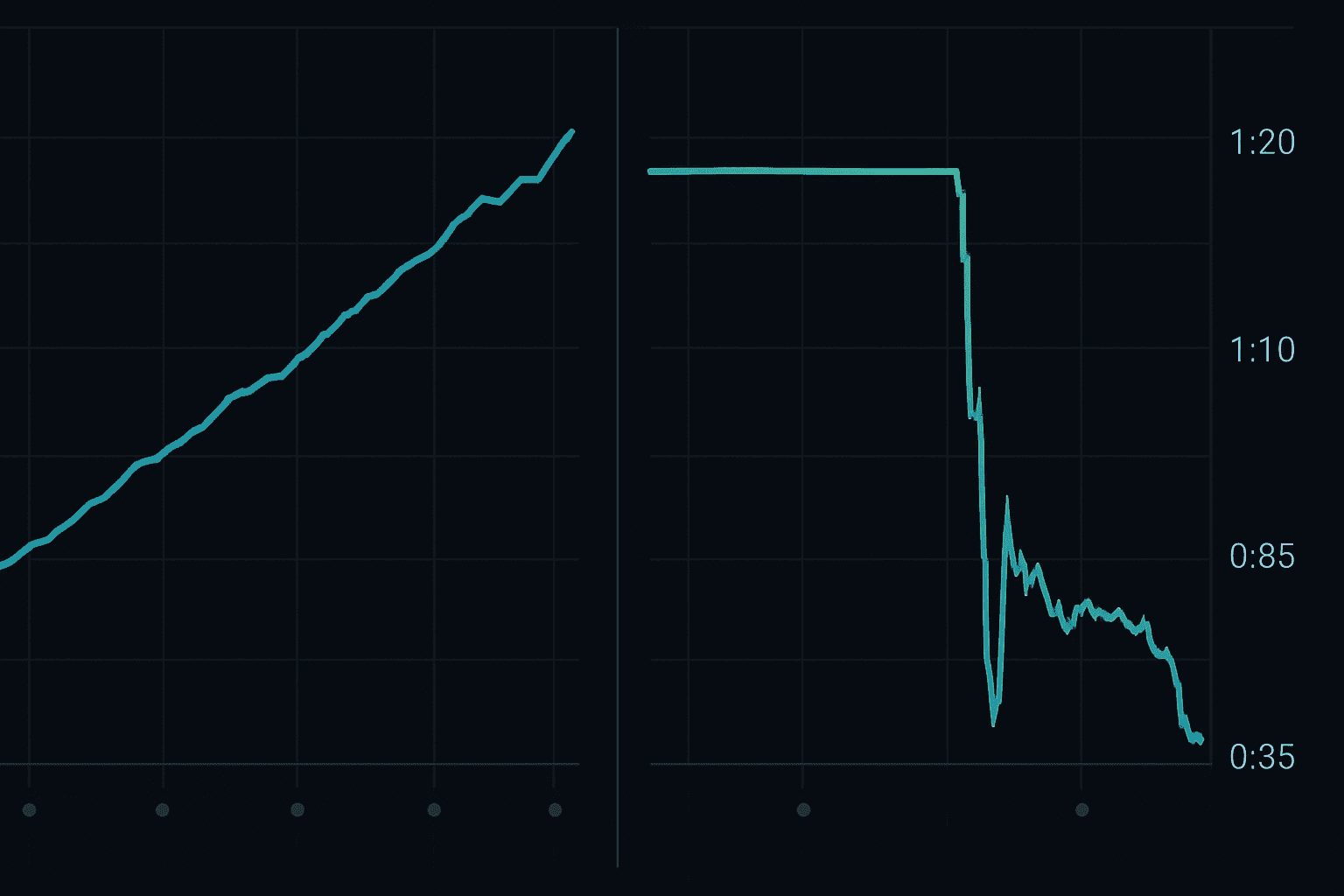

Most crypto traders focus on technical analysis, but **cryptocurrency markets follow distinct seasonal trading patterns** that can significantly improve your win rate. These patterns are driven by tax deadlines, Chinese New Year effects, and institutional quarterly allocations.

Bitcoin, for instance, shows remarkable consistency around certain dates:

- Chinese New Year: BTC typically drops 8-15% in the two weeks before Chinese New Year as Asian traders cash out

- US Tax Season (March-April): Increased selling pressure as traders realize gains for tax payments

- Q4 Institutional Allocation: November-December often sees institutional buying as funds allocate year-end bonuses

During Chinese New Year 2024 (February 10), Bitcoin dropped from $48,200 to $41,850 in the 10 days prior—a predictable 13.2% decline that savvy traders positioned for weeks in advance.

The Crypto Tax Season Trade

April 15th creates one of the most reliable crypto seasonal patterns. Here's the typical sequence:

- March 1-15: Early tax filers begin selling crypto for tax payments

- March 15-April 10: Selling pressure peaks as deadline approaches

- April 15-30: Relief rally begins as selling pressure subsides

- May: "Sell in May" effect often extends the recovery

Forex Seasonal Patterns: Central Bank Clockwork

Currency markets follow some of the most predictable seasonal trading patterns because **central bank meetings and economic releases occur on fixed schedules**. Understanding these cycles gives forex traders a significant edge.

The EUR/USD pair, for example, shows distinct seasonal behavior tied to European Central Bank (ECB) policy cycles:

- March ECB Meeting: EUR typically strengthens 2-3 weeks before major policy announcements

- Summer Doldrums (July-August): Reduced volatility as European traders vacation

- September Reset: Increased volatility as markets refocus after summer break

- December Positioning: Year-end flows create GBP and EUR weakness against USD

Currency seasonal patterns are most reliable during the first two weeks of each month when economic data releases cluster together.

Step-by-Step: Building Your Seasonal Trading Calendar

Creating a systematic approach to seasonal trading patterns requires more than just knowing the dates—you need a **repeatable process that integrates seasonal analysis with your existing strategy**.

Phase 1: Data Collection (Week 1)

- Download Historical Data: Gather 5+ years of price data for your target assets

- Mark Key Dates: Input earnings seasons, Fed meetings, tax deadlines, holidays

- Calculate Returns: Measure average returns for specific date ranges

- Identify Patterns: Look for statistical significance (60%+ win rate minimum)

Phase 2: Calendar Construction (Week 2)

Build your master calendar with three priority levels:

- High Probability (70%+ historical win rate): January Effect, earnings season patterns

- Medium Probability (60-69% win rate): Holiday effects, month-end flows

- Watch List (50-59% win rate): Experimental patterns, new developments

Phase 3: Integration with Technical Analysis

Seasonal patterns work best when combined with technical confirmation. Here's the filter system:

- Seasonal Signal Triggers: Pattern date approaches

- Technical Confirmation Required: Trend alignment, support/resistance levels

- Risk Management Applied: Position sizing based on historical volatility

- Exit Strategy Defined: Both time-based and technical exits

Never rely solely on seasonal patterns—they should be one input in a broader trading system that includes technical analysis and risk management.

Advanced Seasonal Pattern Recognition with AI

Traditional seasonal analysis relies on fixed calendar dates, but **artificial intelligence can identify dynamic seasonal patterns** that adapt to changing market conditions. Modern AI systems can detect seasonal anomalies and pattern shifts that human traders often miss.

For example, AI analysis of Bitcoin data reveals that the Chinese New Year effect has weakened by 40% since 2021, while a new "institutional quarter-end" pattern has emerged with 67% accuracy.

The key is combining traditional seasonal knowledge with advanced AI trading tools that can:

- Identify pattern degradation in real-time

- Discover new seasonal relationships

- Adjust position sizing based on pattern strength

- Alert you to seasonal anomalies

Risk Management for Seasonal Strategies

Seasonal trading patterns are probabilistic, not guaranteed. **Proper risk management is essential** because even high-probability patterns can fail during market disruptions or regime changes.

The 2% Seasonal Rule

Never risk more than 2% of your account on any single seasonal trade, regardless of historical win rates. This rule accounts for the fact that seasonal patterns can fail spectacularly during:

- Market crises (2008, 2020 COVID crash)

- Regulatory changes

- Geopolitical events

- Structural shifts in market participation

Use position sizing formulas that account for pattern reliability: High probability patterns get 2% risk, medium patterns get 1.5%, watch list patterns get 1% maximum.

Portfolio Diversification Across Seasons

Don't concentrate all seasonal trades in one asset class or time period. Spread seasonal opportunities across:

- Asset Classes: Stocks, crypto, forex, commodities

- Time Horizons: Daily, weekly, monthly patterns

- Geographic Regions: US, European, Asian seasonal cycles

- Market Cap: Large-cap, mid-cap, small-cap exposures

The Commodity Connection: Cross-Asset Seasonal Plays

Commodity seasonal patterns create ripple effects across multiple asset classes, offering **sophisticated traders multi-layered opportunities**. Understanding these connections can dramatically improve your seasonal trading results.

Consider natural gas seasonal patterns: heating demand drives prices higher October through March, but this also affects:

- Utility stock performance (higher costs reduce margins)

- Related currencies (CAD, NOK strengthen with energy prices)

- Inflation expectations (energy costs flow through to CPI)

- Technology stocks (higher cooling costs affect data centers)

In October 2023, natural gas futures rose 32% on seasonal demand. Traders who recognized the cross-asset implications profited from shorting utility ETF XLU (-8% that month) and going long energy stocks via XLE (+11%).

Technology Sector Seasonality: The Q4 AI Revolution

Technology seasonal trading patterns have evolved significantly with the rise of AI and cloud computing. **Q4 has become especially powerful for tech stocks** as enterprises finalize annual IT budgets and software purchases accelerate before year-end.

The pattern is remarkably consistent:

- September: Early positioning begins as Q3 earnings approach

- October: Enterprise software companies guide higher for Q4

- November-December: Budget flush creates revenue acceleration

- January: Profit-taking begins as pattern completes

This creates opportunities in both individual tech stocks and sector rotation strategies using ETFs like QQQ, XLK, and ARKK.

🎯 Key Takeaways

- Seasonal trading patterns are driven by institutional flows, tax deadlines, and predictable business cycles

- The January Effect remains powerful but requires positioning in mid-December for maximum impact

- Cryptocurrency seasonal patterns are emerging as the market matures and institutional participation increases

- Combining seasonal analysis with technical confirmation and proper risk management is essential for success

- AI tools can identify evolving seasonal patterns and alert you to anomalies in real-time

Your Seasonal Trading Edge Starts Now

Mastering seasonal trading patterns gives you the same edge that institutional traders have used for decades. But remember: **patterns are only as good as your execution system**.

The most successful seasonal traders combine calendar-based insights with sophisticated technical analysis and risk management. They don't just know when patterns occur—they know how to position for them, when to exit, and how to adapt when patterns change.

Ready to start building your seasonal trading advantage? Try FibAlgo risk-free and access the AI-powered tools that help professional traders identify, validate, and execute seasonal patterns with institutional-grade precision. Our advanced algorithms continuously scan for seasonal opportunities across stocks, crypto, and forex markets, giving you the edge you need to profit from predictable market cycles.

Don't trade calendars blindly—trade them intelligently with the right tools and strategy.