The Hidden Opportunity in Crypto Winter

Bear markets in crypto don't announce themselves with fanfare. One day you're riding the wave of a bull run, and the next you're watching your portfolio bleed red for months on end.

But here's what separates seasoned crypto traders from the crowd: they view bear markets as the best accumulation opportunity they'll see for years. While others panic-sell or freeze in fear, smart money quietly builds positions that will pay off handsomely in the next cycle.

The challenge? Most traders approach bear market buying completely wrong. They either go all-in too early, catching falling knives, or they wait for "the bottom" that never feels safe enough to buy.

That's why I developed what I call the Layered Accumulation System - a structured approach to building crypto positions during bear markets that removes emotion from the equation and maximizes your opportunities across different market conditions.

Why Traditional Bear Market Strategies Fail in Crypto

Crypto bear markets aren't like stock market downturns. They're more violent, more prolonged, and filled with false dawns that trap eager buyers.

The classic "buy the dip" mentality can destroy you when that dip keeps dipping for 18 months. Similarly, waiting for clear reversal signals means you'll miss the early stages of recovery when the best gains happen.

Crypto bear markets typically last 12-24 months, with multiple 30-50% rallies that fail. Your strategy must account for this volatility.

Most crypto bear market strategies fail because they treat it like a single event rather than a series of opportunities that require different approaches at different stages.

Some traders try to time the absolute bottom. Others dollar-cost average blindly without regard for market structure. Both approaches leave money on the table.

The Layered Accumulation System Explained

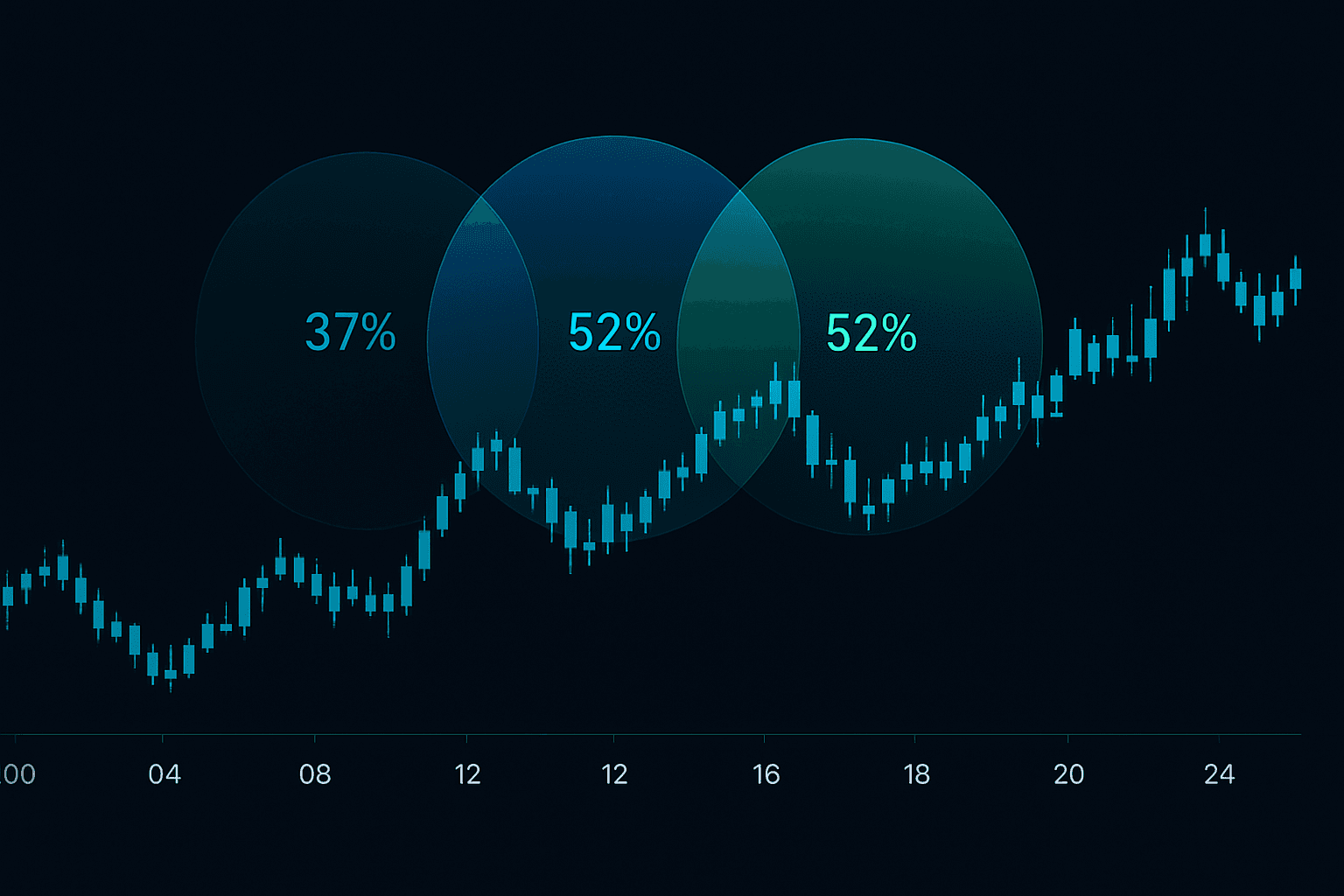

The Layered Accumulation System splits your bear market strategy into three distinct layers, each serving a different purpose and timeline.

Layer 1 provides steady accumulation regardless of market noise. Layer 2 capitalizes on technical opportunities during the bear market. Layer 3 targets extreme value zones where assets become severely undervalued.

Think of it like building a house. Layer 1 is your foundation - steady and reliable. Layer 2 is your framework - structured but responsive to conditions. Layer 3 is your finishing touches - precise and opportunistic.

Here's how much capital you should allocate to each layer:

- Layer 1 (Foundation): 50% of your bear market allocation

- Layer 2 (Technical): 30% of your allocation

- Layer 3 (Value Zones): 20% of your allocation

Let's dive into each layer with specific implementation details.

Layer 1: The Dollar-Cost Averaging Foundation

Your foundation layer removes timing from the equation entirely. This is where consistency beats cleverness every time.

Set up systematic purchases of your core crypto holdings regardless of price. But here's the twist - instead of buying the same amount each week, you scale your purchases based on market fear.

Suppose you allocate $2,000 monthly for Layer 1. When the Fear & Greed Index is below 20, you buy $2,500. When it's 20-40, you buy $2,000. Above 40, you buy $1,500.

This approach naturally increases your buying during peak fear and reduces it when the market shows signs of recovery.

For asset selection in Layer 1, stick to the crypto blue chips: Bitcoin, Ethereum, and maybe one or two other top-10 assets that have survived previous bear markets.

The beauty of Layer 1 is its simplicity. You can automate most of it and let it run in the background while you focus on the more active layers.

Use exchange auto-buy features for Layer 1, but adjust the amounts manually based on market sentiment. This maintains consistency while staying responsive to opportunity.

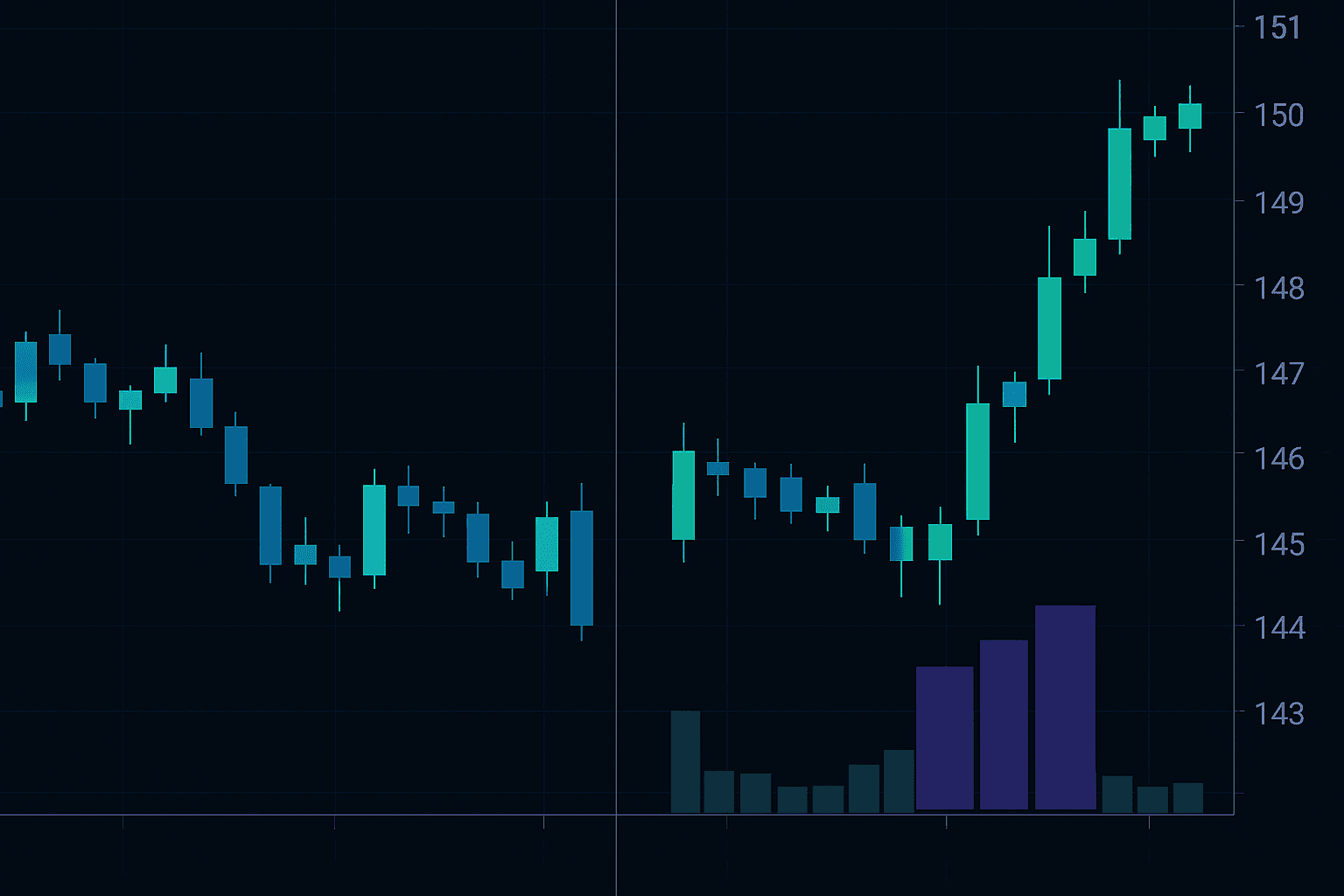

Layer 2: Technical Signal Entries

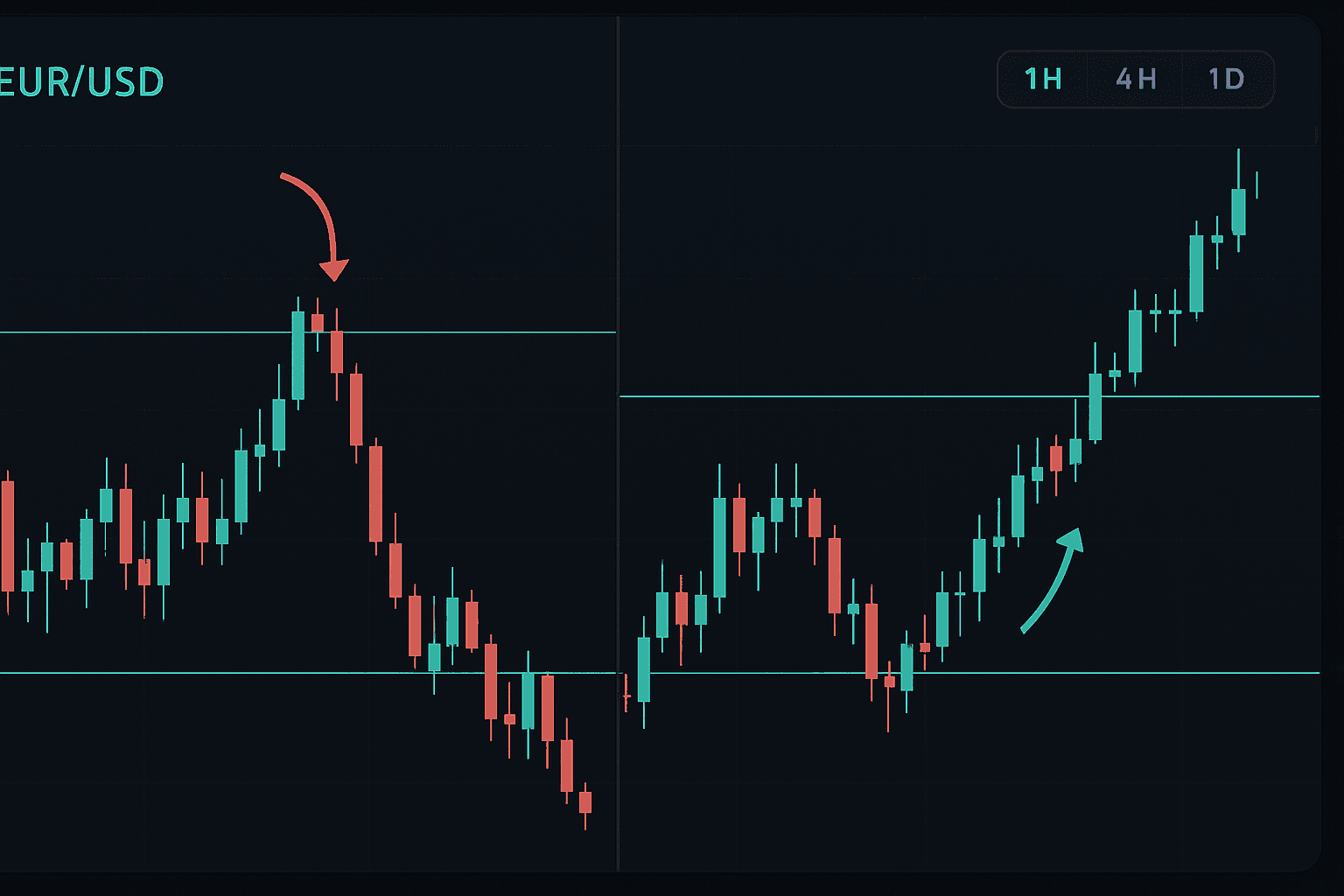

Layer 2 is where your technical analysis skills shine. Instead of buying blindly, you wait for specific signals that indicate short-term oversold conditions or potential reversals.

The key indicators I watch for Layer 2 entries:

- RSI below 30 on weekly charts - indicates sustained oversold conditions

- Bullish divergences on 4-hour and daily timeframes

- Volume spikes on bounces - suggests institutional buying interest

- Support level retests that hold with strong rejection candles

But remember, in a bear market, these signals can fail. That's why Layer 2 uses smaller position sizes and always includes stop-losses.

Imagine Bitcoin is trading at $32,000 and you notice bullish divergence on the 4-hour RSI while price makes a lower low. You might allocate $500 from Layer 2 with a stop at $30,500.

The goal isn't to catch the exact bottom, but to capture meaningful bounces during the bear market. Many of these will be 20-40% moves that you can either take profit on or hold for the longer term.

Timing your Layer 2 entries requires patience. Sometimes you'll wait weeks for the right setup. That's perfectly fine - forced trades in bear markets are account killers.

Layer 3: Extreme Value Zone Targeting

Layer 3 is your "blood in the streets" allocation. This is for moments when crypto assets reach levels that seem impossible - until they happen.

These are the times when Bitcoin drops 70% from its peak, when solid altcoins lose 90% of their value, and when fear reaches levels that make even experienced traders question their sanity.

The challenge with Layer 3 is recognizing these moments in real-time. Fear feels the same whether an asset is down 50% or 80%. You need objective criteria to trigger these purchases.

My Layer 3 triggers include:

- Bitcoin trading below its 200-week moving average

- Market cap of top altcoins below previous cycle lows

- Funding rates consistently negative for 30+ days

- Fear & Greed Index below 10 for extended periods

Layer 3 purchases can feel like financial suicide when you make them. That's exactly when they're most effective, but never risk more than you can afford to lose completely.

When these conditions align, you deploy Layer 3 capital aggressively. These purchases often represent your highest-conviction, lowest-price entries that will drive most of your bear market returns.

Step-by-Step Implementation Tutorial

Ready to implement the Layered Accumulation System? Here's your step-by-step action plan.

Step 1: Calculate Your Bear Market Allocation

Determine how much total capital you can commit to your crypto bear market strategy. This should be money you won't need for at least 2-3 years.

Let's say you have $10,000 available:

- Layer 1 (Foundation): $5,000

- Layer 2 (Technical): $3,000

- Layer 3 (Value Zones): $2,000

Step 2: Set Up Layer 1 Automation

Choose 2-3 core assets for Layer 1. For most traders, this means Bitcoin and Ethereum, possibly adding one carefully selected altcoin.

Set up recurring purchases, but build in flexibility to adjust amounts based on market sentiment. Track the Fear & Greed Index weekly and adjust your purchase amounts accordingly.

Step 3: Create Your Layer 2 Watchlist

Identify 5-8 cryptocurrencies you want to accumulate using technical signals. Focus on projects with strong fundamentals that have simply been caught in the bear market downdraft.

Set up alerts for your technical triggers: RSI levels, support retests, and volume anomalies. When alerts fire, assess the setup and execute if it meets your criteria.

Step 4: Define Your Layer 3 Criteria

Write down your specific Layer 3 triggers and the exact amounts you'll deploy when each one hits. Having this predetermined removes emotion from these critical decisions.

Keep a dedicated Layer 3 cash reserve in a high-yield savings account. When extreme value opportunities arise, you want immediate access to capital without selling other positions.

Step 5: Track Everything

Maintain a detailed trading journal for your bear market strategy. Record not just your purchases, but your emotional state and market conditions when you made each decision.

This documentation becomes invaluable for refining your approach and maintaining discipline during the most challenging periods.

Risk Management During Crypto Bear Markets

Bear market accumulation strategies can feel like catching falling knives if you don't manage risk properly. Here's how to stay safe while building positions.

Never go all-in on a single entry. Even with the Layered Accumulation System, you're spreading risk across time and different market conditions. But within each layer, continue to diversify your entries.

For Layer 2 technical entries, always use stop-losses. In bear markets, technical levels break more often than they hold. A 10-15% stop-loss protects you from major breakdowns while giving the position room to breathe.

Your biggest risk in a crypto bear market isn't losing money on individual trades - it's running out of capital before the real opportunities arrive.

Position sizing becomes critical. If Bitcoin is down 60% and you think it's a great buy, resist the urge to deploy 50% of your capital. The next month might bring another 30% drop.

This connects directly to having a solid risk management framework that prevents you from overcommitting during emotional periods.

Keep detailed records of your average cost basis across all three layers. This helps you understand your true breakeven levels and make informed decisions about taking profits during bear market rallies.

Psychology: Staying Disciplined When Everything Looks Broken

The hardest part of any crypto bear market strategy isn't the technical execution - it's maintaining belief when everything around you suggests crypto might be finished.

I've watched traders abandon perfectly sound accumulation strategies three months before the market turned. The emotional pressure of watching your purchases immediately go underwater can be overwhelming.

Here's what keeps me disciplined: I focus on accumulating assets, not making money. During bear markets, your goal should be building the largest possible position in quality projects, not seeing green numbers in your portfolio.

"The time to buy is when there's blood in the streets, even if the blood is your own." - Baron Rothschild

This mindset shift changes everything. Instead of feeling bad about a Bitcoin purchase that drops another 15%, you feel excited about the opportunity to buy even more at lower prices.

Bear market depression is real. If you find yourself losing sleep or constantly checking prices, you're likely overinvested. Scale back your strategy until you can execute it calmly.

Remember that bear markets are temporary, but the positions you build during them can generate wealth for decades. Every major crypto fortunes was built by accumulating during the darkest periods.

Common Mistakes That Destroy Bear Market Strategies

After watching hundreds of traders attempt crypto bear market strategies, I've identified the fatal mistakes that turn opportunity into disaster.

Mistake #1: Going all-in too early. The first 30% drop feels like a massive opportunity, but crypto bear markets often see 70-90% declines. Save capital for the later stages.

Mistake #2: Abandoning the plan during despair phases. The deepest despair often coincides with the best buying opportunities. Your strategy should be designed to work especially well when it feels most wrong.

Mistake #3: Focusing only on price instead of accumulation. Dollar amounts fluctuate, but the number of Bitcoin or Ethereum you own is permanent. Build your stack, not your account value.

Let's say you bought Ethereum at $2,500, $2,000, $1,500, and $1,200. Your average is $1,800, but if ETH hits $3,600 in the next cycle, every purchase was profitable - even the $2,500 one.

Mistake #4: Not maintaining discipline across all three layers. It's tempting to abandon Layer 1's systematic approach when you think you see a perfect Layer 2 setup. Stick to your allocations.

Mistake #5: Trying to optimize too much. The goal isn't to buy the exact bottom, but to build a significant position across a range of prices. Perfection is the enemy of execution.

🎯 Key Takeaways

- Use the three-layer system to balance consistent accumulation with opportunistic buying

- Allocate 50% to systematic DCA, 30% to technical entries, and 20% to extreme value zones

- Focus on accumulating assets rather than short-term portfolio performance

- Maintain strict risk management with position sizing and stop-losses on technical entries

- Prepare psychologically for the emotional challenges of buying during maximum fear

Building Your Crypto Empire During the Winter

Bear markets separate the speculators from the builders. While others retreat or panic, you now have a systematic framework for turning crypto winter into your greatest wealth-building opportunity.

The Layered Accumulation System isn't just about making money - it's about positioning yourself for the next major cycle when crypto adoption reaches new heights and institutional money floods back into the space.

Start by implementing Layer 1 immediately. The foundation layer works in any market condition and removes the pressure to time your entries perfectly. As you gain confidence, add Layer 2 technical signals and prepare your Layer 3 criteria for extreme opportunities.

Remember, some of the most successful crypto investors I know made their fortunes not by trading the volatility, but by systematically accumulating during the periods when everyone else had given up hope.

Your future self will thank you for the discipline you show today. And if you want to enhance your bear market strategy with advanced technical analysis tools, explore FibAlgo's comprehensive indicator suite designed to help traders identify high-probability entries across all market conditions.