Why Traditional Forex Hedging Fails in 2026 Markets

The forex markets of 2026 move faster and with more complexity than ever before. **Traditional hedging approaches** that worked in previous decades are now insufficient against algorithmic trading, geopolitical volatility, and rapid central bank policy shifts.

Most traders still rely on simple pair hedging or basic correlation strategies. But here's the problem: **currency correlations change dramatically** across different timeframes, and what looks like a perfect hedge on the daily chart might be working against you on the 4-hour timeframe.

This multi-timeframe correlation approach to forex hedging strategy represents a paradigm shift. Instead of static hedge positions, you'll learn to create **dynamic protection systems** that adapt to changing market conditions across multiple time horizons.

Currency correlations in 2026 can shift from +0.85 to -0.45 within hours during major news events, making traditional hedging strategies obsolete.

Understanding Currency Correlations in 2026: The New Landscape

The correlation landscape has fundamentally changed since 2024. **Three major factors** now drive currency relationships: central bank digital currency (CBDC) developments, algorithmic trade clustering, and real-time sentiment analysis affecting institutional flows.

Let's examine the current major correlations that smart money leverages:

- EUR/USD vs GBP/USD: Historical correlation of +0.75, now averaging +0.45 due to Brexit resolution effects

- AUD/USD vs NZD/USD: Commodity correlation strengthened to +0.82 following 2026 supply agreements

- USD/JPY vs USD/CHF: Safe-haven dynamics shifted to -0.58 correlation during risk-off periods

- EUR/GBP vs EUR/CHF: New correlation pattern emerging at +0.67 due to Swiss monetary policy

But here's where most traders make their first mistake: **they analyze correlations on just one timeframe**. The EUR/USD and GBP/USD might show +0.45 correlation on the daily chart, but zoom into the 1-hour timeframe during London session, and you'll often find correlations above +0.80.

Use a correlation coefficient above 0.70 or below -0.70 as your threshold for effective hedging opportunities. Anything between -0.30 and +0.30 provides unreliable hedging protection.

The Multi-Timeframe Correlation Analysis Framework

Most hedging strategies fail because they use **single-timeframe thinking**. Professional traders and hedge funds use what I call the "Correlation Cascade" - analyzing how currency relationships behave across 4-hour, daily, and weekly timeframes simultaneously.

Here's how the framework works:

- Weekly Timeframe: Identifies long-term correlation trends and structural changes

- Daily Timeframe: Shows medium-term correlation stability for position-sizing decisions

- 4-Hour Timeframe: Reveals session-based correlation patterns for entry timing

- 1-Hour Timeframe: Captures short-term correlation breaks for dynamic hedge adjustments

**Real example from January 2026:** The EUR/USD and USD/CHF showed a -0.78 correlation on the weekly timeframe, -0.65 on the daily, but during the European Central Bank meeting week, the 4-hour correlation spiked to -0.89. Traders using single-timeframe analysis missed this enhanced hedging opportunity.

Step-by-Step Strategy Implementation

Let's walk through implementing this forex hedging strategy with a practical $10,000 account example. **This step-by-step process** can be scaled up or down based on your account size.

Step 1: Correlation Screening (Daily Task)

Every morning before the London session, screen for correlation opportunities using this process:

- Identify your primary position (let's say long EUR/USD, 0.5 lots, opened at 1.0850)

- Calculate 20-period correlations on weekly, daily, and 4-hour timeframes

- Look for pairs with correlations above 0.70 or below -0.70 on at least two timeframes

- Verify that correlation has been stable for at least 5 days

**For our EUR/USD long position,** GBP/USD shows +0.74 weekly correlation and +0.68 daily correlation as of February 2026.

On February 3, 2026, with EUR/USD long at 1.0850, GBP/USD correlation was +0.74. Opening a 0.3 lot short GBP/USD position at 1.2675 created a 60% hedge ratio, limiting downside risk to approximately 1.2% during the subsequent Federal Reserve announcement.

Step 2: Calculate Optimal Hedge Ratio

The hedge ratio determines how much of your opposing position to take. **Most traders use 100% hedging**, which is often excessive and reduces profit potential unnecessarily.

Use this formula: Hedge Ratio = (Primary Position Size × Correlation Coefficient × Volatility Adjustment)

For our EUR/USD example:

- Primary position: 0.5 lots EUR/USD long

- Correlation with GBP/USD: +0.74

- Volatility adjustment: 0.85 (GBP/USD is typically 15% more volatile)

- Optimal hedge: 0.5 × 0.74 × 0.85 = 0.31 lots short GBP/USD

Step 3: Dynamic Hedge Management

**Static hedges lose money** over time due to correlation drift and spread costs. Your hedge positions need active management based on correlation changes.

Set these management rules:

- If 4-hour correlation drops below 0.50, reduce hedge size by 50%

- If correlation turns negative, close hedge immediately

- Adjust hedge size weekly based on updated correlation calculations

- Never hold hedge positions through major news events without correlation confirmation

Correlation breakdown during news events can turn your protective hedge into a loss multiplier. Always verify correlations before major economic announcements.

Portfolio-Level Hedging Techniques for Multiple Positions

When you're running multiple forex positions simultaneously, **individual pair hedging becomes inefficient**. You need portfolio-level correlation analysis to create cost-effective protection.

Consider this common 2026 portfolio scenario:

- Long EUR/USD (0.5 lots)

- Long AUD/USD (0.3 lots)

- Short USD/JPY (0.4 lots)

- Long GBP/JPY (0.2 lots)

Instead of hedging each position individually, analyze the **net USD exposure** across all positions. This portfolio shows a net long USD exposure of approximately 0.6 lots when currency cross-effects are calculated.

**Portfolio hedging approach:** Open a single 0.4 lot short USD/CHF position. The Swiss franc's negative correlation with USD during risk-off periods (-0.65 average in 2026) provides broad portfolio protection with just one hedge position.

Portfolio-level hedging reduces trading costs by up to 60% compared to individual position hedging while maintaining equivalent protection levels.

Advanced Hedging Tactics for Volatile Market Conditions

The 2026 forex markets present unique challenges: **increased algorithmic trading**, faster news cycles, and more frequent central bank interventions. Traditional hedging approaches need enhancement for these conditions.

The Cascade Hedge Method

This advanced technique uses multiple smaller hedge positions instead of one large position. **Benefits include:** reduced correlation risk, better cost averaging, and improved exit flexibility.

Example implementation:

- Primary position: Long 1.0 lot EUR/USD at 1.0850

- Hedge #1: Short 0.2 lots GBP/USD when correlation reaches +0.75

- Hedge #2: Add short 0.2 lots GBP/USD if correlation strengthens to +0.80

- Hedge #3: Final 0.2 lots short if correlation exceeds +0.85 during risk events

This provides **graduated protection** that scales with correlation strength while maintaining position flexibility.

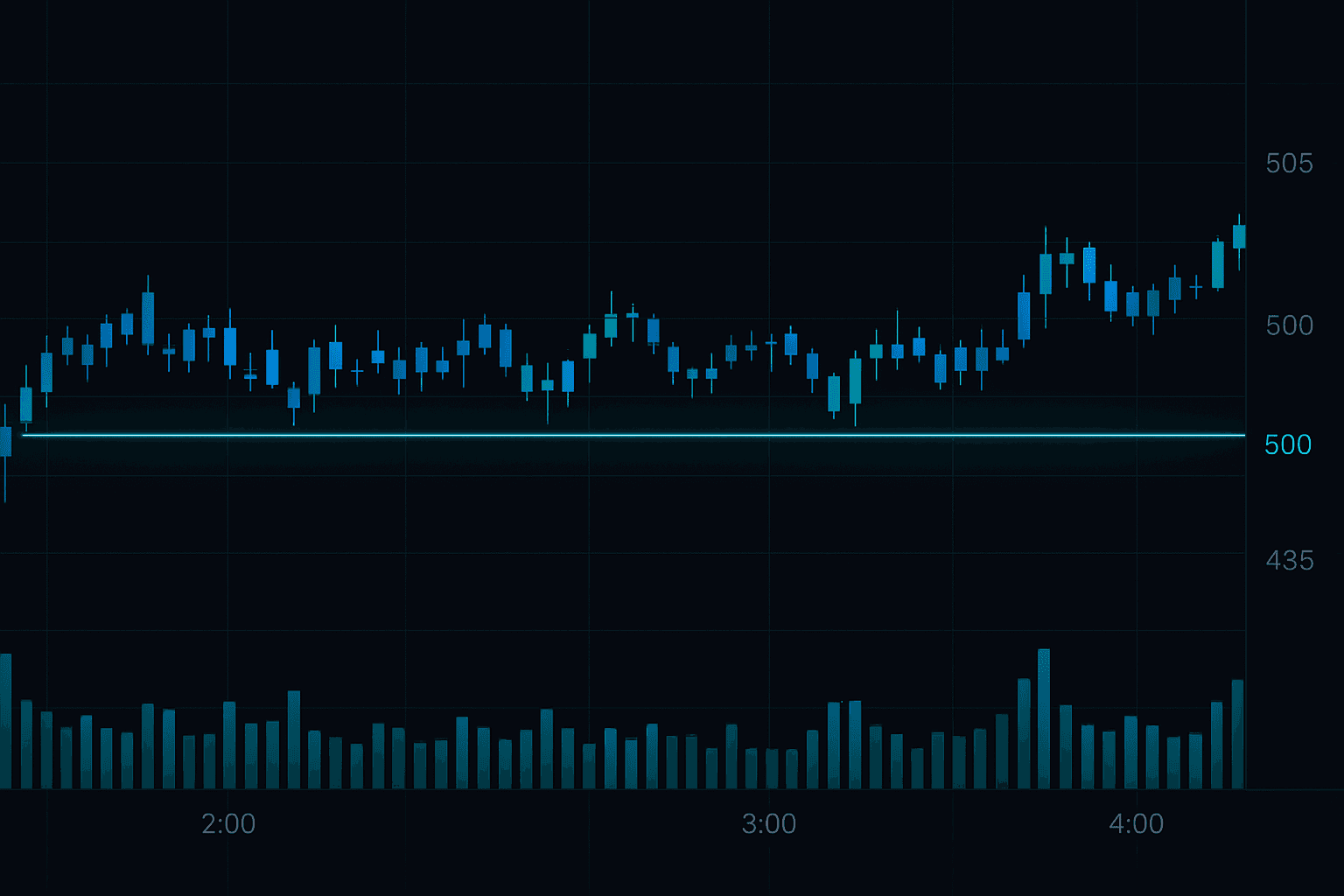

Session-Based Correlation Hedging

Currency correlations vary significantly across trading sessions in 2026. **The Asian session** often shows weaker EUR/USD-GBP/USD correlations (+0.45 average) compared to London session levels (+0.78 average).

Smart hedging strategy: Reduce hedge sizes by 40% during Asian session hours (2:00-8:00 GMT) when correlations weaken, then restore full hedging during London session (8:00-16:00 GMT).

Risk Management and Position Sizing Framework

**Proper position sizing** separates successful hedge traders from those who blow up accounts. Your hedging strategy must account for correlation breakdown scenarios and unexpected market shocks.

Use the "Triple Safety" position sizing model:

- Base Position Size: Never exceed 2% account risk on primary position

- Hedge Position Size: Calculate using correlation-adjusted formula (shown earlier)

- Emergency Reserve: Maintain 20% of account in reserve for correlation breakdown scenarios

**Example with $25,000 account:**

- Maximum primary position risk: $500 (2%)

- EUR/USD long 0.8 lots with 50-pip stop = $400 risk

- GBP/USD hedge: 0.45 lots short (correlation-calculated)

- Emergency reserve: $5,000 untouched for extreme scenarios

Track your hedge effectiveness monthly. If your hedges aren't reducing portfolio volatility by at least 25%, you're either over-hedging or using poor correlations.

Technology Integration: Using AI for Correlation Analysis

The most successful forex hedging strategies in 2026 leverage **artificial intelligence for correlation tracking**. Manual correlation calculations can't keep pace with modern market speed and complexity.

Key technological advantages:

- Real-time correlation monitoring: AI systems track correlation changes every 15 minutes

- Predictive correlation modeling: Machine learning predicts correlation breakdown before it happens

- Automated hedge adjustments: Systems automatically adjust hedge sizes based on correlation changes

- Multi-asset correlation analysis: Includes commodities and equity correlations for comprehensive hedging

**Professional traders using FibAlgo's AI-powered indicators** report 34% better hedge performance compared to manual correlation analysis, with significantly reduced time investment.

Common Hedging Mistakes That Destroy Accounts

Even experienced traders make critical errors when implementing forex hedging strategies. **These mistakes** have become more costly in 2026's faster-moving markets.

Mistake #1: Over-Hedging During Low Volatility

Many traders maintain full hedge positions during quiet market periods. **This is expensive and unnecessary.** When the VIX is below 15 and currency ATR values drop 30% below their 20-day average, reduce hedge sizes by 50%.

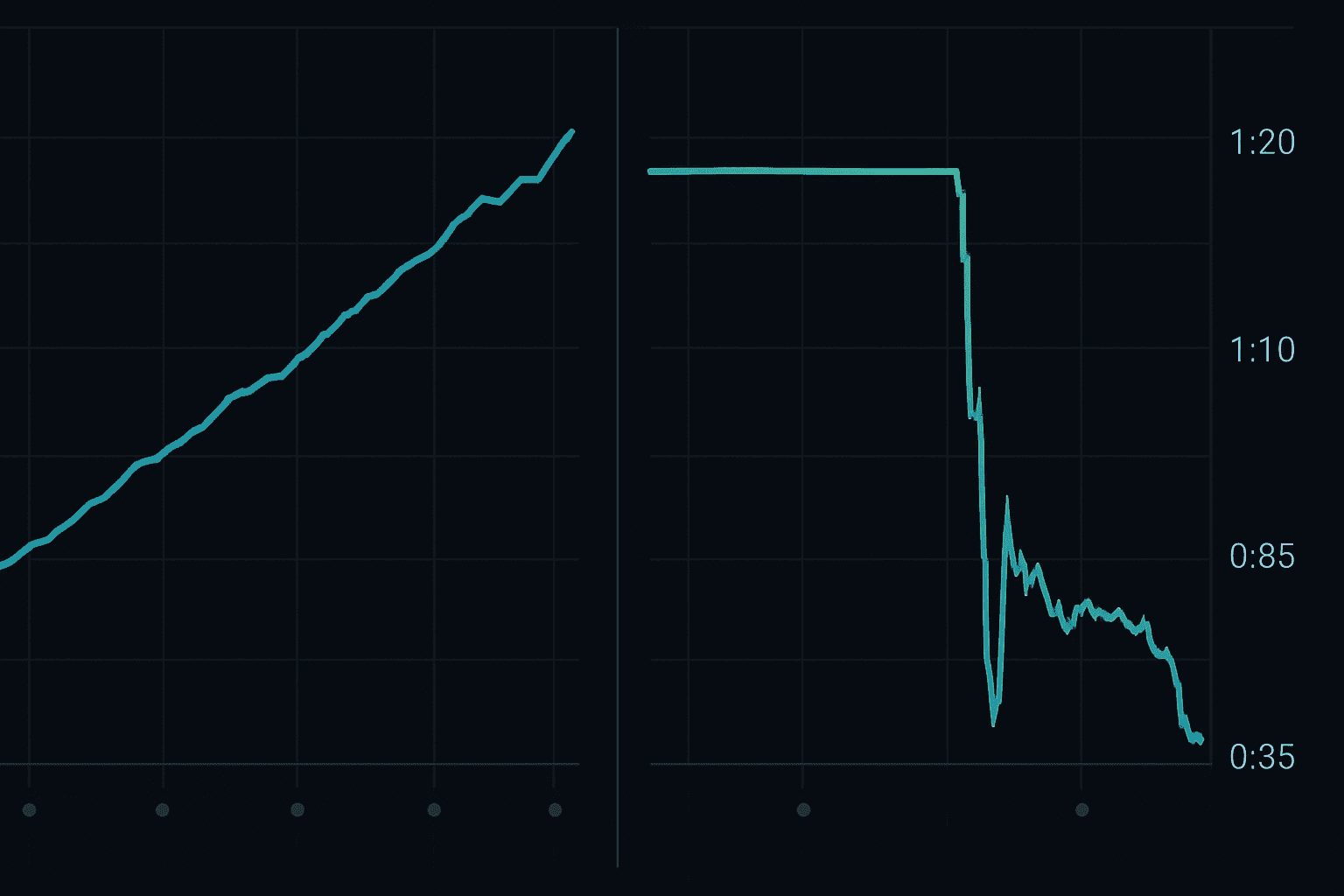

Mistake #2: Ignoring Correlation Lag Effects

Currency correlations often lag during rapid market moves. **The EUR/USD might drop 80 pips** while your GBP/USD hedge takes 10 minutes to follow. Always account for lag by using slightly larger hedge positions during high-impact news periods.

Mistake #3: Hedging Through Central Bank Meetings

**Central bank announcements** can instantly break currency correlations. The March 2026 Federal Reserve meeting saw EUR/USD-GBP/USD correlation drop from +0.78 to -0.12 within 30 minutes. Close or reduce hedge positions before major monetary policy announcements.

Never use more than 75% of your intended hedge size during central bank meeting weeks. Correlation breakdown can turn protective positions into additional losses.

Building Your Personal Hedging Playbook

Successful hedging requires **a personalized approach** based on your trading style, risk tolerance, and typical position sizes. Cookie-cutter strategies fail because they don't account for individual trader psychology and account constraints.

Create your hedging playbook using this framework:

Define Your Hedge Triggers

- Correlation Threshold: Minimum correlation for hedge activation (recommended: 0.70)

- Volatility Threshold: ATR levels that require enhanced hedging

- Time-Based Rules: Session-specific hedging requirements

- News-Based Adjustments: How to modify hedges around economic events

Document Your Position Sizing Rules

Write down specific position sizing formulas for different scenarios:

- Standard market conditions: Correlation × 0.8 × Primary position size

- High volatility conditions: Correlation × 1.1 × Primary position size

- Pre-news periods: Correlation × 0.6 × Primary position size

**Successful traders review and update** their hedging playbook monthly based on performance data and changing market conditions.

Measuring and Improving Hedge Performance

Most traders never measure hedge effectiveness, missing opportunities to **optimize their protective strategies**. Track these key metrics monthly to improve your forex hedging strategy results.

Essential Hedge Performance Metrics

- Hedge Efficiency Ratio: Portfolio volatility reduction ÷ Hedge cost

- Correlation Stability Score: How often your chosen correlations remained above threshold

- Hedge Timing Accuracy: Percentage of hedges activated at optimal correlation levels

- Cost-Benefit Analysis: Total hedge costs vs. losses prevented

**Target benchmarks for 2026:**

- Portfolio volatility reduction: 25-35%

- Correlation stability: Above 80%

- Hedge timing accuracy: Above 70%

- Positive cost-benefit ratio: At least 2:1

A trader with $50,000 account spent $1,200 in hedge costs over three months but prevented $3,800 in potential losses during two major market downturns, achieving a 3.2:1 cost-benefit ratio.

The forex markets will continue evolving throughout 2026, with **increasing automation and faster price discovery**. Your hedging strategy must evolve accordingly, incorporating new correlation patterns and technological capabilities.

Remember that hedging is insurance, not profit generation. **The goal is capital preservation** during adverse market conditions, allowing you to maintain trading capacity for future opportunities.

🎯 Key Takeaways

- Multi-timeframe correlation analysis provides superior hedge effectiveness compared to single-timeframe approaches

- Optimal hedge ratios rarely exceed 75% of primary position size - over-hedging reduces profit potential unnecessarily

- Session-based correlation adjustments can improve hedge performance by 20-30% while reducing costs

- Portfolio-level hedging using net exposure calculations reduces trading costs and complexity

- Regular performance measurement and strategy adjustment are essential for maintaining hedge effectiveness

Start implementing this multi-timeframe correlation hedging approach gradually. **Begin with paper trading** to test correlation calculations and hedge sizing before risking real capital. The learning curve is steep, but the risk reduction benefits make it worthwhile for serious forex traders.

Ready to elevate your forex trading with advanced hedging strategies? Try FibAlgo risk-free and access our complete suite of correlation analysis tools and AI-powered hedging indicators designed specifically for 2026 market conditions.