The Hidden $2.1 Trillion Opportunity Most Traders Miss

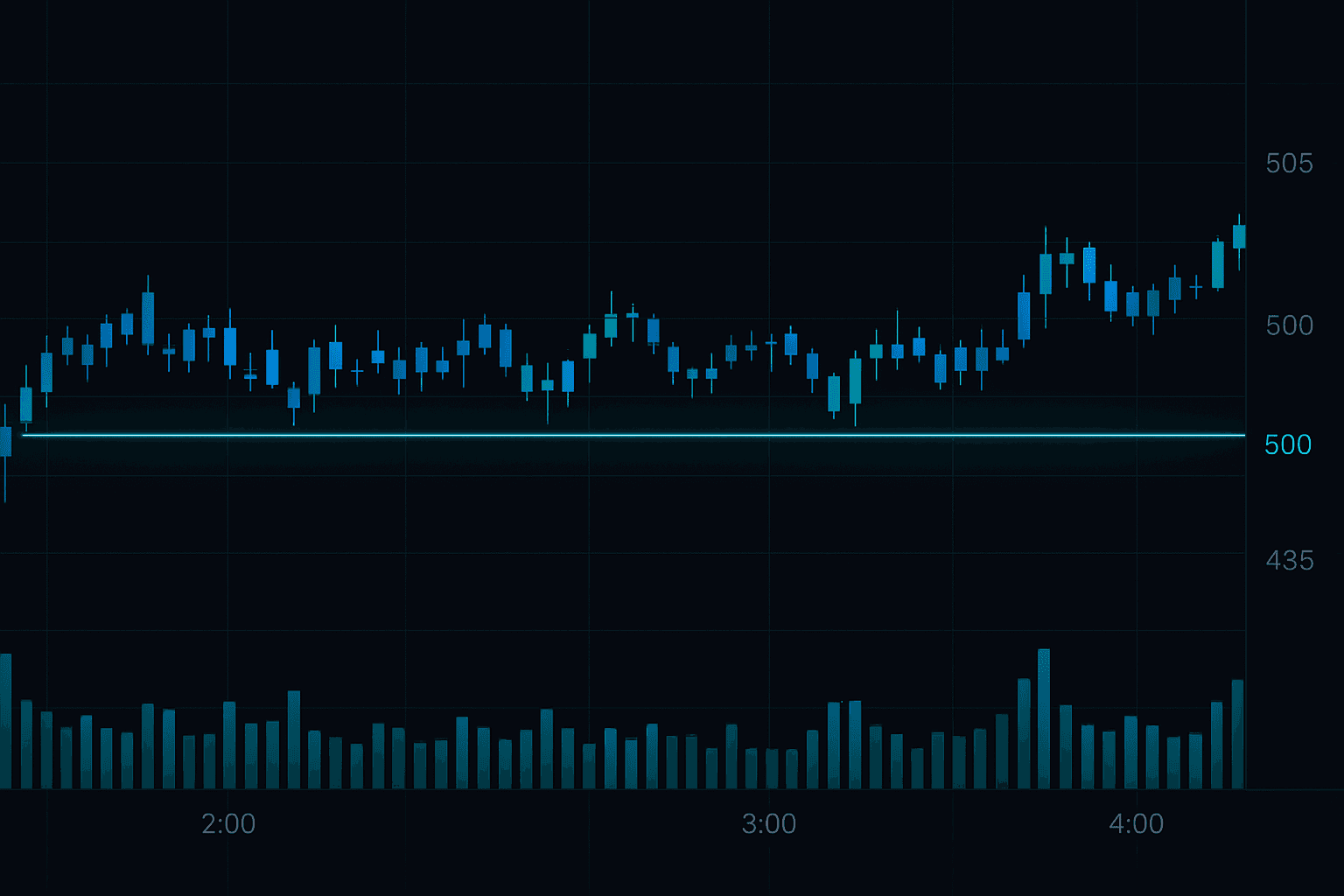

While 90% of retail traders close their platforms at 4 PM EST, **$2.1 trillion worth of securities** continue trading in the after hours market until 8 PM. This extended session isn't just leftover volume—it's where earnings reactions unfold, where institutional money repositions, and where prepared traders can capitalize on reduced competition and amplified price movements.

After hours trading represents one of the most misunderstood yet profitable opportunities in modern markets. **The average daily volume** during the 4-8 PM window reaches $450 billion, with individual stocks often moving 5-15% on earnings or news releases when most retail traders have already logged off.

This comprehensive guide reveals how to master the after hours trading window using proven strategies, proper risk management, and the right technological setup. You'll discover why the evening session demands different tactics than regular market hours and how to profit from the unique characteristics that define this specialized trading environment.

Why After Hours Trading Demands Different Strategies

**Liquidity drops by an average of 85%** once regular trading hours close at 4 PM EST. This dramatic reduction creates both opportunity and risk that requires a completely different approach than daytime trading strategies.

The bid-ask spreads widen significantly during after hours sessions. A stock that might have a $0.01 spread during regular hours could see spreads of $0.05-$0.20 in the evening. **For a $50 stock, this represents an immediate 0.4% cost** just to enter and exit a position, compared to 0.02% during regular hours.

The reduced liquidity creates price inefficiencies that skilled traders can exploit, but requires position sizes 50-70% smaller than daytime trades.

Volatility increases substantially after hours, particularly in the first 30 minutes following earnings releases. **Studies show that stocks gap 2.3x more frequently** during after hours sessions compared to regular trading, creating both significant profit opportunities and enhanced risk exposure.

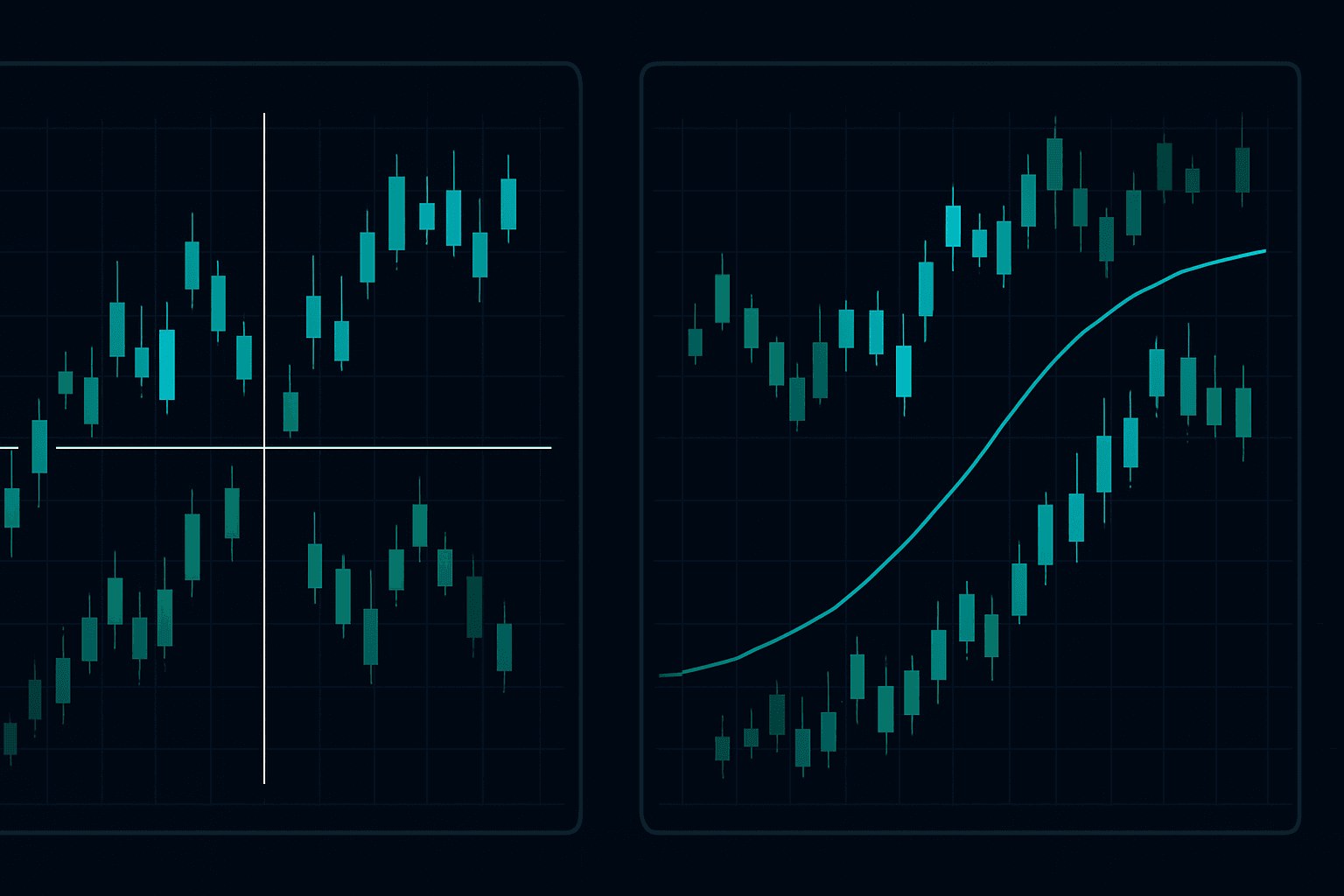

The participant mix changes dramatically after 4 PM. While retail traders largely exit, institutional investors, hedge funds, and algorithmic trading systems continue operating. This creates a more professional trading environment where **technical analysis often proves more reliable** due to reduced noise from emotional retail trading.

The 4-8 PM Golden Window Strategy Framework

The most profitable after hours trading occurs within specific time windows, each offering distinct characteristics and opportunities. **The 4:00-4:30 PM period** captures immediate earnings reactions, while the 4:30-6:00 PM window allows for trend continuation strategies.

During the 4:00-4:30 PM immediate reaction phase, focus on stocks reporting earnings with **analyst estimate surprises exceeding 10%**. These securities often gap aggressively and continue trending for 15-45 minutes as institutional algorithms process the news and adjust positions.

"The after hours market rewards preparation over speed. While day trading demands split-second decisions, evening sessions allow for methodical analysis and strategic positioning."

The 4:30-6:00 PM consolidation phase offers trend continuation opportunities. Stocks that gapped significantly in the first 30 minutes often establish trading ranges during this period. **Look for breakouts above resistance levels** established during the initial reaction phase, particularly with volume spikes exceeding 150% of the 20-day average.

Set alerts for stocks breaking above their regular session highs with 200%+ normal volume during the 5:30-6:30 PM window—these often gap up significantly the following morning.

The 6:00-8:00 PM late session typically sees decreasing volume and tighter ranges. However, **West Coast institutional money** often becomes active during this window, particularly in technology stocks. Focus on NASDAQ-listed securities with market caps exceeding $5 billion during this period.

Essential Technology Setup for After Hours Success

**Your trading platform must support extended hours trading** with real-time data feeds. Many brokers charge additional fees for after hours capabilities, but the investment typically pays for itself within 2-3 successful trades given the profit potential.

Level 2 market data becomes exponentially more valuable during after hours sessions. With reduced liquidity, **seeing the order book depth** allows you to identify support and resistance levels that aren't visible on standard charts. This data typically costs $15-30 monthly but provides crucial insights for position sizing and entry timing.

News feed integration is essential for after hours trading success. **Earnings releases, FDA approvals, and major announcements** drive 80% of significant after hours moves. Subscribe to real-time news services that deliver alerts within 30 seconds of release—speed advantages of even 60 seconds can mean the difference between profitable entries and chasing momentum.

On October 24, 2023, Netflix (NFLX) reported earnings that beat expectations by 15%. Traders with proper news feed integration could enter positions at $385 within 90 seconds of the release, capturing the subsequent move to $412 by 6:30 PM—a 7% gain in under 3 hours.

Risk management tools require special attention for after hours trading. **Stop-loss orders may not execute at expected prices** due to wider spreads and reduced liquidity. Consider using limit orders exclusively and manually monitoring positions rather than relying on automated stop losses.

Three High-Probability After Hours Trading Strategies

**Strategy 1: Earnings Gap Continuation** focuses on stocks that gap 3%+ on earnings beats and show continued buying pressure after the initial 15-minute reaction. Look for securities maintaining volume above 300% of daily average with minimal retracement from post-earnings highs.

Entry criteria require confirmation above the initial gap high with volume expansion. **Position sizing should not exceed 2% of account equity** due to overnight gap risk. Target profits of 2-5% while maintaining strict stop-losses at the low of the initial gap reaction.

**Strategy 2: News-Driven Momentum** capitalizes on FDA approvals, merger announcements, and breakthrough technology news that breaks after market close. These events often create sustained moves lasting 2-4 hours as institutional money reacts and repositions.

Identify stocks with **news catalyst potential** by monitoring FDA calendars, earnings calendars, and regulatory filing schedules. When positive news breaks, enter on the first pullback to the 5-minute EMA with volume confirmation. Target 4-8% moves while maintaining 2% maximum risk per trade.

Never chase news-driven moves that have already advanced more than 15% from the close—the risk/reward ratio becomes unfavorable due to increased volatility and reduced liquidity.

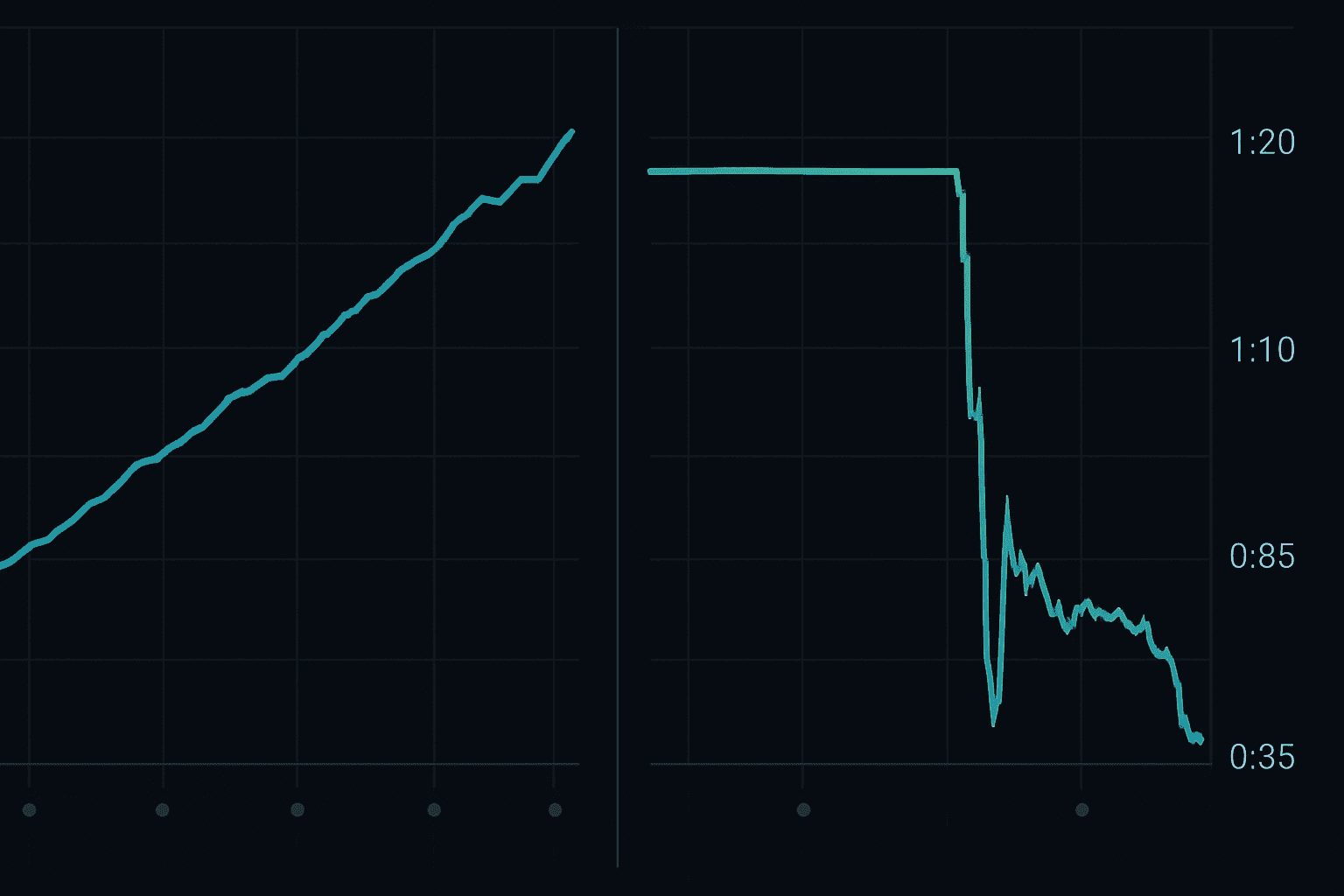

**Strategy 3: Pre-Market Setup Positioning** involves identifying stocks showing technical setups during after hours that are likely to gap up at the following day's open. This strategy requires patience but offers excellent risk/reward ratios.

Look for stocks breaking above key resistance levels during the 6:30-7:30 PM window with **volume 50%+ above average**. Enter positions with tight stops below the breakout level and hold overnight for gap-up profits at the next session's open.

Reading After Hours Price Action Like a Professional

**Volume analysis becomes critical** during after hours sessions due to the reduced participant pool. A volume spike to 200% of normal during after hours represents significantly more institutional interest than the same volume increase during regular trading hours.

Price action patterns require different interpretation after hours. **Traditional support and resistance levels** from regular trading hours often prove less reliable due to the changed participant mix and liquidity profile. Instead, focus on round numbers and previous after hours high/low levels.

The relationship between futures markets and individual stocks strengthens after hours. **S&P 500 futures direction** provides valuable context for individual stock movements when regular market correlation data is unavailable. A strongly trending futures market often supports continuation moves in after hours individual stocks.

Time decay accelerates for options positions during after hours trading. **Implied volatility often increases** immediately following earnings or news releases, but rapidly declines during the 6:00-8:00 PM window as uncertainty resolves. This creates opportunities for volatility-based strategies but requires precise timing.

Risk Management Framework for After Hours Trading

**Position sizing must be reduced by 50-70%** compared to regular hours trading due to increased volatility and reduced liquidity. A trader comfortable with 5% account risk during regular hours should limit after hours positions to 2% maximum risk.

Stop-loss placement requires special consideration for after hours trading. **Traditional percentage-based stops** may not execute effectively due to wider spreads. Instead, use dollar-amount stops and consider the increased cost of wide bid-ask spreads when calculating position sizes.

Overnight risk becomes a primary concern for after hours positions held past 8 PM. **International market developments** can create significant gaps at the next day's open that may far exceed your intended risk levels. Consider closing 70% of profitable positions before 7:30 PM and trailing stops on remaining positions.

"Risk management in after hours trading is about survival first, profits second. The reduced liquidity can turn small losses into account-damaging disasters without proper position sizing."

Diversification rules change for after hours trading. **Never hold more than 3 positions simultaneously** during extended hours due to correlation risk and liquidity concerns. Focus on quality setups rather than quantity of trades.

Step-by-Step After Hours Trading Checklist

**Pre-Market Preparation (3:30-4:00 PM):**

- Review earnings calendar for companies reporting after close

- Identify stocks with technical setups approaching key levels

- Set news alerts for holdings and watchlist securities

- Verify extended hours trading is enabled on your platform

- Calculate position sizes based on reduced risk parameters

**Initial Session Management (4:00-4:30 PM):**

- Monitor earnings releases and immediate price reactions

- Identify stocks gapping 3%+ with volume confirmation

- Enter positions only after initial volatility subsides

- Set alerts for key technical levels and volume thresholds

- Document trade rationale and risk parameters

**Mid-Session Monitoring (4:30-6:30 PM):**

- Track position progress against predetermined targets

- Monitor overall market sentiment via futures direction

- Adjust stops to breakeven on profitable positions

- Identify new setups developing for late session entry

- Prepare exit strategy for positions approaching targets

**Late Session Wind-Down (6:30-8:00 PM):**

- Begin closing profitable positions to avoid overnight risk

- Tighten stops on remaining positions

- Document lessons learned and strategy performance

- Prepare watchlist for next day's regular session

- Review and analyze completed trades

Advanced After Hours Techniques for Consistent Profits

**Sector rotation analysis** becomes more pronounced during after hours sessions. When biotech stocks report positive clinical trial results, **the entire sector often experiences** sympathetic moves lasting 2-3 hours. Identify 3-5 stocks in the same sector as your primary position for potential momentum trades.

Options strategies require significant modification for after hours trading. **Call spreads and put spreads** can be effective for capturing earnings moves while limiting risk, but ensure sufficient time to expiration and avoid complex multi-leg strategies due to liquidity constraints.

The most consistent after hours profits come from patience and selectivity—wait for high-probability setups rather than forcing trades due to reduced market activity.

International market correlation provides predictive value for after hours U.S. trading. **European market closes and Asian market opens** can influence after hours sentiment, particularly for multinational corporations and commodity-related stocks.

Algorithmic trading patterns become more visible during after hours due to reduced human participation. **Recognize recurring price levels and timing patterns** that indicate institutional algorithm activity, and position trades to benefit from these predictable behaviors.

Common After Hours Trading Mistakes That Destroy Accounts

**Chasing gap moves** represents the most expensive mistake in after hours trading. Once a stock has gapped 8%+ on news, the risk/reward ratio typically favors waiting for a pullback rather than entering at extended levels. **Patient traders often find better entries** 30-60 minutes after initial reactions.

Using regular hours position sizing during after hours sessions leads to account damage. **The reduced liquidity and increased volatility** require smaller position sizes even when setups appear identical to daytime opportunities. Many traders lose more money from oversizing after hours positions than from incorrect trade direction.

Ignoring the overnight gap risk destroys many otherwise profitable after hours traders. **International developments, terrorist attacks, and economic announcements** can create gap opens that exceed stop-loss levels by 300-500%. Always consider the maximum tolerable loss including potential gap scenarios.

The best after hours traders often make more money from the trades they don't take than from the positions they enter—discipline and patience are essential skills.

Failing to monitor overall market sentiment through futures and international markets creates blind spots in after hours trading. **Individual stock moves can reverse quickly** when broader market conditions deteriorate, even with company-specific positive news driving the initial momentum.

Tools and Resources for After Hours Excellence

**Professional-grade charting software** becomes essential for after hours success. Platforms offering customizable alerts, multiple timeframe analysis, and real-time news integration provide significant advantages over basic retail trading platforms. Budget $100-300 monthly for professional-grade tools if serious about after hours trading.

Economic calendar integration helps identify potential market-moving events scheduled for release during after hours. **FOMC minutes, international economic data, and earnings guidance** often break during extended hours and create systematic trading opportunities for prepared traders.

Social media monitoring tools can provide early warnings for developing news stories. **Twitter alerts for relevant keywords and company mentions** sometimes provide 2-5 minute advantages over traditional news services, particularly for breaking regulatory approvals or merger rumors.

For traders serious about mastering after hours strategies, FibAlgo's AI-powered indicators provide valuable insights into institutional money flows and trend strength during low-liquidity sessions. The platform's smart money concepts help identify when large players are accumulating or distributing positions during extended hours.

Risk management software becomes more important during after hours due to the potential for rapid, significant price movements. **Position size calculators, correlation analysis tools, and portfolio heat maps** help maintain appropriate risk levels across multiple after hours positions.

🎯 Key Takeaways

- Reduce position sizes by 50-70% compared to regular hours trading due to increased volatility and reduced liquidity

- Focus on the 4:00-4:30 PM window for earnings reactions and 5:30-6:30 PM for technical breakouts

- Never chase moves that have already advanced more than 15% from the regular session close

- Use limit orders exclusively and avoid stop-loss orders due to wide spreads and potential slippage

- Close 70% of profitable positions before 7:30 PM to avoid overnight gap risk and international market volatility

Your Path to After Hours Trading Mastery

After hours trading success requires a fundamental shift in mindset from the rapid-fire decision making of regular market hours to the patient, methodical approach of extended session trading. **The reduced competition and amplified price movements** create exceptional profit opportunities for traders willing to develop the specialized skills this market demands.

Start with paper trading during after hours sessions to develop familiarity with the unique characteristics of extended hour price action. **Practice with $10,000 virtual accounts** before risking real capital, focusing on position sizing, entry timing, and risk management rather than profit maximization.

The most successful after hours traders treat it as a specialized discipline requiring different tools, strategies, and psychology than regular hours trading. **Develop a systematic approach** that includes pre-market preparation, real-time monitoring protocols, and post-session analysis to continuously improve your edge.

Remember that consistency beats aggressive profit-seeking in after hours trading. **Target 15-20% monthly returns** through careful position selection and risk management rather than attempting to double your account through high-risk, high-reward trades that can quickly destroy your capital base.

Ready to master the after hours markets with professional-grade tools and analysis? Try FibAlgo risk-free and discover how our AI-powered indicators can help you identify institutional money movements and high-probability setups during the crucial 4-8 PM trading window. Join 10,000+ traders who use our platform to gain an edge in both regular and extended market hours.